Nordstrom Inc. (NYSE: JWN) is one department store chain that has managed to stay resilient to the retail upheaval that continues to pose a threat to traditional players. The continuing efforts to innovate and adapt to the changes have given the company an edge over most of its peers. It is expected to reflect in the performance of the retailer’s stock in the near term.

Nordstrom has maintained a stable inventory position. That, combined with the efforts to promote the off-price segment, should help the company revive sales growth this year. Meanwhile, profitability is seen improving supported by the management’s aggressive cost-cutting measures. Considering the brightening future prospects, it is wise to consider the stock for long-term investment.

Innovation

When it comes to sustaining the momentum, a lot will depend on the company’s ability to take forward its omnichannel initiatives. In that respect, shareholders can pin hope on the digital push and efforts to provide customers a better experience through store openings and convenient fulfillment options.

An improvement in the stock’s value is in the offing as the company is in a position to use its cash flow for returning capital to shareholders. Having spent heavily on growth initiatives in the past, Nordstrom is expected to reduce capital spending this year.

Recovery

Nordstrom’s shares have been gaining steadily after hitting a ten-year low in mid-2019. The stock is prone to post-earnings fluctuations. When the fourth-quarter numbers are published early next month, the stock movement would be more towards the downside if the sales slowdown persisted.

Meanwhile, the weak estimates call for patience as far as investing in Nordstrom is concerned. Experts recommend holding the stock for the time being as the majority of them expect it to remain flat in the run-up to the release.

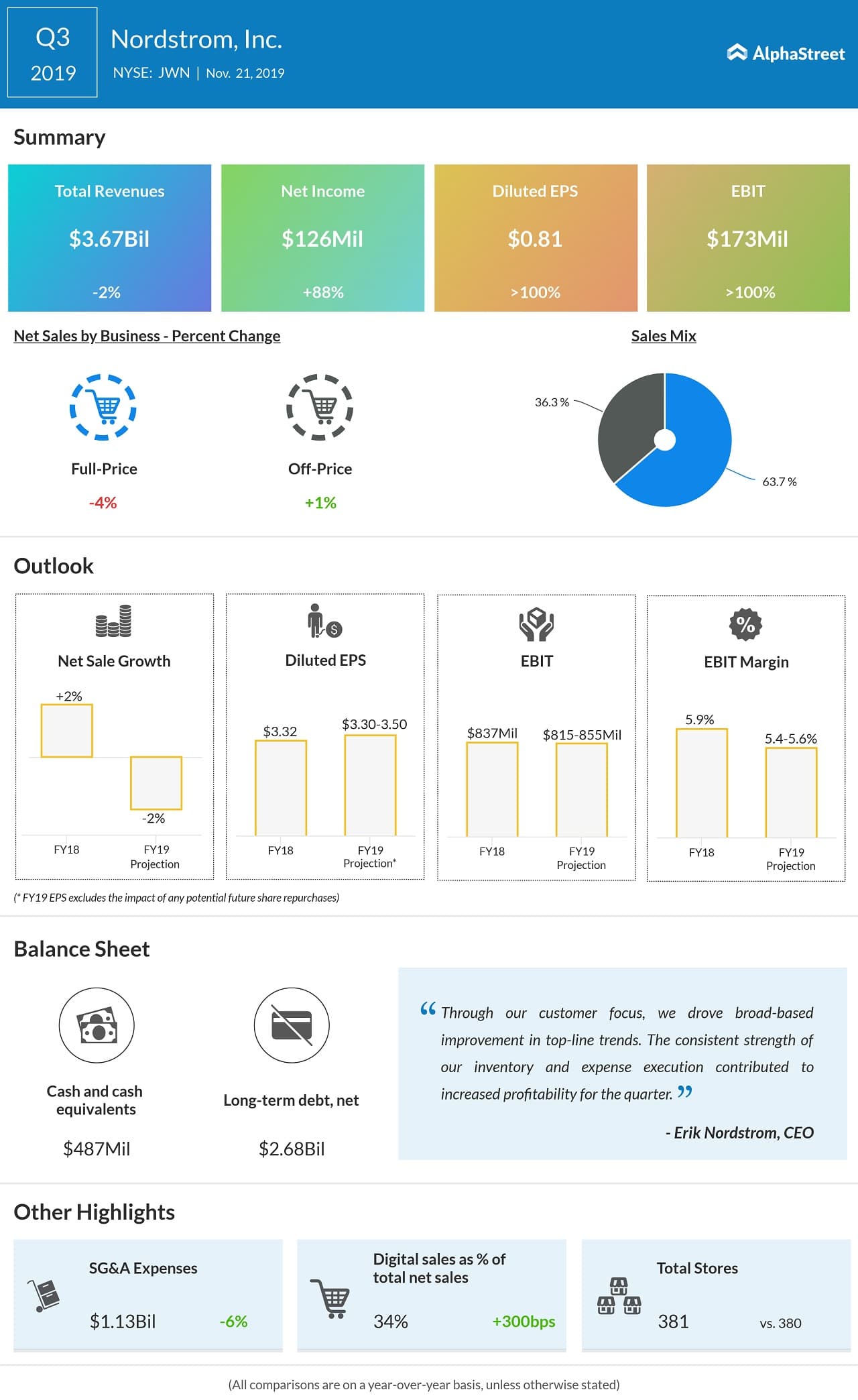

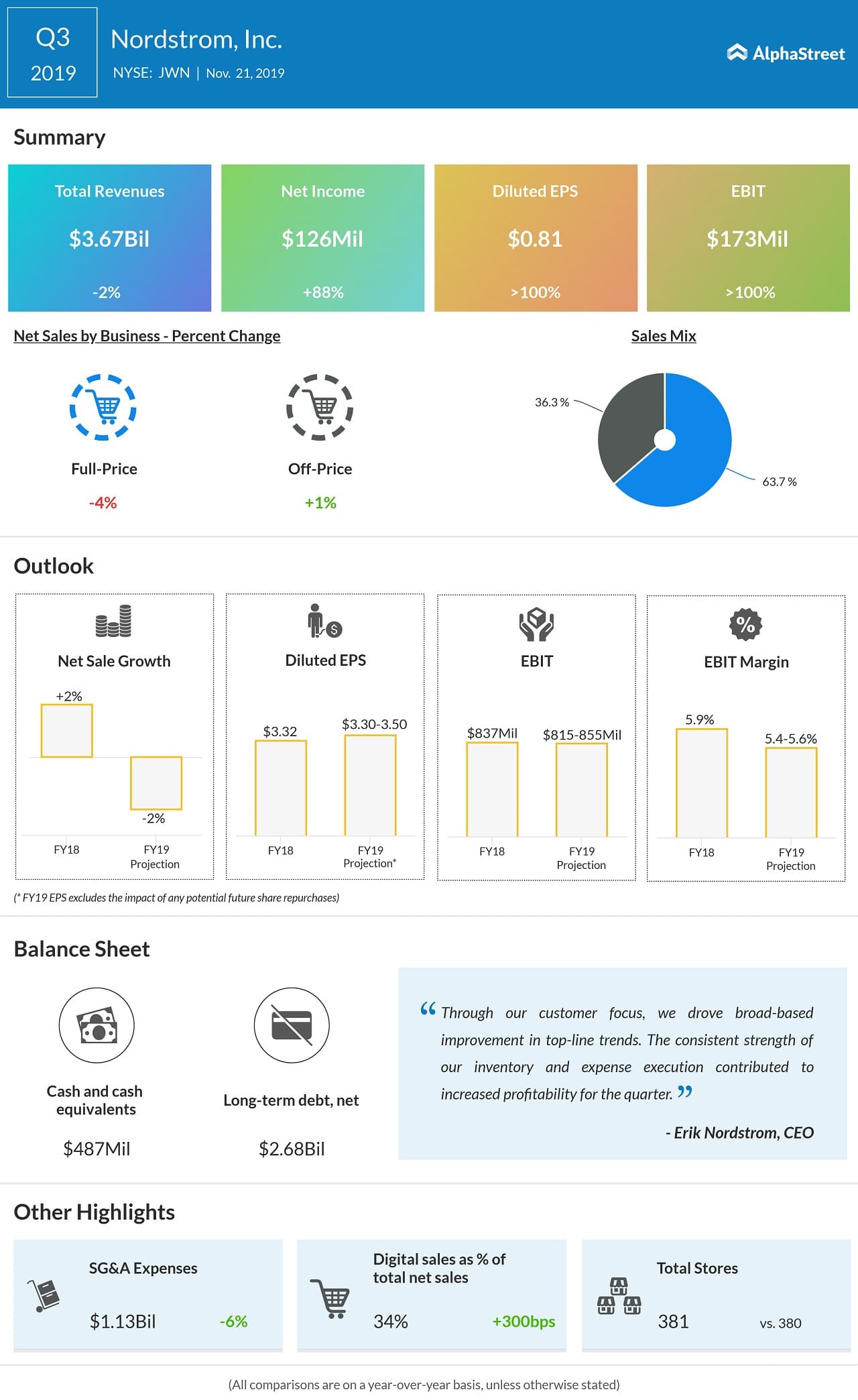

Mixed Results

In what could be a reflection of the changing consumer behavior, the core full-price segment witnessed a modest slowdown last quarter, dragging the top-line by 2%. Nevertheless, earnings more than doubled to 81 cents and topped expectations. Raising concerns, the management warned of a decline in full-year sales and predicted flat earnings growth.

Also read: Nordstrom Q2 2019 Earnings Call Transcript

The stock is currently trading slightly above the levels seen at the beginning of the year. It has declined by about 10% in the past twelve months.