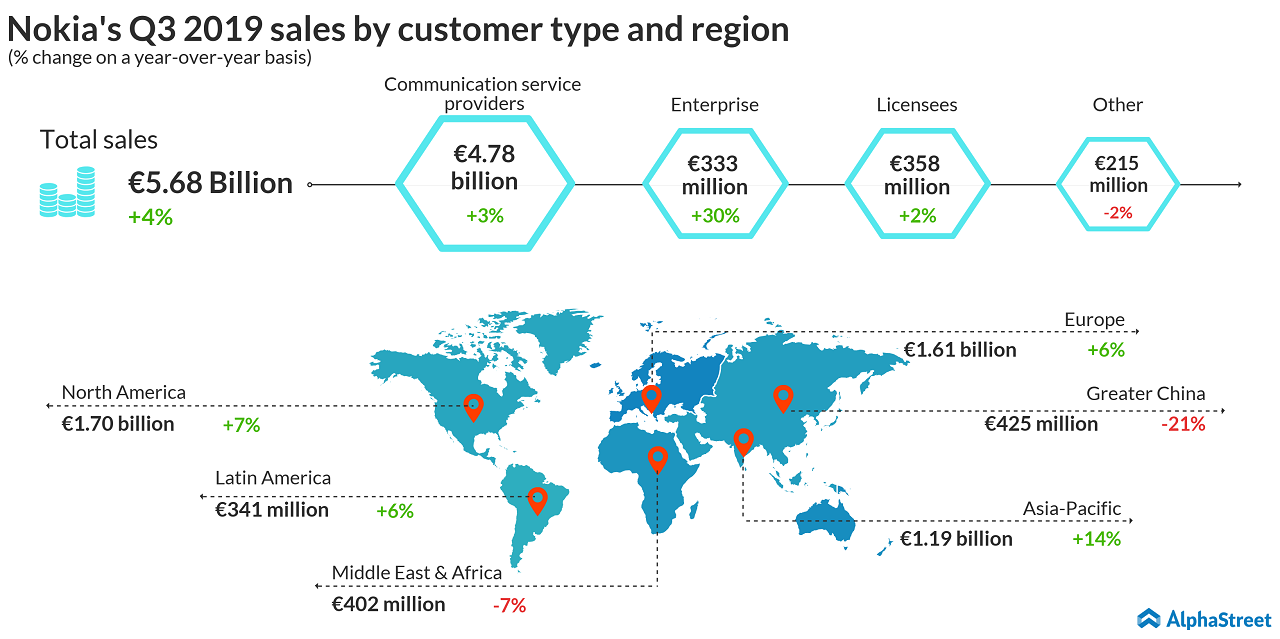

Net sales advanced 4% annually to EUR 5.69 billion. The top-line benefited from improved industry demand and the revamped product portfolio, with growth across all the key regions and customer types.

Earnings Drop

Earnings, on a non-IFRS basis, declined to EUR 0.05 per share from $EUR 0.06 per share in the third quarter of 2018, hurt by lower gross profit in Networks and fluctuations in financial income and expenses. This was partially offset by higher gross profit in Nokia Software and lower costs.

Reported profit was EUR 0.01 per share, compared to a loss of EUR 0.02 per share last year. The improvement reflects continued progress in the cost savings program and a gain on defined benefit plan amendments.

Dividend Paused

Meanwhile, the management decided not to distribute the third and fourth quarterly installments of the pending dividend for fiscal 2018, mainly for enhancing 5G investments and the company’s cash position.

Outlook

Nokia currently expects non-IFRS earnings per share to be EUR 0.21 plus or minus 3 cents in fiscal 2019, which is below the earlier forecast. The outlook for full-year non-IFRS operating margin is 8.5% plus or minus 1 percentage point.

For fiscal 2020, the company expects non-IFRS earnings per share to be EUR 0.25 plus or minus 5 cents, down from the previous outlook. Non-IFRS operating margin for 2020 is expected to be 9.5% plus or minus 1.5 percentage points.

Nokia shares lost sharply in the New York Stock Exchange Thursday morning, immediately after the announcement. The shares lost about 8% in the past twelve months and 15% since the beginning of the year.