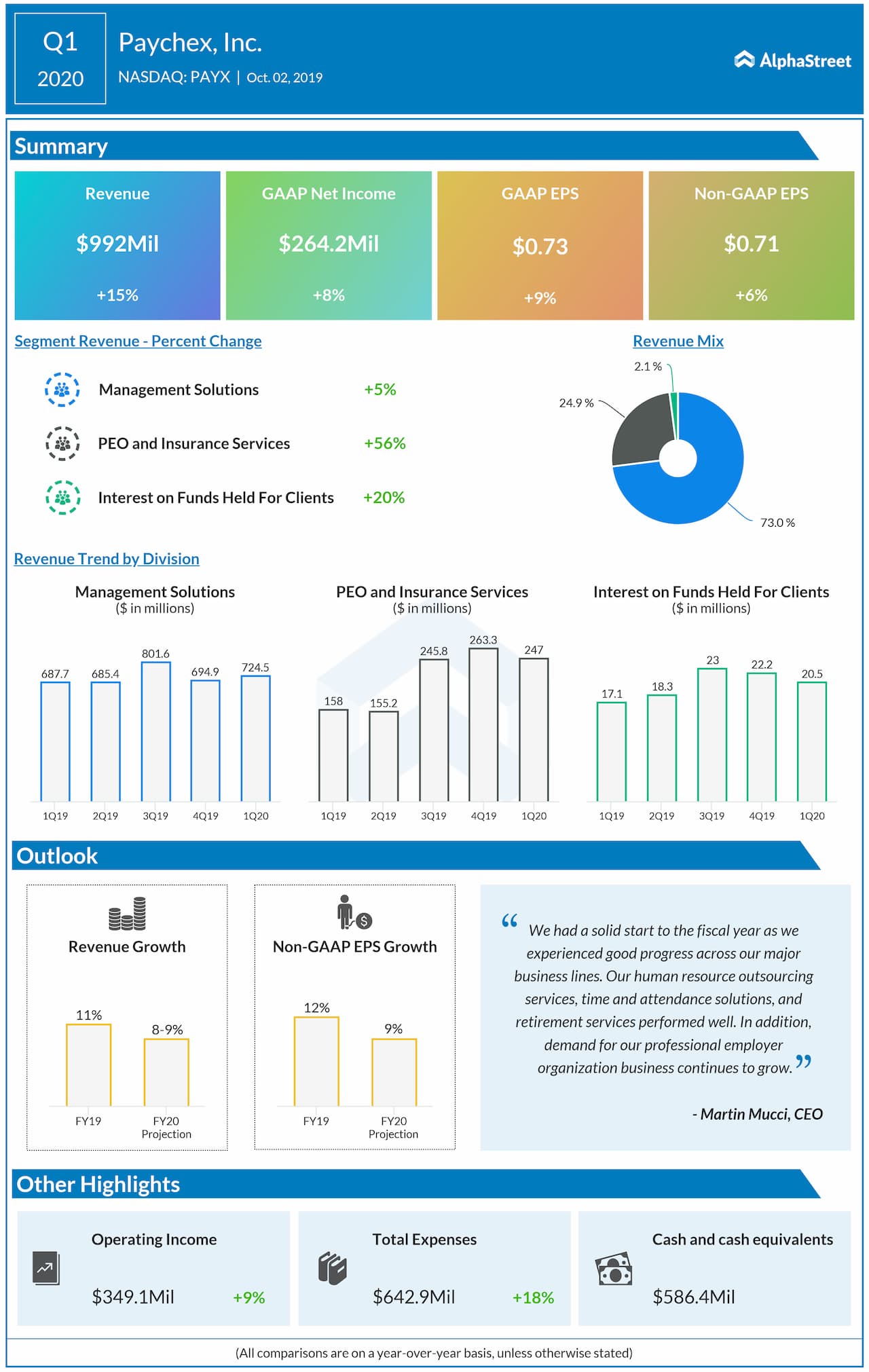

Total revenues grew by 15% to $992 million. Oasis Outsourcing Group Holdings, acquired during December 2018, contributed a little less than 10% to the growth in total revenue compared to the same period last year.

Looking ahead into fiscal 2020, the company still expects total revenue growth in the range of 10% to 11%. The earnings growth guidance is lifted to about 9% from the prior estimates of about 8%. Adjusted earnings are now predicted to grow by about 9% compared to the previous forecast range of 8% to 9% for the full year.

For fiscal 2020, management solutions revenue is now anticipated to grow by about 5% and PEO and Insurance Services revenue is predicted to grow by about 30%. Interest on funds held for clients is still anticipated to grow in the range of 4% to 8%. The operating margin is still projected to be about 36%.

For the first quarter, Management Solutions’ revenue rose by 5% driven primarily by increases in client bases across many of its services and growth in revenue per client. Retirement services revenue also benefited from an increase in asset fee revenue earned on the asset value of participants’ funds.

PEO and Insurance Services revenue jumped by 56% year-over-year. This was driven by the Oasis purchase, growth in clients and client worksite employees across its existing PEO business. Insurance Services revenue was moderated by softness in the workers’ compensation market as state insurance fund rates declined.

Interest on funds held for clients grew 20%, resulting primarily from higher average interest rates earned. Funds held for clients’ average investment balances rose by 1% as the impact of wage inflation and increases within its client base were offset by changes in client base mix and timing of collections and remittances.

The company’s financial position remained strong as of August 31, 2019, with cash, restricted cash, and total corporate investments of $695.3 million. In contrast, the total short-term and long-term borrowings, net of debt issuance costs, were $853 million.