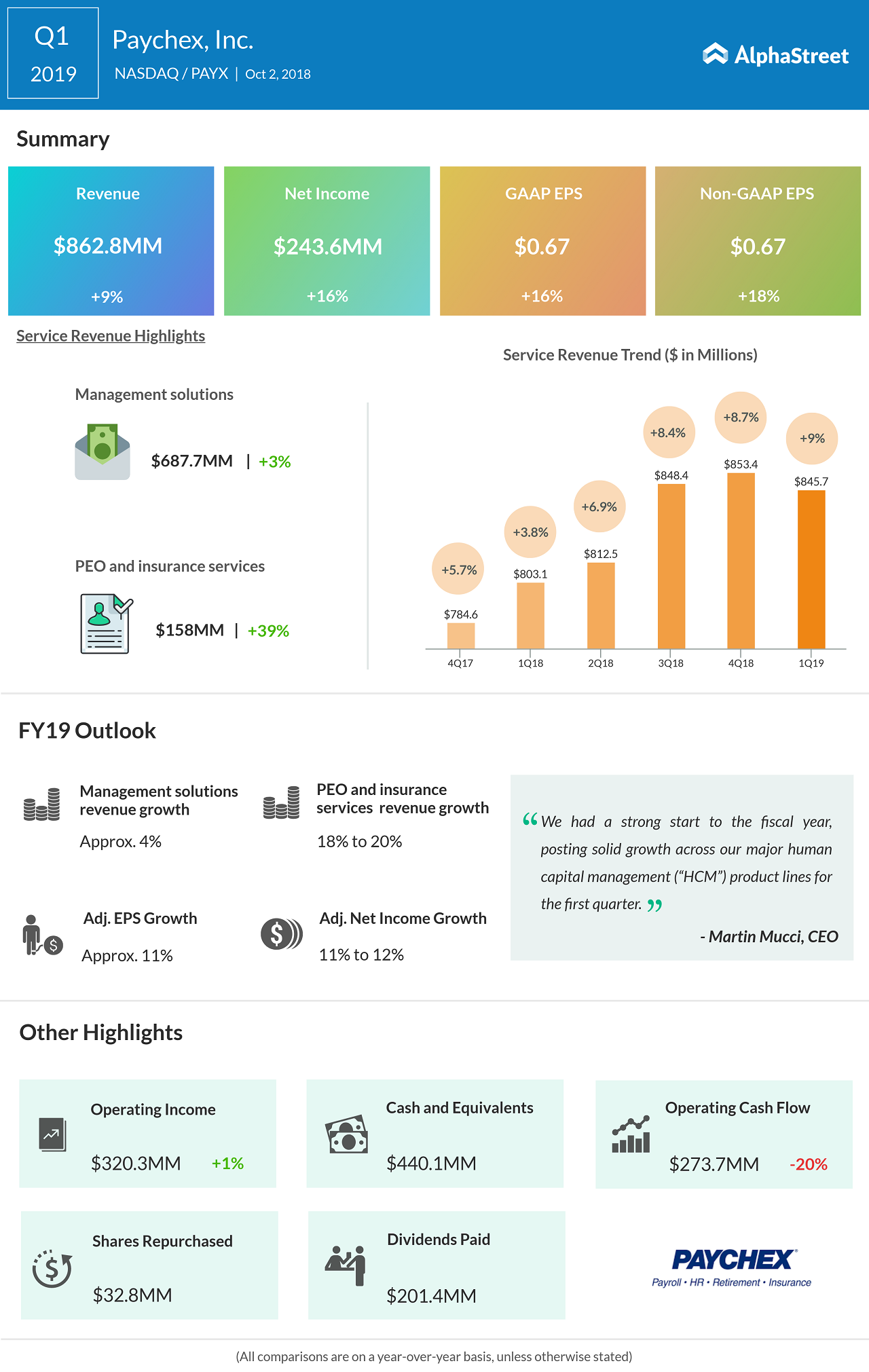

Payroll services company Paychex (PAYX) reported better-than-expected results during the first quarter, helped by solid growth in human capital management products. Revenue rose 9% to $862.8 million, higher than the Wall Street’s expectation of $852.28 million.

The company posted adjusted earnings of 67 cents per share during the first quarter. Analysts had, on an average, expected 65 cents per share. On a reported basis, net income rose 16% to $243.6 million.

Management Solutions revenue grew 3% to $687.7 million during the quarter, driven by an increase in customer base. The Rochester, New York-based company said its interest on funds held for clients increased 25% to $17.1 million due to higher average interest rates earned.

CEO Martin Mucci said in a statement, “In particular, our administrative services organization, retirement services, and time and attendance solutions performed well. We also continue to experience strong demand for our professional employer organization services, achieving double-digit growth in the number of client worksite employees served.”

For fiscal 2019, Paychex expects management solutions revenue to increase by about 4%. Meanwhile, PEO and insurance services revenues are anticipated to increase about 18-20%.

Paychex shares were slightly down in pre-market trading.