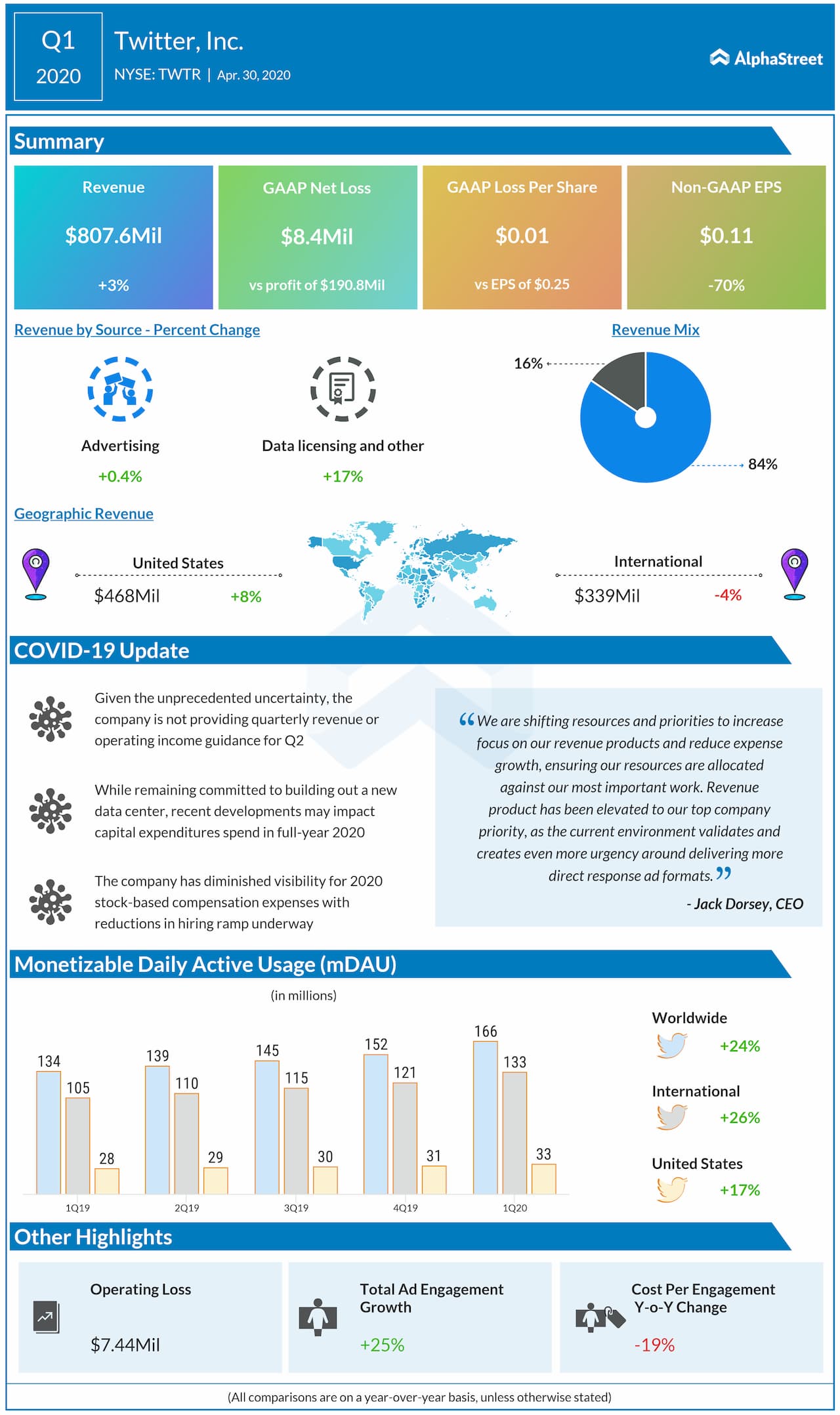

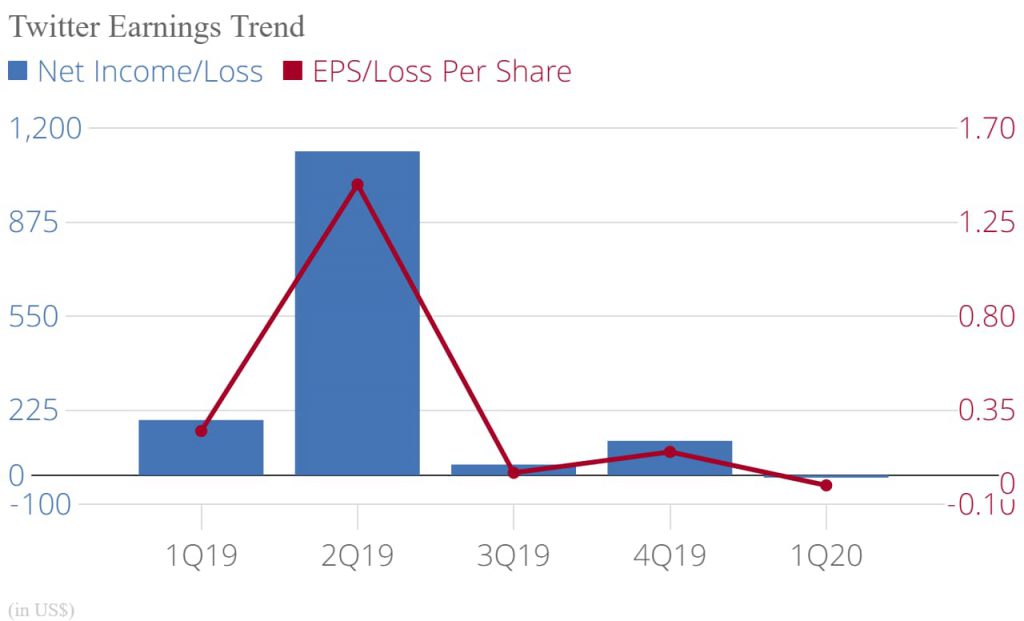

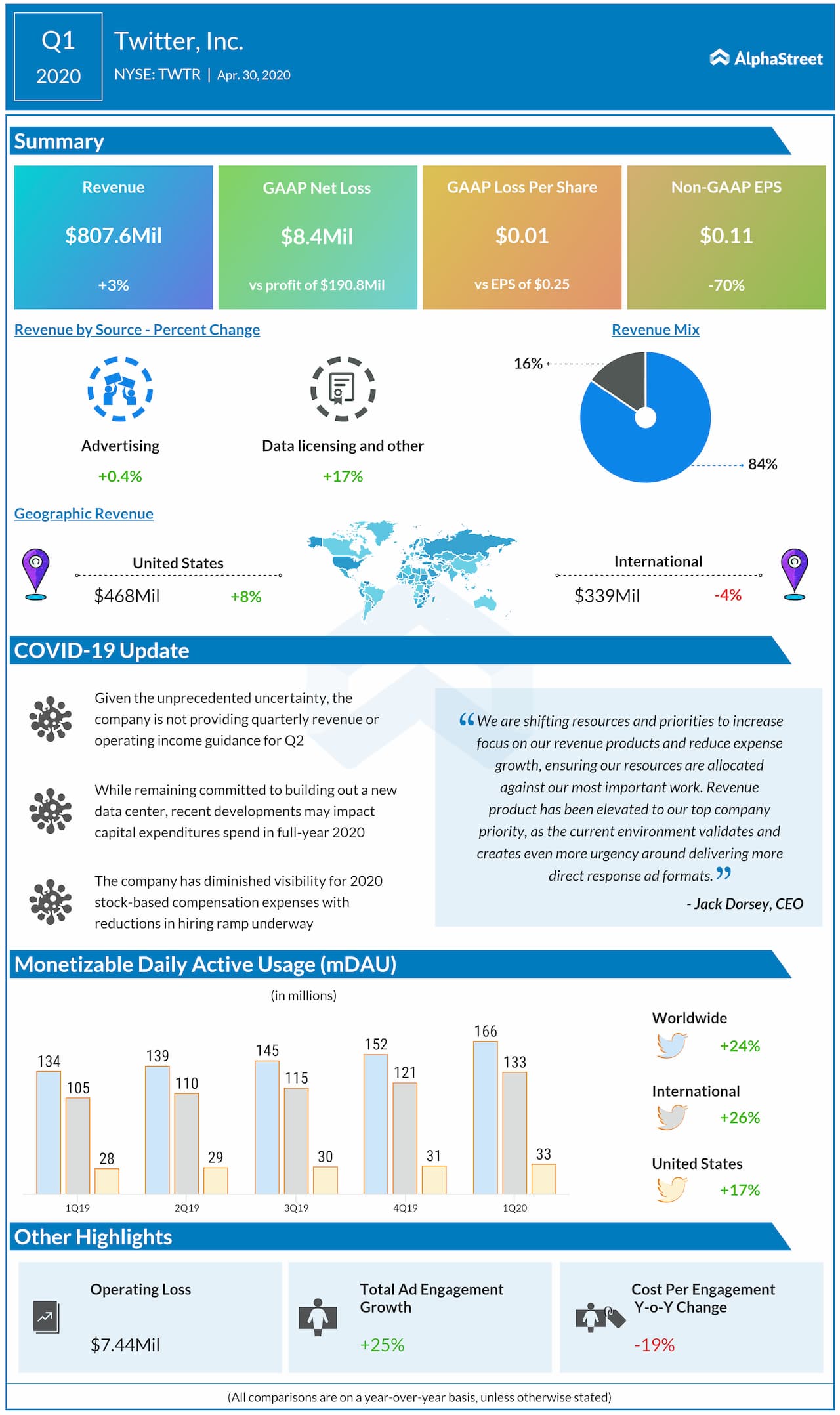

Microblogging platform Twitter Inc. (NYSE: TWTR) slipped to a loss in the first quarter of 2020 from a profit last year, due to the growing impact of COVID-19 on the global operating and economic environment and their effect on advertiser demand. The results exceeded analysts’ expectations.

Revenue rose by 3% reflecting a strong start to the quarter that was impacted by widespread economic disruption related to the COVID-19 in March. The company said the reduced expenses resulting from coronavirus disruption partially offset the revenue shortfall, which resulted in an operating loss.

The average monetizable DAU grew by 24% year-over-year, driven by typical seasonal strength, ongoing product improvements, and global conversation related to the COVID-19 pandemic. Given the unprecedented uncertainty and rapidly shifting market conditions of the current business environment, the company is not providing quarter revenue or operating income guidance for Q2.

Past Performance

Twitter Q4 2019 Earnings Results

TWTR Q3 2019 Earnings Performance