Shares of Twitter Inc. (NYSE: TWTR) were down 2% on Friday, a day after it reported fourth quarter 2021 results that missed expectations across the board. The company’s top and bottom line numbers as well as its user metrics all fell short of estimates. Despite this, Twitter remains quite ambitious with regards to its near-term goals and its strategy is focused on two key pillars.

Content selection

Twitter has stated that its purpose is to serve the public conversation. The selection of content and conversations on its platform plays a huge role in this matter. Currently there is a lot of interest in general topics like politics, sports, entertainment and music. The expansion of features such as Ticketed Spaces, Tips, Super Follows, and Communities are expected to help broaden the range of topics being discussed on Twitter.

The company is also partnering with media companies, news organizations, and sports leagues to provide premium live and on-demand video content. During the fourth quarter, Twitter extended its content partnership with the NBA and also entered into agreements with ViacomCBS and Bloomberg Media.

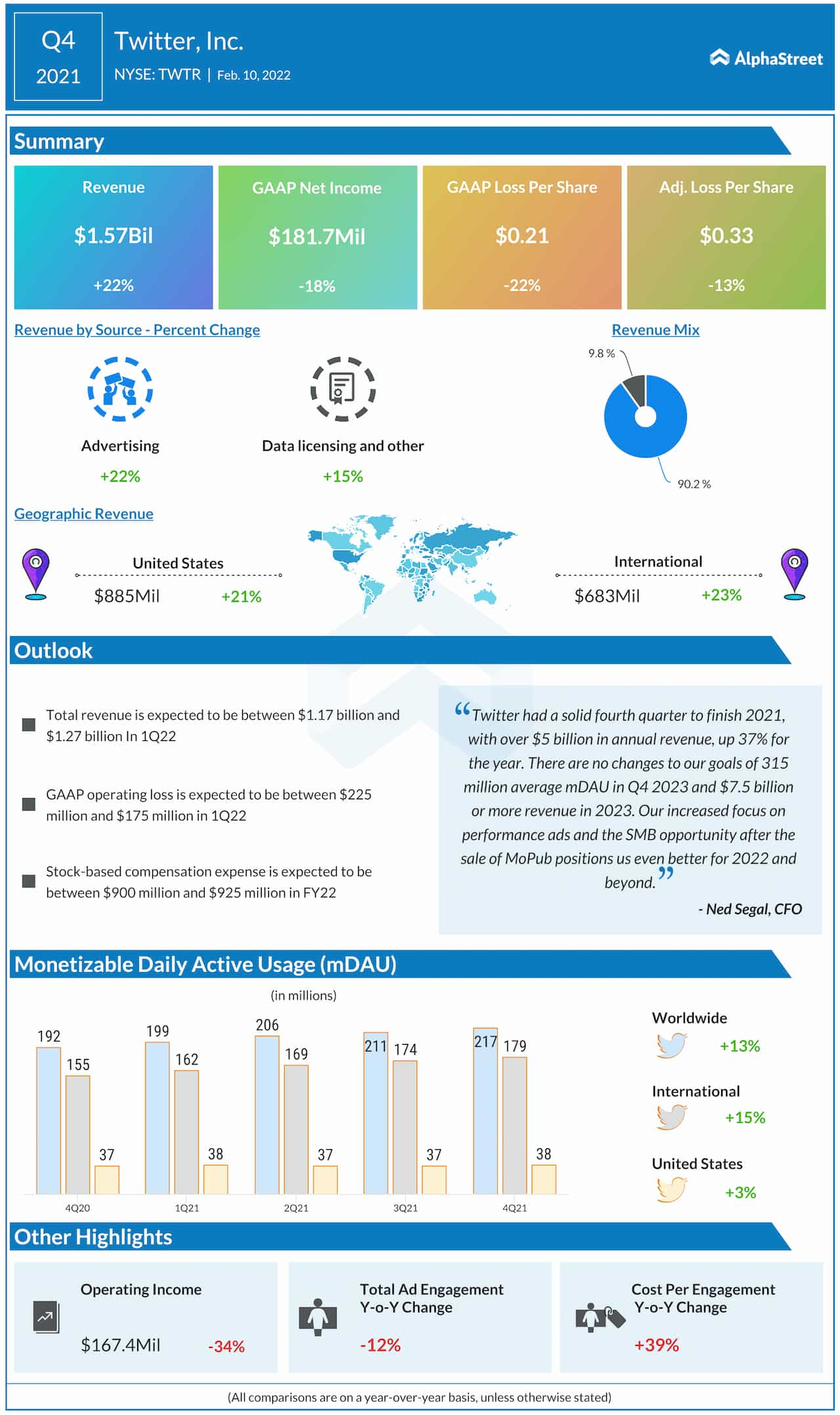

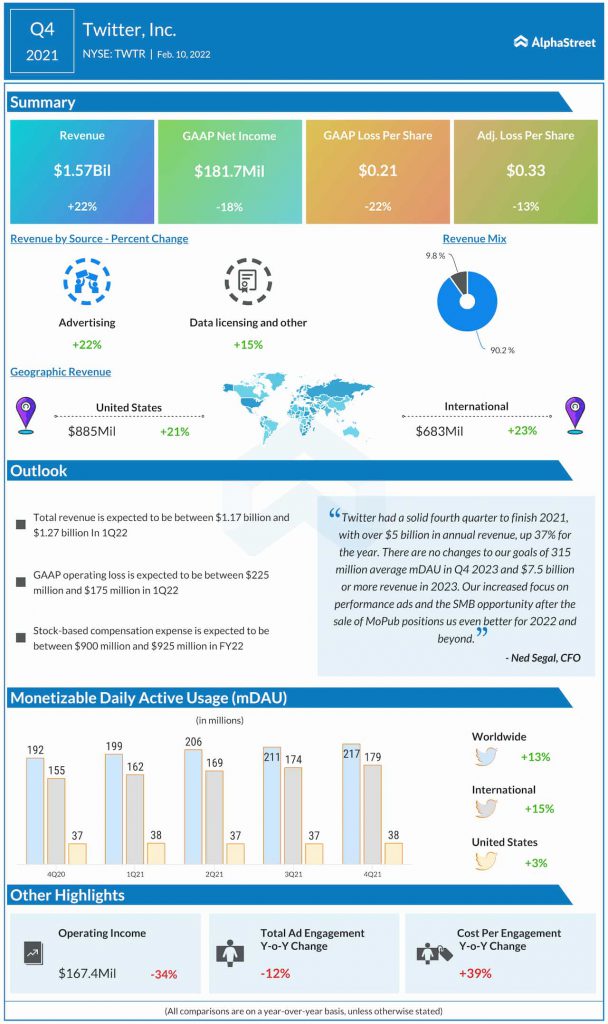

This will give the company more opportunities for monetization through advertising. In Q4, advertising revenues were up 22% year-over-year. Total ad engagements declined 12% while cost per engagement rose 39% YoY.

Personalization

The second part of the strategy is personalization. Twitter has been focusing on understanding customer interests through machine learning and through products like followable Topics. The microblogging site has 14,500 topics available across 11 languages and around 280 million accounts follow at least one topic.

During the fourth quarter, average monetizable daily active usage (mDAU) increased 13% YoY to 217 million, driven by product improvements and global conversation around current events. In the US, mDAU increased 2% YoY to 38 million while internationally, it was up 15% to 179 million.

Twitter stated that it made meaningful progress in fiscal year 2021 against its 2023 goals. During the year, the company added 25 million mDAU and saw a 25% YoY increase in the number of people who log on to Twitter to create a new account or reactivate an existing one. It also witnessed a 35% YoY increase in daily sign-ups.

Twitter believes there is vast opportunity for it to grow revenue and mDAU and to move into the digital ads market, which is currently worth $150 billion and growing, and where the company has less than 3% market share at present.

Click here to read the full transcript of Twitter’s Q4 2021 earnings conference call