American restaurant franchise company Papa John’s International (PZZA), whose stock plunged 28% over the course of last one year and over 7% during last month, reported disappointing top and bottom line results for the first quarter 2018. Revenue dipped 4.9% to $427.3 million, while profit tanked 41.1% to $16.7 million or $0.50 per share. The revenue decline was mainly attributable to lower comparable sales for the company’s North America restaurants and declining North America commissary sales attributable to lower volumes.

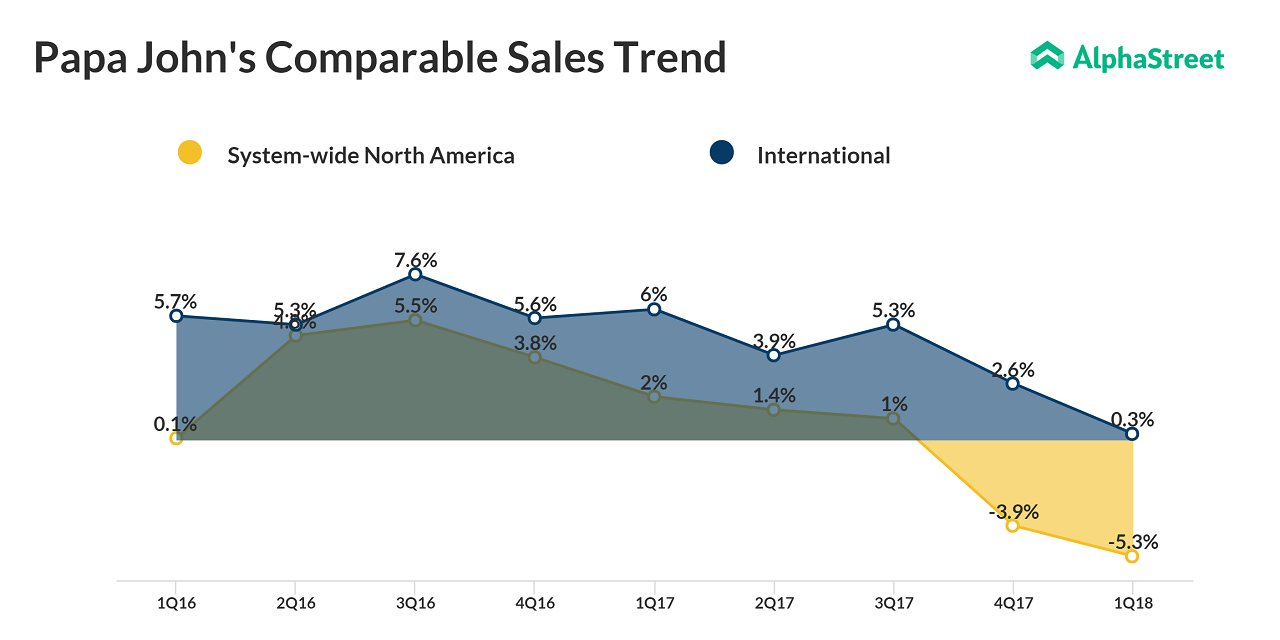

The pizza company has had a bad patch since the termination of the company’s partnership with NFL and has had reported negative comparable store sales in North America for the first time in over a couple of years. However, International comparable store sales saw some marginal increase.

For the quarter, Papa John’s North America comparable sales declined 5.3%, while international comparable sales inched up 0.3%. The international comp sale increase was aided by international franchise sales increase of 21.1%. The pizza chain also opened 13 new units in the first quarter, driven by its international operations. Favorable foreign exchange rates helped the company report positive results for its international operations.

“Although first quarter results were lower than the prior year, they were consistent with our expectations. We remain focused on enhancing our value perception and driving our strategic initiatives,” said Steve Ritchie, CEO.

Papa John’s reaffirmed its previous fiscal year 2018 outlook of diluted earnings per share in the range of $2.40 to $2.60. The company also reaffirmed its previous comparable sales outlook for North America in the range of negative 3% to flat, with international comparable sales expected between 3% and 5%.

The company’s stock plunged almost 5% post the earnings release on the disappointing results.