Quarterly performance

Trends

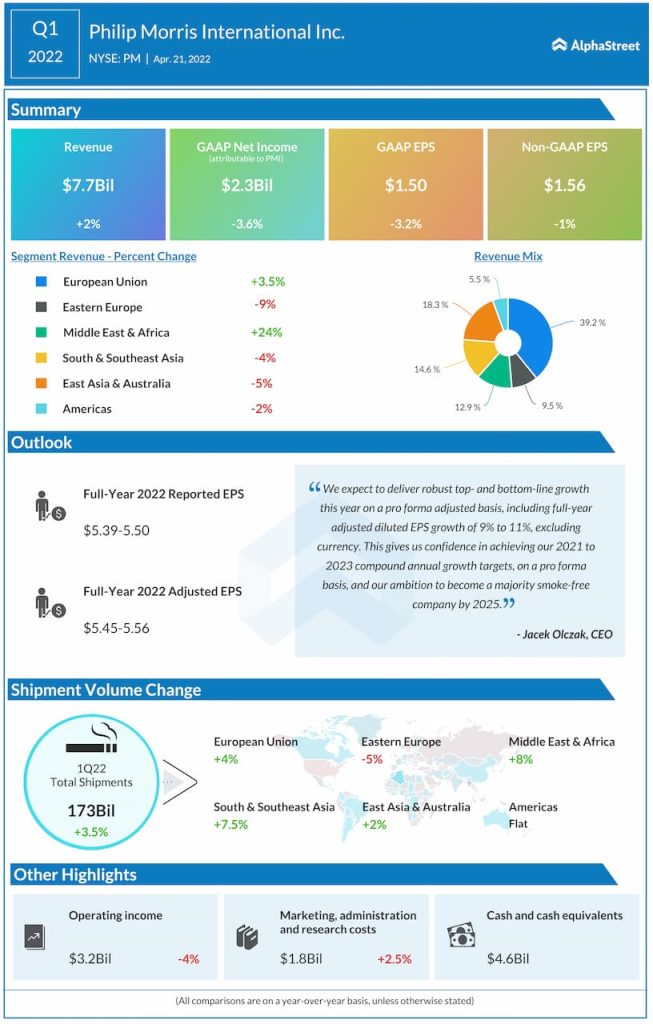

In Q1, PMI’s total shipment volume rose 3.5% driven by increases in the EU, Middle East & Africa, South & Southeast Asia, and East Asia & Australia. This was partly offset by declines in Eastern Europe and the Americas. The company’s cigarette shipment volume of brands like Marlboro and Chesterfield increased while volumes for brands like L&M decreased.

The company recorded revenue increases across most of its regions except for Eastern Europe, which remained flat, and South & Southeast Asia, which saw a decline. During the quarter, the total market in the EU increased by 3%, helped by growth in Italy and Poland.

PMI is looking to exit the Russian market as it feels the business environment there has become too complex and volatile amid the ongoing war with Ukraine. The company has discontinued a number of its cigarette products in the market and has cancelled all its product launches planned for this year.

It has also cancelled its plans to manufacture TEREA heated tobacco units for IQOS ILUMA in Russia. Last year, Russia accounted for almost 10% of total volumes and around 6% of net revenues. As of March 31, 2022, PMI’s Russian operations have approx. $1.4 billion in total assets.

Outlook

PMI cut its earnings guidance for the full year of 2022 to exclude contributions from its businesses in Russia and Ukraine for the remainder of the year. Reported EPS is now expected to be $5.39-5.50 and adjusted EPS is estimated to be $5.45-5.56 versus the previous outlook of $6.12-6.30.

The company’s outlook puts it on track to deliver, on a pro forma basis, its compound annual growth targets for 2021-2023 of more than 5% for organic net revenues and more than 9% for currency-neutral adjusted diluted EPS. It is also on track to deliver around $2 billion in gross cost savings. PMI is also confident that its transformation will help it achieve its goal of becoming a majority smoke-free business by net revenues in 2025.

Click here to access Philip Morris International’s Q1 2022 earnings conference call transcript