Stock Value

[irp posts=”60204″]

Like most Wall Street firms, Pinterest is also facing uncertainty due to the pandemic, amid falling advertising spending. The company has remained debt-free and improved its cash position since last year – something that will help it continue investing in content, ads diversification, and use-case expansion. But there is a compelling need to keep innovating, given the growing competition, with the latest to enter the photo-sharing space being Google’s (GOOG) Keen app. One aspect of the business Pinterest can effectively leverage is the model that supports online shopping.

Addressing

analysts at last month’s earnings conference call, Pinterest’s CEO Ben

Silbermann said, “While we are working to help Pinners and advertisers through

this current crisis, we remain firmly committed to our long-term strategies. We

continue to invest in our vision to be the home of the Internet’s most inspiring

content, to help users discover more ways to use Pinterest in their lives, to

let Pinners easily purchase things they find on our surface, and to create

value for a much more diverse base of advertisers.”

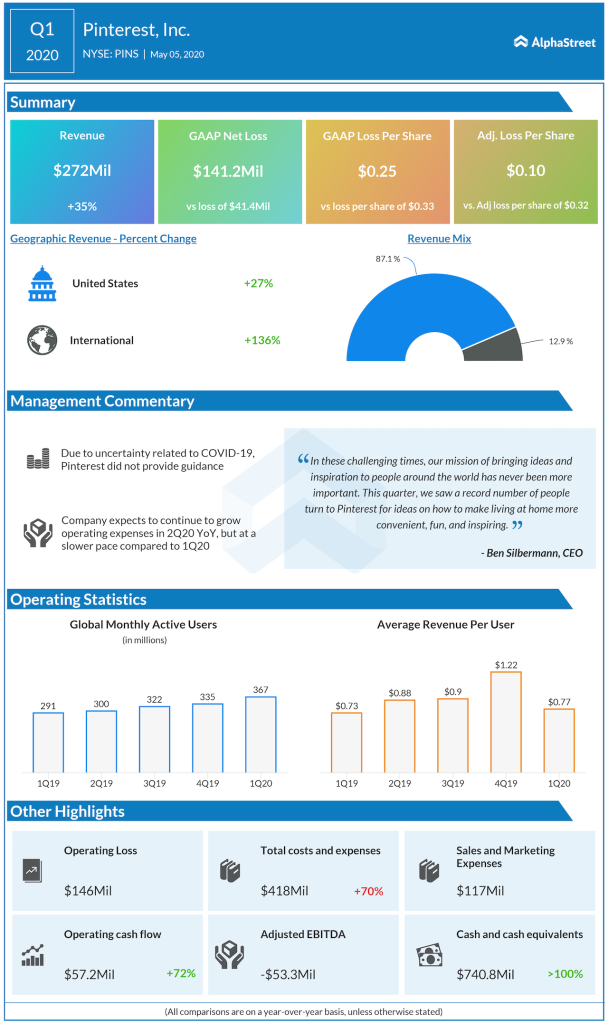

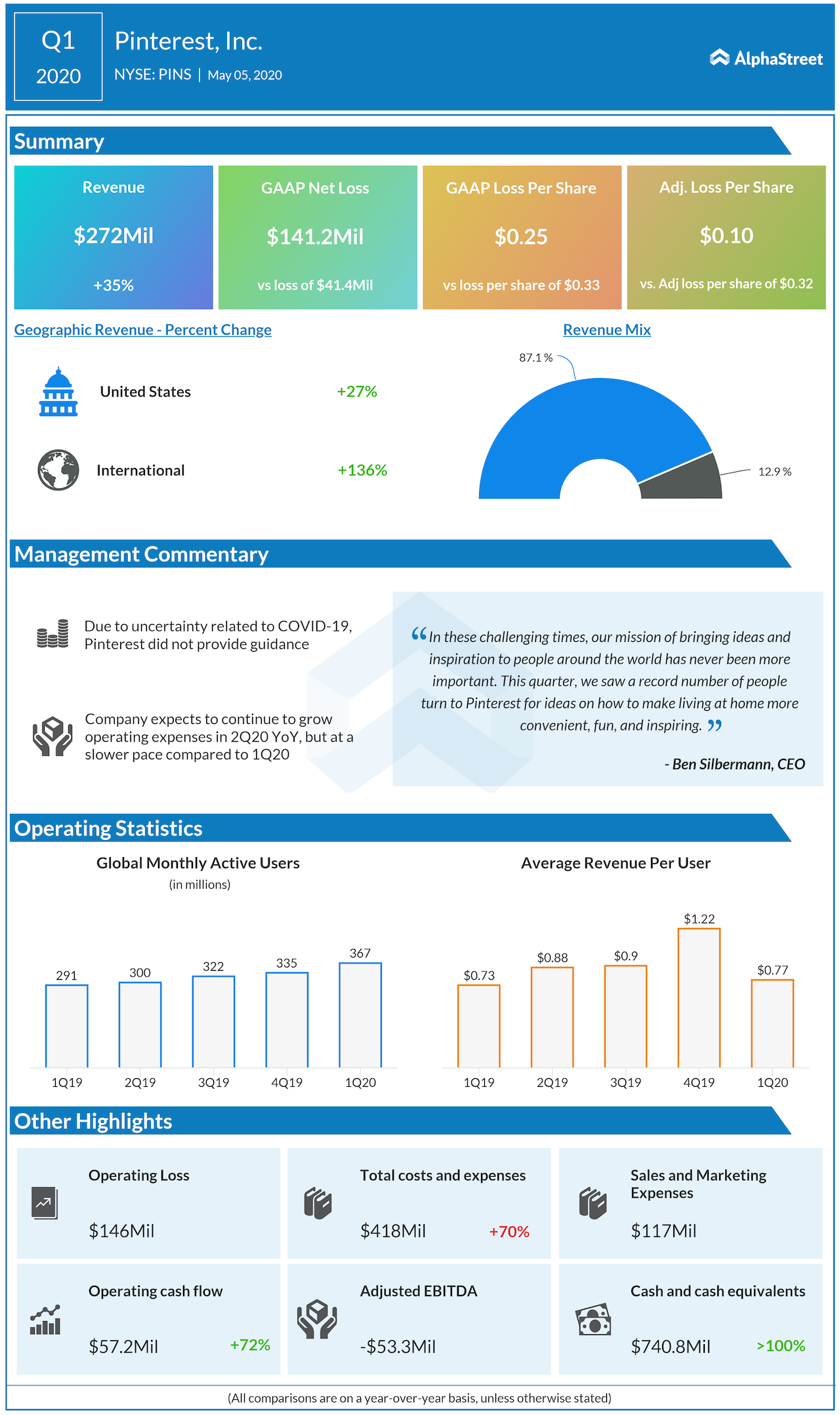

While the general sentiment is mixed, Pinterest is quite optimistic about the future of the business and expects the digital transformation wave to drive more traffic. Earlier, the management had withheld its guidance, citing a lack of visibility. Though the user base continues to grow – with overseas markets accounting for most of the new additions – there is a notable drop in revenue per user. That could be the result of a possible stagnation in the local market.

Ad Power

But the digital advertising market will continue to thrive after this temporary slump and that is expected to reflect in the performance of social media firms. In the case of Pinterest, it will depend on the company’s ability to attract more users in the domestic market that is rapidly getting overcrowded. Overall, the current trend is not very encouraging, especially in the absence of a clear turnaround strategy.

Also, the unusually high social media traffic might ease once normalcy returns after the shutdown. However, considering the fluidity of the situation, it is difficult to predict a clear trend now. Initial estimates show that Pinterest’s revenues dropped 8% year-over-year in April.

Turnaround Hopes

In the first quarter, the loss narrowed to $0.10 per share from $0.32 per share last year, aided by a 35% surge in revenues to $272 million. More recently, the company witnessed an increase in the number of users in the early weeks of the second quarter.

[irp posts=”59468″]

Pinterest’s stock traded lower during Wednesday’s regular session, after making a steady recovery from the downturn spurred by the recent market selloff. The stock, which has gained 24% since the beginning of the year, is currently hovering near the IPO price of around $24.