Organigram Holdings Inc. (NASDAQ: OGI) (TSX: OGI) is a leading producer and distributor of medical and recreational cannabis products. The Canada-based company has a portfolio of adult-use recreational cannabis brands including Edison, Big Bag o’ Buds, SHRED, and Monjour. In an interview with AlphaStreet, Organigram’s chief executive officer Beena Goldenberg provided insights into the company’s operations.

Please give a brief overview of the company and its operations

Founded in 2013, Organigram is an award-winning cannabis licensed producer and a trailblazer in the innovation, manufacturing, and production of category-leading products for domestic and international cannabis markets.

Organigram’s flagship facility in Moncton, New Brunswick, is one of the largest indoor cannabis facilities in the world, utilizing unique modular, 3-tier grow rooms designed to increase plant yields, control environmental conditions, and increase harvest quality and consistency. Organigram’s operations are spread across three provinces: Its 500,000-square-foot Moncton facility in New Brunswick, its highly automated edibles facility in Winnipeg, Manitoba, and its craft cannabis cultivation and hash production facility in Lac-Supérieur, Quebec.

In Canada, Organigram is credited with being the innovator behind the first ingestible extract cannabis lozenges, the first-to-market with pre-milled flower, the only company to have created a new hash format with its SHRED X Rip Strip Hash, and more while continuing to push the envelope in producing new and exciting cannabis products guided by deep consumer insights and research and development.

At the same time, Organigram is unique in its focus on longer-term research conducted as part of its Product Development Collaboration (PDC) with British American Tobacco. The PDC is aimed at conducting scientific and clinical research into cannabis products that can provide faster onset and better bioavailability, among other research initiatives.

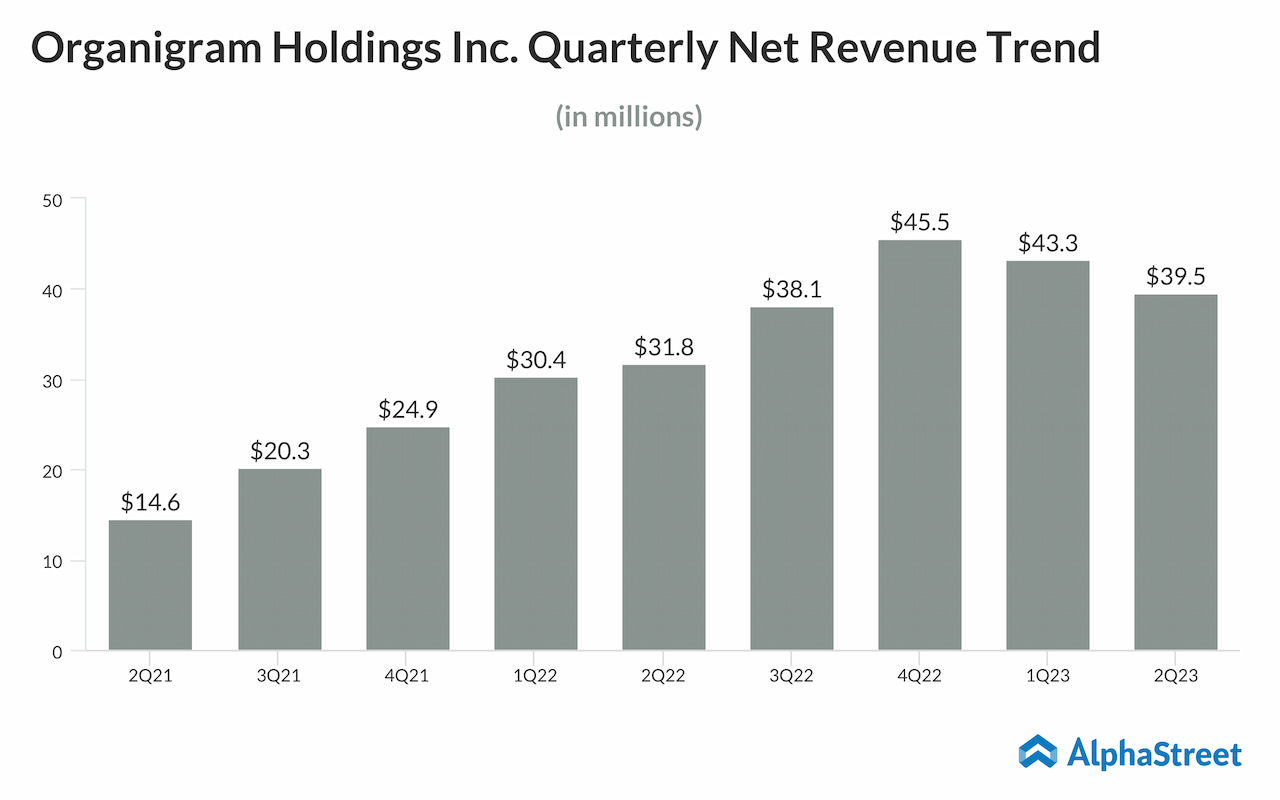

Internationally, Organigram is highly regarded as a trustworthy and consistent source of high-quality medical cannabis flower and is growing its international shipments to federally legal markets. In Organigram’s second quarter fiscal 2023 results, released in April, the Company maintained its #3 position among Canadian licensed producers and held the #1 position in milled flower, #1 in hash, and #3 in gummies nationally.

Can you provide insights into Organigram’s product pipeline, including hash and vape?

Just 12 months after adding hash to our portfolio with the acquisition of our Lac Supérieur facility, we gained the number one position in the hash category and launched SHRED X Rip-Strip Hash, the first product of its kind in Canada. Rip-Strip Hash is a novel hash format that lowers the barriers for new consumers to enjoy the differentiated experience of hash.

Within two months of their launch, Rip Strips have shipped over 62,000 units which translates to over $1.6 million in retail sales. Given their warm reception, we will be focused on further refining the hash experience while potentially introducing new flavor profiles in the future.

In March, we entered into an agreement with Green Tank Technologies, a leading vape-hardware developer and distributor. Green Tank has developed a new heating technology that addresses the inconvenience many users experience with vapes, namely clogging and reduced flavor and performance over the life of a cartridge. Further, given that the new technology produces a characteristically different vape cloud compared to the ceramic heating coils seen in most vapes, it may provide increased potency per puff. Organigram will maintain exclusive rights to use this technology in a new wave of vape cartridges coming to market by the end of its fiscal year for a period of 18 months from its first shipment of Green Tank-enabled vapes to the Ontario Cannabis Store.

Is there a timeline for achieving sustainable profitability, and what is your strategy to reach there?

Organigram just achieved its fifth consecutive quarter of positive adjusted EBITDA and has guided toward free positive cash flow by the end of this fiscal year, predicated upon completing a capital expenditure spend of approximately $32 million in fiscal 2023. Much of the 2023 capex budget is being allocated toward projects that can help produce a trend of increasing margins. Some of these projects include internalizing business needs like laboratory testing, while others are focused on optimizing and further automating our production and packaging processes.

Given these initiatives, alongside higher margin international sales, very stringent and responsible capital stewardship, and the potential to increase our market share in target categories like vapes, we are hopeful to establish a trend of free positive cash flow and profitability beginning in fiscal 2024.

What are the emerging trends in the Canadian cannabis market?

Since legalization in 2018, the Canadian Cannabis market has undergone a tremendous transformation, and we have been at the forefront of this movement as one of the leading licensed producers.

While many trends are defining the growth of the recreational cannabis sector, we are fascinated by the rapidly evolving customer sophistication. Not only is there an increased demand for high-quality cannabis products that offer specific effects and flavors, but many consumers are also granular in their choices, having a clear idea about the type of high, desired taste and aroma they seek. They are also looking for more product formats beyond traditional flowers and edibles. This includes vape pens, other minor cannabinoids, and other forms of cannabis-infused products.

From a business perspective, the industry in Canada is experiencing some headwinds. Many licensed producers are poorly capitalized, having focused on growth at the expense of operational efficiencies and long-term sustainability. Further, the government of Canada has very strict policies about what producers can and cannot say about their products which prevents some of the educational dialogue we would like to be having with consumers. This, alongside a heavy tax burden, makes product differentiation difficult and reduces licensed producers’ ability to operate sustainable, long-term businesses. These elements of the Canadian market are challenging, and we anticipate there will be further consolidation and supply removed from the market in the near-mid-term.

However, for a company like Organigram, these headwinds do present some interesting opportunities. As we have been very responsible with our balance sheet, we maintain the financial flexibility to opportunistically evaluate strategic investments that further build upon our key competencies, while many of our peers are missing this important strategic piece of the puzzle. We hope to see some reduction in market fragmentation in the coming months, which could lead to a more sustainable competitive landscape.

How do you look at the regulatory environment outside Canada, mainly in the US and Europe?

We are certainly eager to see more federal legal cannabis markets emerge. In the first half of fiscal 2023 alone, our international shipments to Australia and Israel surpassed the $15.4 million we saw in fiscal 2022. However, potential movements toward U.S. federal legalization of cannabis (THC) remain difficult to predict. We continue to monitor and develop a potential U.S. entry strategy that could include THC, cannabidiol, and other minor cannabinoids.

Similarly, we are monitoring recreational legalization opportunities in European jurisdictions based on the size of the addressable market and evolving regulations.

Organigram’s goal is to build on its leadership in the Canadian cannabis market to become an internationally recognized science and research-led producer and international distributor of cannabis and innovative cannabis products.

(Disclaimer: The views and opinions expressed in this interview are those of the interviewee and do not necessarily reflect the official policy and position of AlphaStreet)