PayPal Holdings’ (NASDAQ: PYPL) fourth-quarter 2019 earnings and revenue results topped market’s expectations. However, the digital payments firm’s weaker-than-expected outlook resulted in a 6% decline of PYPL stock immediately after the earnings announcement.

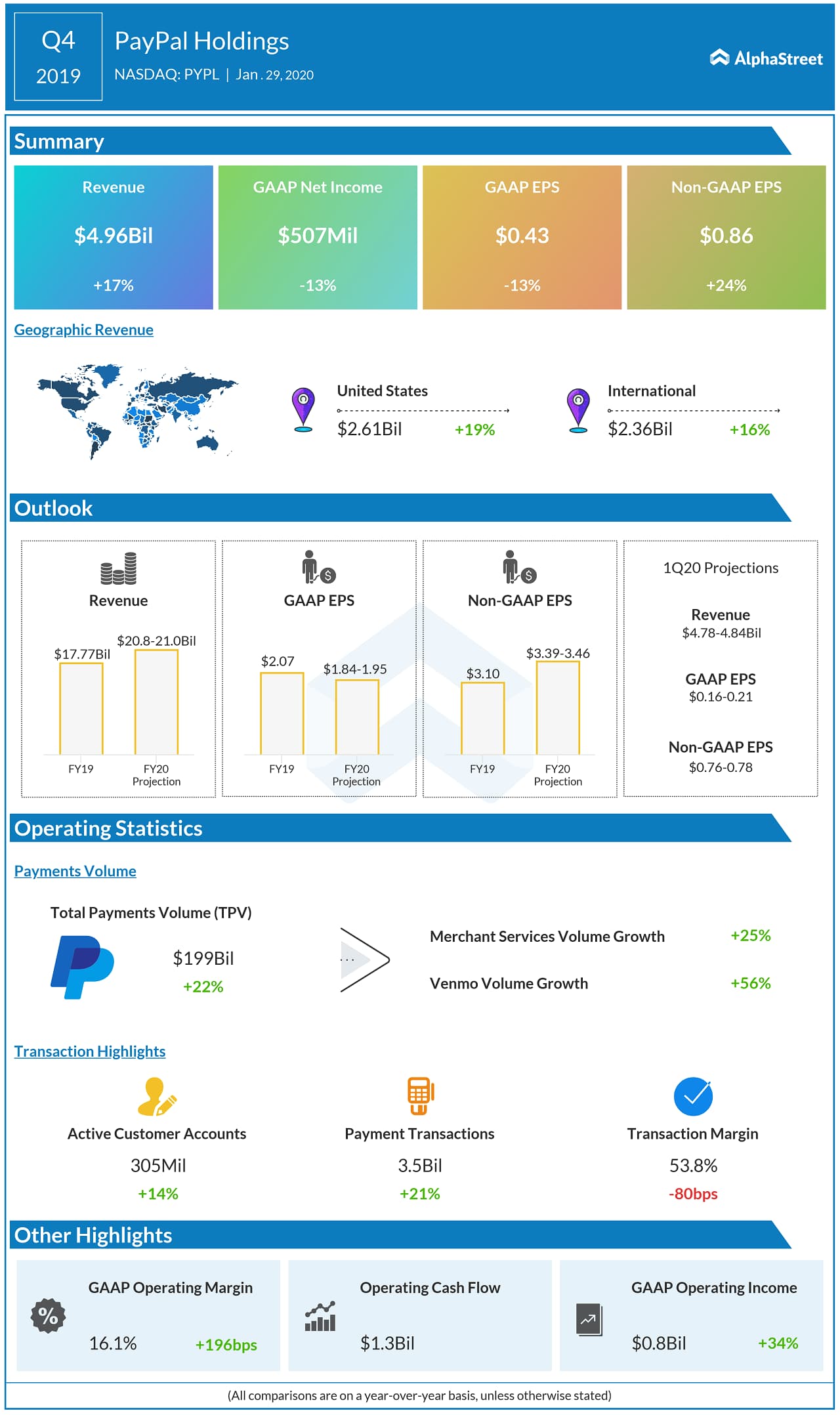

PayPal’s non-GAAP EPS increased 24% year-over-year to $0.86 and revenue rose 17% to $4.96 billion. Analysts had expected the company to earn $0.83 per share on revenue of $4.94 billion.

For full-year 2020, PayPal expects revenue to grow 17-18% at current spot rates and 18 – 19% on an FX-neutral basis, to a range of $20.8 – $21.0 billion. GAAP EPS is expected to be $1.84 – $1.95 and non-GAAP EPS is pegged to be in the range of $3.39 – $3.46.

For the first quarter of 2020, PayPal expects revenue to grow 16 – 17% at current spot rates and 17 – 18% on an FX-neutral basis, to a range of $4.78 – $4.84 billion. GAAP earnings per share is estimated to be in the range of $0.16 – $0.21 and non-GAAP earnings is estimated to be in the range of $0.76 – $0.78 per share.

For the three months ended December 31, 2019, PayPal added 9.3 million net new active accounts, bringing total active accounts to 305 million. At 3.5 billion, payment transactions were up 21%. Total payment volume increased 22% to $199 billion.

PayPal stock, which inched up by 0.12% to $116.66 at the end of today’s regular trading session, had advanced 28% in the past 12 months.