Tailwinds

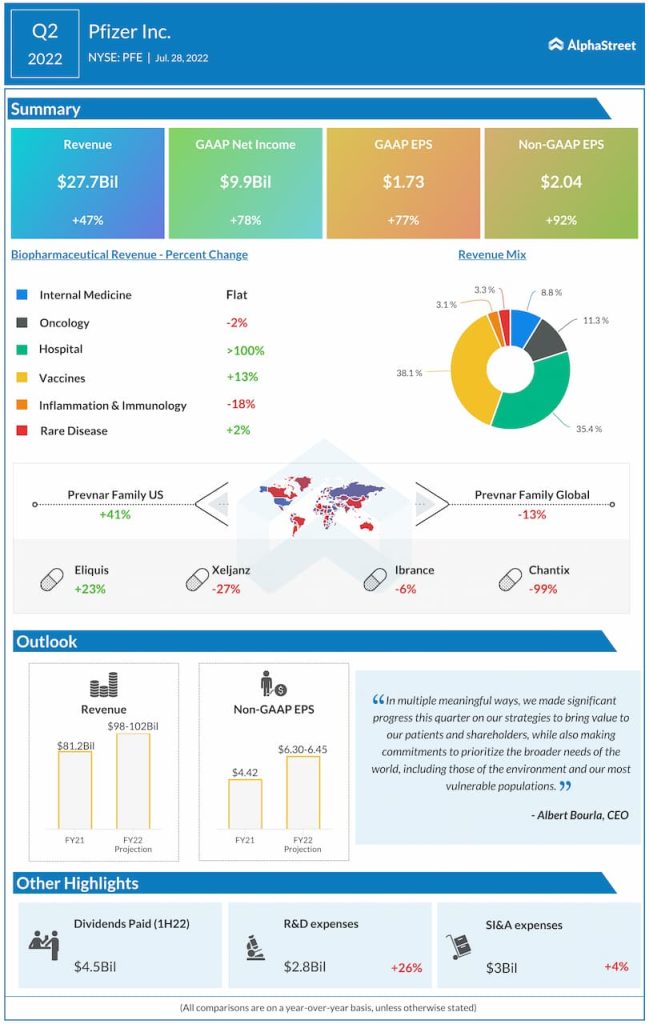

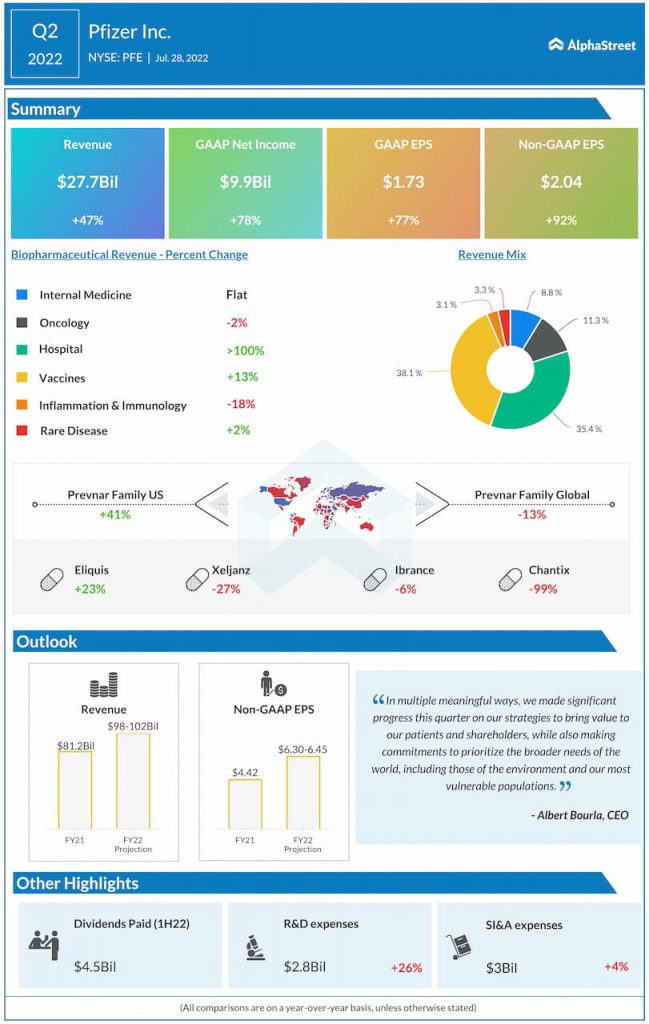

The threat of COVID is anticipated to continue in the near term as infections rise and new variants emerge. In this situation, there will be a demand for booster vaccines which in turn could boost Pfizer’s revenue. For FY2022, Pfizer expects Comirnaty to generate revenues of approx. $32 billion and Paxlovid to yield revenues of approx. $22 billion.

Although its COVID-19 products form a large part of its revenue, Pfizer is not entirely dependent on them. The company has a large portfolio of products that help drive meaningful revenues outside the COVID-19 space. During the second quarter, Pfizer witnessed double-digit growth in products like the Prevnar family, Eliquis and Vyndaqel/Vyndamax.

The company also has a robust pipeline of products in development for various indications including multiple myeloma and ulcerative colitis. Once approved, these will generate additional revenue and drive further growth.

Pfizer is also expanding its portfolio through acquisitions. In May, the company announced the acquisition of Biohaven Pharmaceuticals, which will bring Biohaven’s migraine treatments under the Pfizer umbrella. Pfizer has also announced plans to acquire Global Blood Therapeutics, which will expand its presence in rare hematology and give it access to the latter’s portfolio and pipeline in sickle cell disease, which has the potential to generate worldwide peak sales of more than $3 billion.

Headwinds

The fact that a significant portion of Pfizer’s revenue came from its COVID-19 products has raised concerns over the company’s top line growth once the pandemic subsides and demand for this particular category dips. Pfizer’s revenue, excluding Comirnaty and Paxlovid, increased only 1% in Q2. The company has also seen double-digit sales declines for some of its products like Xeljanz and Sutent due to price declines and loss of exclusivity. These factors have raised concerns over the company’s growth prospects over the long term.

Click here to read the full transcript of Pfizer’s Q2 2022 earnings conference call