Shares of Pfizer Inc. (NYSE: PFE) were up more than 4% on Tuesday after the company beat revenue and earnings estimates for the second quarter of 2020. The pharma giant raised its outlook and also disclosed that its COVID-19 vaccine has entered the final stage of clinical trials.

While the coronavirus outbreak impacted revenues by disrupting patient visits in the US and hurting demand for certain products in China, the company’s saw some respite in higher demand for certain injectable products in the US and Prevnar 13 overseas.

COVID-19 vaccine

The COVID-19 pandemic has both hurt Pfizer as well as put it in the spotlight. While the health crisis impacted its quarterly revenues, the company’s progress in the development of a vaccine for the coronavirus has been the main highlight of its report.

Earlier this month, after reviewing the data from its Phase 1/2 clinical trials, Pfizer and BioNTech decided to move their BNT162b2 vaccine candidate into the Phase 2/3 study at a level of 30 micrograms in a two-dose regimen. The dosing commenced in the USA on Monday.

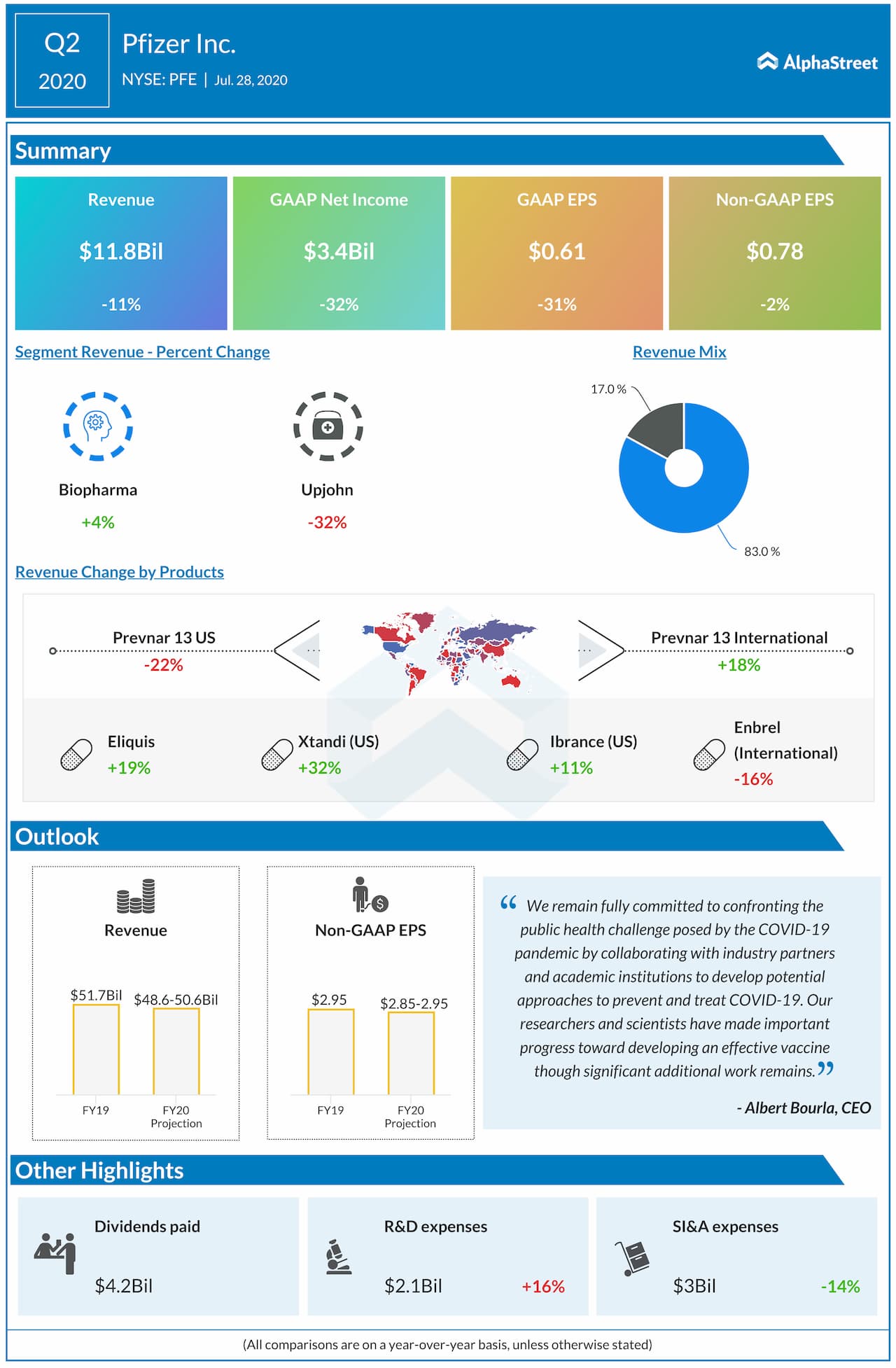

“We remain fully committed to confronting the public health challenge posed by the COVID-19 pandemic by collaborating with industry partners and academic institutions to develop potential approaches to prevent and treat COVID-19. Our researchers and scientists have made important progress toward developing an effective vaccine though significant additional work remains.” – Albert Bourla, Chairman and CEO

ADVERTISEMENT

The study plans to enrol up to 30,000 participants aged between 18 and 85 years across a diverse population, including members from places that have significant exposure to the coronavirus. If the trial is successful, Pfizer and BioNTech will look to obtain regulatory approval as early as October.

If the companies manage to obtain regulatory approval, they aim to supply up to 100 million doses by the end of 2020 and around 1.3 billion doses by the end of 2021. The companies have already entered into agreements with the US and UK governments for the supply of the vaccine doses. The US government will pay $1.95 billion for the first 100 million doses and can acquire 500 million more doses. The UK government has agreed to acquire 30 million doses in 2020 and 2021.

Product performance

Pfizer had mixed product performance during the quarter, with a 6% operational increase in Biopharma revenues and a 31% operational decline in Upjohn revenues. Upjohn revenues were hurt by generic competition for Lyrica in the US.

The company saw strength in Eliquis and Ibrance, helped by market share gains in oral anti-coagulants as well as CDK market share leadership in metastatic breast cancer. Prevnar 13 gained in international markets due to greater vaccine awareness for respiratory illnesses due to the pandemic.

In the US, Prevnar 13 saw a decline due to disruptions in patient visits as a result of the health crisis. Ibrance was hurt by pricing pressures in certain markets.

Outlook

Pfizer raised its guidance for revenues and adjusted EPS for the full year of 2020 based on assumptions that there will be an uptick in patient visits, vaccination rates and elective surgical procedures from the third quarter. The company also assumes that prescription trends for certain key products will improve in the third quarter versus the second quarter.

The company also expects its investments in potential COVID-19 treatments to continue throughout this year but the guidance does not include any revenues from a vaccine for COVID-19.

Click here to read the transcript of Pfizer Q2 2020 earnings conference call