The Company

Ocean Biomedical was founded by Chirinjeev Kathuria, Jack Elias, and Jonathan Kurtis in 2019 and is engaged in supporting the development and commercialization of pharmaceutical products from research universities and medical centers. The core portfolio is focused on the critical areas of oncology, pulmonary fibrosis, and infectious disease. Headquartered in Providence, Rhode Island, the company is led by chief executive officer Elizabeth Ng. Gurinder Karla is the chief financial officer.

It has a unique business model — inventors and research organizations retain a 20% interest in their discoveries, and the company would acquire the remaining 80% by meeting the future research & development and general & administrative expenses. Since the company does not own research facilities, it would outsource and use third-party facilities for research and clinical trials. The oncology and fibrosis franchises are licensed from Brown University, while the infectious diseases franchise is licensed from Rhode Island Hospital.

The company forms a partner subsidiary for each discovery it licenses – it typically has an ownership stake for the inventor-scientist and their affiliated institution. It also forges pipeline partnerships with leading research institutions to promote their best discoveries.

IPO

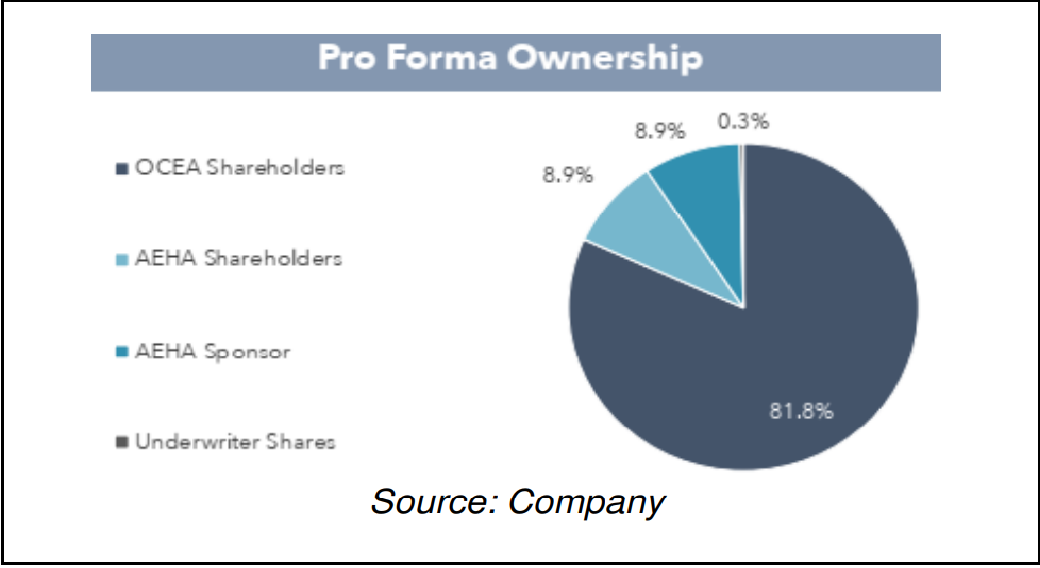

Ocean Biomedical became a listed company on February 15, 2023, through a reverse merger of special purpose acquisition company Aesther Healthcare Acquisition Corp. Pursuant to the initial public offering, the stock has started trading on the Nasdaq stock exchange under the ticker symbol OCEA. Shareholders received 23.36 million shares at $10 apiece. Post-merger, 82% of the company is now owned by OCEA shareholders. Ocean Biomedical has a market cap of about $365 million.

Financials

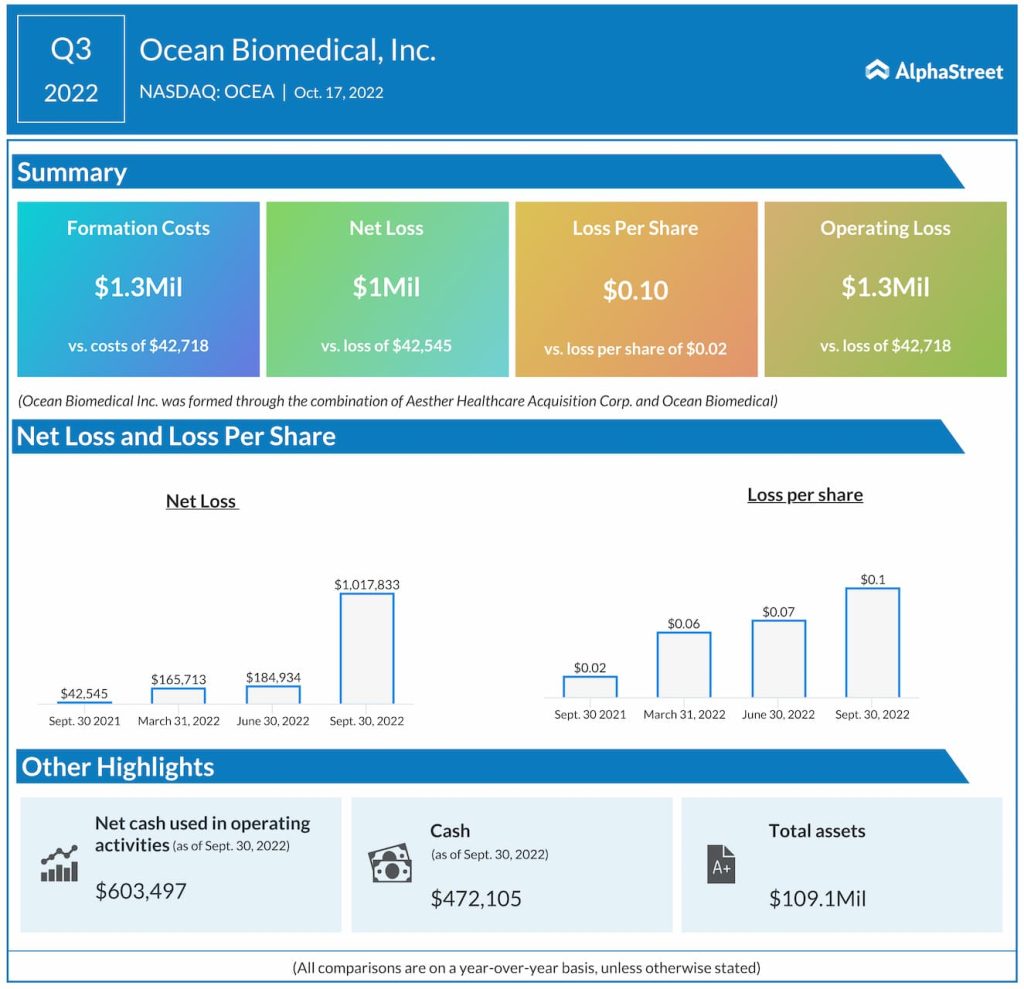

In the nine months that ended December 2022, Ocean Biomedical had cash and cash equivalents of $54.8 million. It posted a net loss of $17.1 million or $0.47 per share during that period. In the quarter that ended September 2022, the net loss was $1.02 million or $0.10 per share, compared to a loss of $ 42,545 in the comparable period of 2021. The bottom-line performance reflects a sharp increase in the formation & operating costs to $1.37 million. At the end of the quarter, the company had a negative cash flow of (-)603,497.

Pipeline

The company has three drug candidates for cancer prevention, one for fibrosis and three for malaria. Currently, it is developing five potential therapies for the treatment of lung cancer, brain cancer, pulmonary fibrosis, and malaria. Its various drug and vaccine candidates are at different stages of IND-enabling studies. As those are completed over the next 12-18 months, the company will seek FDA approval for starting human trials.

In oncology, Ocean Biomedical is targeting non-small cell lung cancer and glioblastoma multiforme. Studies have revealed that the antibodies developed by the company against cancer-causing CHI3L1 significantly reduce tumors. It has also been found that the company’s OCF-203 reduces fibrosis by preventing Chit1, which could play a key role in the research being conducted for finding treatments for Idiopathic pulmonary fibrosis and Hermansky-Pudlak Syndrome. For Malaria treatment, studies showed that Ocean Biomedical’s ODA-570 mRNA vaccine has the potential to kill 90% of malaria parasites.

According to research done by KPMG, the total value of Ocean Biomedical’s drug candidates is $2.1 billion – oncology $1.2 billion, fibrosis $0.5 billion, and infectious diseases $0.4 billion.

Check this space to read management/analysts’ comments on quarterly reports

Risks & Competition

The primary risk for business expansion is Ocean Biomedical’s limited operating experience. Since there are no marketable products yet, currently it does not generate any revenue. As the company needs to pursue equity financing, there will be potential share dilution. Also, it is not immune to uncertainties associated with pharmaceutical companies in general, for the successful development and commercialization of drug candidates. Though the company follows an innovative business model and operates in an emerging healthcare segment, it could face competition from other firms having similar business objectives.