Quarterly performance

Segment performance and trends

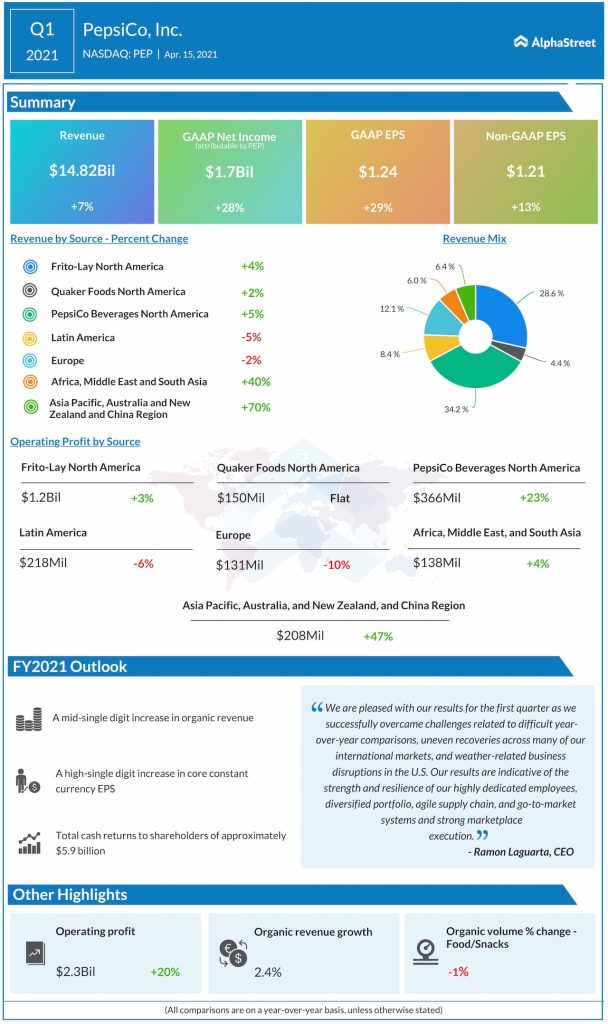

PepsiCo faced challenges during the quarter from business disruptions in the US due to bad weather and uneven recoveries across some of its international markets. The company witnessed healthy growth in its snacks and beverages businesses while managing to hold or gain share across several key markets.

PepsiCo’s business did well both in North America and international markets despite pandemic-related restrictions and although the company expects changes in customers’ habits as restrictions ease, it believes it can hold its ground in the marketplace.

PepsiCo’s Frito-Lay and Quaker divisions benefited from high demand for snacks as well as the trend of eating breakfast at home. The company introduced new products within its Doritos and Cheetos brands to take advantage of the spike in snacking and these efforts paid off. Quaker could see its demand moderate slightly as people start going out for work but the snacks business is expected to stay strong. Revenues for Frito-Lay grew 4% while Quaker revenues rose 2%.

The beverages segment benefited from growth in bubly, Starbucks, Mountain Dew and Gatorade. PepsiCo has been rolling out more products with less or no sugar to cater to its health-conscious customer base. Along with carbonated soft drinks, the company has gained share in categories like teas, juices, and sparkling water.

In terms of international performance, PepsiCo gained share for its savory products in regions like Mexico, Brazil, Russia and China while its beverages business picked up share in places like the UK, Saudi Arabia, and Thailand.

Outlook

PepsiCo expects its organic revenues to increase in the second quarter of 2021. The company expects certain trends like growth in ecommerce and remote work, which picked up during the pandemic, to continue in a post-COVID world. It also expects its foodservice business to see improvements once vaccines are distributed and people start going out more.

For FY2021, PepsiCo expects organic revenue to grow in the mid-single digits and core constant currency EPS to grow in the high single digits.

Click here to read the full transcript of PepsiCo Q1 2021 earnings conference call