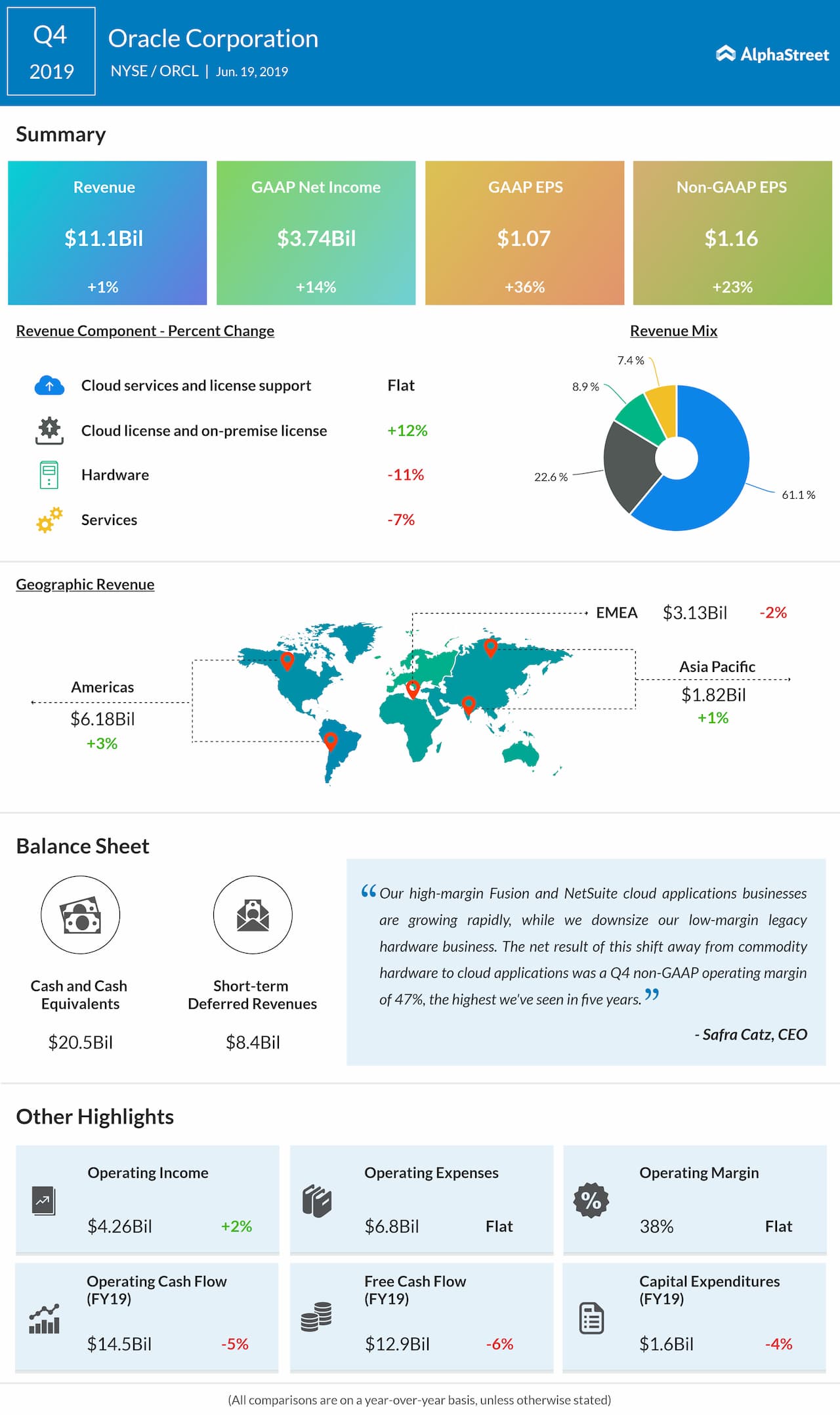

Though the ongoing slump in the core segments weighed down on sales, revenues moved up 1% to $11.1 billion in the fourth quarter and surpassed the consensus estimate. Cloud Services and License Support revenues were flat year-over-year at $6.8 billion, while Cloud License and On-Premise License revenues rose 12% to $2.5 billion. The top-line benefited from the strong performance by the Fusion and NetSuite cloud applications.

Cloud Services and License Support revenues were flat, while Cloud License and On-Premise License revenues rose 12%

“Our high-margin Fusion and NetSuite cloud applications businesses are growing rapidly, while we downsize our low-margin legacy hardware business. The net result of this shift away from commodity hardware to cloud applications was a Q4 non-GAAP operating margin of 47%, the highest we’ve seen in five years,” said CEO Safra Catz.

Related: Oracle Q3 2019 Earnings Conference Call Transcript

ADVERTISEMENT

Oracle’s sales remain under pressure even as the company continues its transition from conventional computing to the cloud space. The shift in business model keeps posing challenges, in terms of revenue performance.

The company’s board of directors declared a quarterly cash dividend of $0.24 per share, which will be paid on July 31, 2019, to stockholders of record on July 17, 2019.

Shares of Oracle hovered near the peak once again this week, after retreating from last month’s record high. The stock’s movement in the coming days might be influenced by the management’s outlook for fiscal 2019. It closed Wednesday’s regular session lower but gained sharply in the after-hours following the earnings report.