On Track

Oracle has been a good dividend payer and also repurchases stock regularly as it remains committed to returning value to shareholders. The company banks on cost advantages, flexibility in sizing, and convenient deployment options to catch up with the top players in the cloud market. While continuing technical innovation, it also pursues strategic acquisitions to expand the portfolio. Meanwhile, the company’s ability to meet growth goals would depend on how fast it builds data centers.

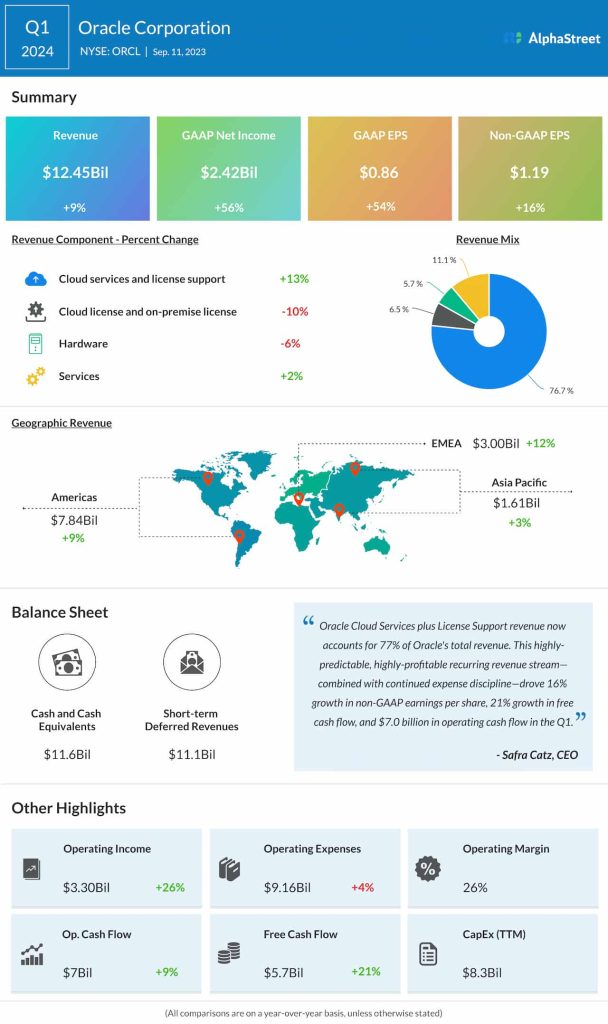

In the first three months of fiscal 2024 — results for which were released this week — revenues rose 9% annually to $12.45 billion, benefitting from the high demand for the company’s Cloud Services and License Support services. Though the top line beat estimates by a small margin, the stock selloff indicates that investors were expecting a bigger gain. Total cloud revenue — apps, and IaaS excluding Cerner — grew 29% but it was slower than the growth registered in the previous quarter.

EPS Beats

Remaining performance obligations, excluding Cerner, increased 11% to about 65 billion. First-quarter earnings, adjusted for special items, was $1.19 per share, compared to $1.03 per share in the prior-year period. On a reported basis, net income rose to $2.42 billion or $0.86 per share in Q1 from $1.55 billion or $0.56 per share a year earlier. Analysts had predicted a slower growth.

“Because we have far more demand than we can supply, our biggest challenge is building data centers as quickly as possible. In addition, we are in an accelerated transition of Cerner to the cloud. This transition is resulting in some near-term headwinds to the Cerner growth rate as customers move from licensed purchases, which are recognized upfront, to cloud subscriptions, which are recognized relatively. Again, excluding Cerner, I remain committed to accelerating our total revenue growth rate this fiscal year, as well as maintaining our current high,” Oracle’s CEO Safra Catz said at the earnings call.

Outlook

For the second quarter, the management expects total revenues to grow 5%-7% and between 3% and 5% in constant currency, which is slightly below the consensus estimates. Total cloud revenue, excluding Cerner, is expected to grow 29% to 31%. It is looking for adjusted earnings between $1.30 per share and $1.34 per share for the second quarter, which represents a 7-11% growth.

Oracle’s stock opened Tuesday’s session sharply lower and the weakness persisted in early trading. Meanwhile, over the past twelve months, the value nearly doubled.