Content management platform Box Inc. (NYSE: BOX) has reported higher earnings and revenues for the fourth quarter of 2022. Both the top line and profit topped analysts’ expectations.

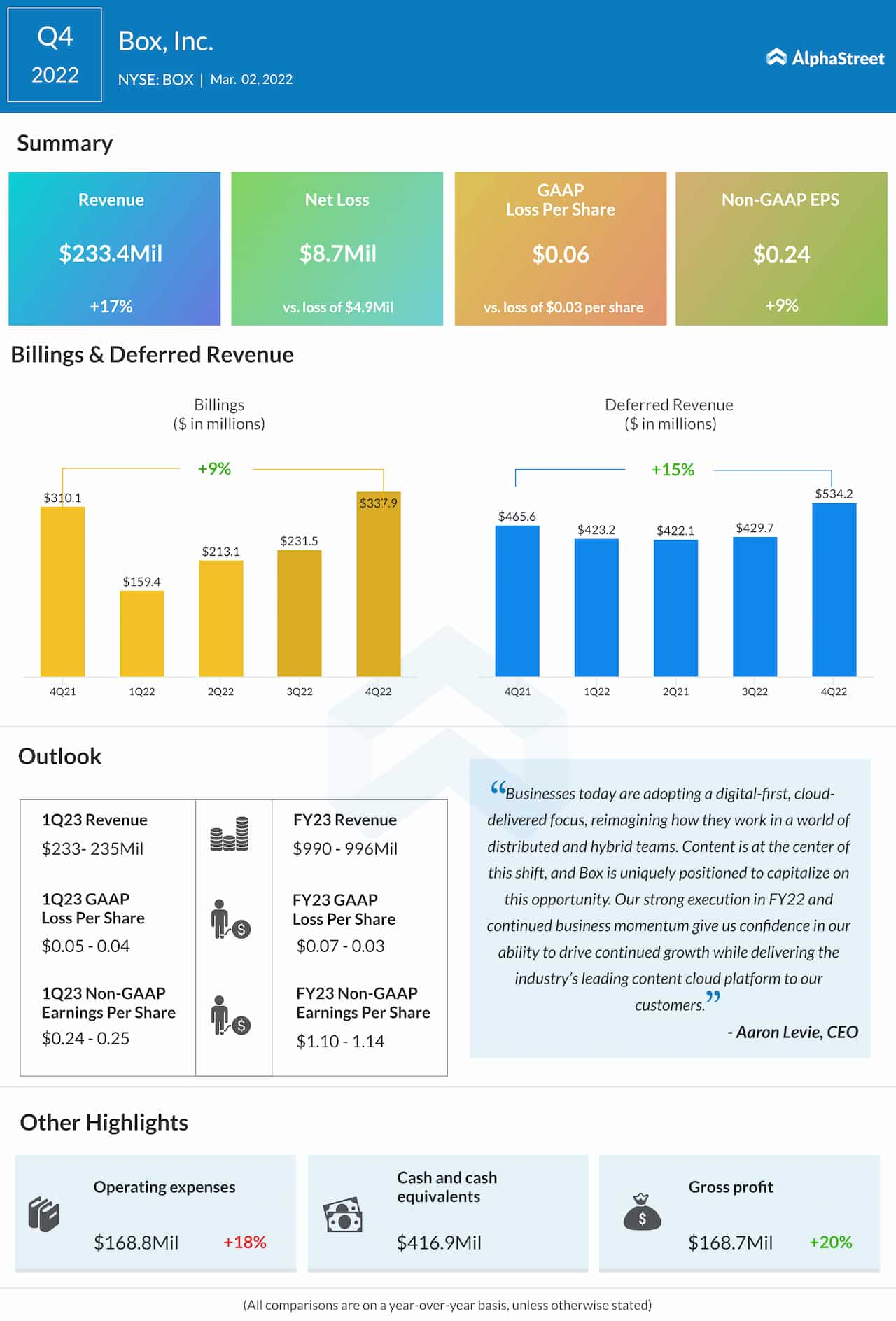

Fourth-quarter net income, on an adjusted basis, was $0.24 per share, compared to $0.22 per share in the same period of 2021. On an unadjusted basis, it was a net loss of $8.7 million or $0.06 per share, compared to a loss of $4.9 million or $0.03 per share in the prior-year period.

At $233.4 million, revenues were up 17% and above analysts’ expectations. Billings increased 9% annually to $337.9 million.

Read management/analysts’ comments on Box’s Q4 2022 results

Shares of Box gained around 4% since the beginning of the year. The stock traded slightly lower in the pre-market session on Monday, after closing the previous session higher.