Sales from the digital front continued the strong growth trend from the previous quarter, where e-commerce sales rose 23% over last year. It’s worth noting that the digital sales now bring in 34% of total sales in the quarter.

The retailer also wants to integrate the brick-and-mortar stores and digital technology as part of its strategy to keep competition at bay and improve customer engagement. The seamless integration efforts would be launched in Los Angeles, which is the largest market for Nordstrom.

The company has been investing on the digital front to tackle competition from the likes of Amazon (AMZN) and its peers. This is inevitable for all retailers to cater to the changing consumer landscape and shopping habits of millennials. Earlier this month, Nordstrom hired Edmond Mesrobian as the Chief Technology Officer to spearhead its digital efforts to bring seamless shopping experience to its customers.

Related: Nordstrom shares drop on weak sales projection

As a part of the investments on the digital side, Nordstrom recently bought BevyUp and MessageYes to augment its online related offerings to its customers. It also launched an online tailoring option where customers can customize their apparels. In addition, the Seattle, Washington-based company is planning to roll out small-stores where users can try out various outfits and can order them online for same day delivery.

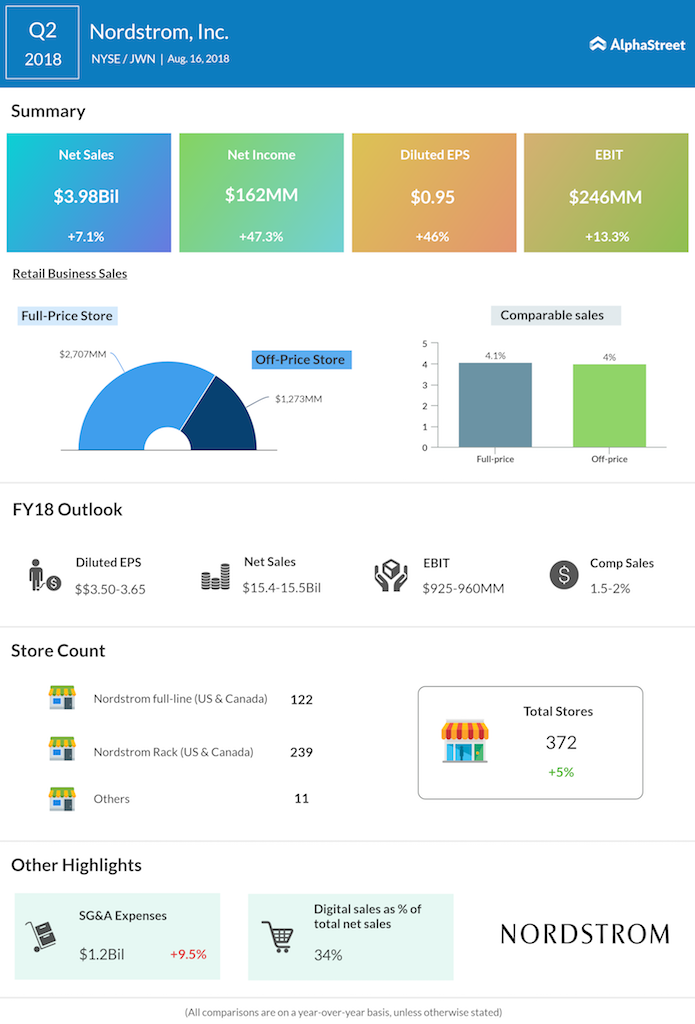

Nordstrom raised its 2018 outlook on the back of strong first-half results. The company expects sales to come between $15.4 billion and $15.5 billion compared to the prior estimate of $15.2 billion and $15.4 billion provided last quarter. Comp-sales growth is revised upwards now to a range of 1.5% and 2% compared to the 0.5% to 1.5% growth estimate reported earlier. Earnings target lifted to a range of $3.50 to $3.65 per share from $3.35 to $3.55 per share outlook provided in the first quarter.

Nordstrom stock price has been sporadic so far this year increasing nearly 11% and it advanced more than 17% in the last 12 months.