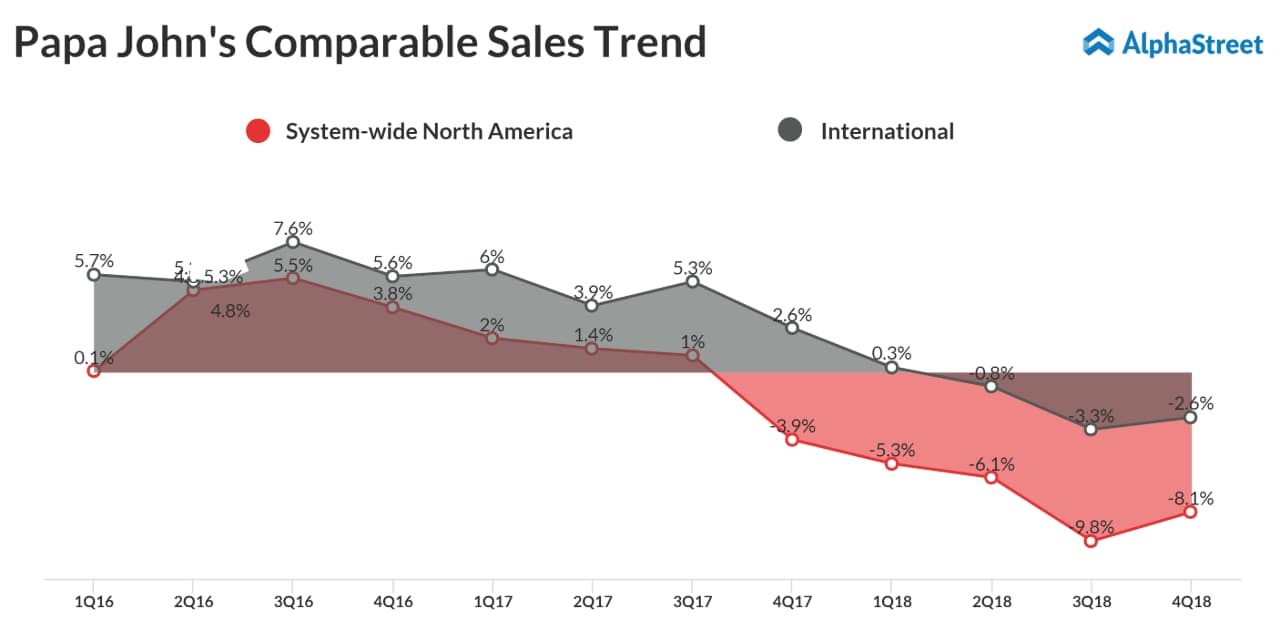

Revenues declined by 20% to $373.98 million. All the business segments witnessed a slump in sales, with domestic company-owned restaurant sales registering the biggest fall. System-wide North America comparable sales and international same-store sales dipped 8.1% and 2.6% respectively.

Looking ahead into the full year 2019, the company expects earnings in the range of $0.00 to $0.50 per share and adjusted earnings in the range of $1.00 to $1.20 per share. North America comparable sales are anticipated to decline in the 1% to 5% range. International comparable sales are predicted to be flat to positive 3%. Papa John’s expects net global new unit growth of 75 to 150 net units and capital expenditures of $45 million to $50 million.

For the fourth quarter, the company opened 56 new units in the fourth quarter driven by International. International revenues fell by 21% due to the refranchising of the company-owned restaurants and quality control center in China as well as lower new store franchise fees.

Comparable sales fell by 10.2% for domestic company-owned restaurants and 7.4% for franchise restaurants. This resulted in lower company-owned restaurant revenues, lower royalties and decreased North American commissary sales.

Papa John’s surges as recovery hopes brighten amid deal with Starboard

At December 30, 2018, there were 5,303 Papa John’s restaurants operating in all 50 states and in 46 international countries and territories. The company has added 104 net worldwide units over the trailing four quarters ended December 30, 2018. Papa John’s development pipeline as of December 30, 2018, included about 1,030 restaurants (130 units in North America and 900 units internationally).

The company did not repurchase any shares after August 9, 2018. For the year ended December 30, 2018, the company repurchased about 2.7 million shares for an aggregate cost of about $158 million. Papa John’s paid a cash dividend of about $7.1 million during the fourth quarter of 2018. On January 31, 2019, the board declared a first-quarter dividend of $0.225 per share, payable on February 22 to shareholders of record on February 11.

Shares of Papa John’s ended Tuesday’s regular session down 0.19% at $41.79 on the Nasdaq. The stock has fallen over 27% in the past year while it has risen over 3% in the year so far.