During the quarter, Pfizer returned $8.1 billion to shareholders through dividends and share repurchases.

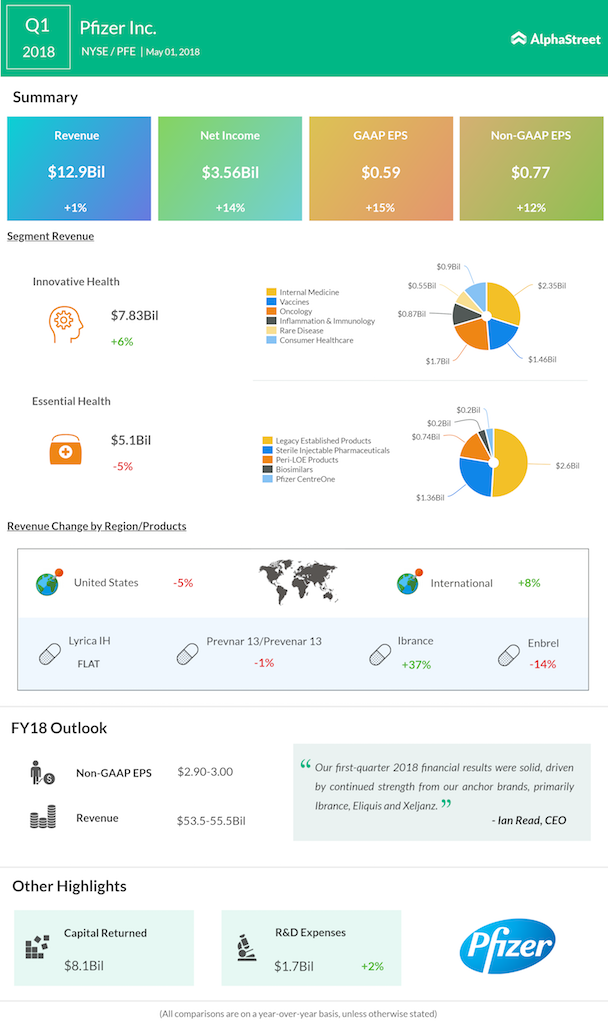

For the full year of 2018, Pfizer expects revenues of $53.5 billion to $55.5 billion and adjusted EPS of $2.90 to $3.00.

Pfizer’s quarterly results benefited from strength in anchor brands, primarily Ibrance, Eliquis, and Xeljanz. Revenues in the Innovative Health segment increased 6% to $7.8 billion while in the Essential Health segment, revenues dropped 5% to $5 billion.

The Essential Health business was negatively impacted by legacy Hospira product supply shortages in the US as well as product losses of exclusivity.

In April 2018, Pfizer announced that Trumenba received Breakthrough Therapy designation from the FDA for active immunization to prevent invasive disease caused by Neisseria meningitidis group B (MenB) in children aged one to nine. This is the first ‘Breakthrough Therapy’ designation for a MenB vaccine to help protect children as young as one year of age.