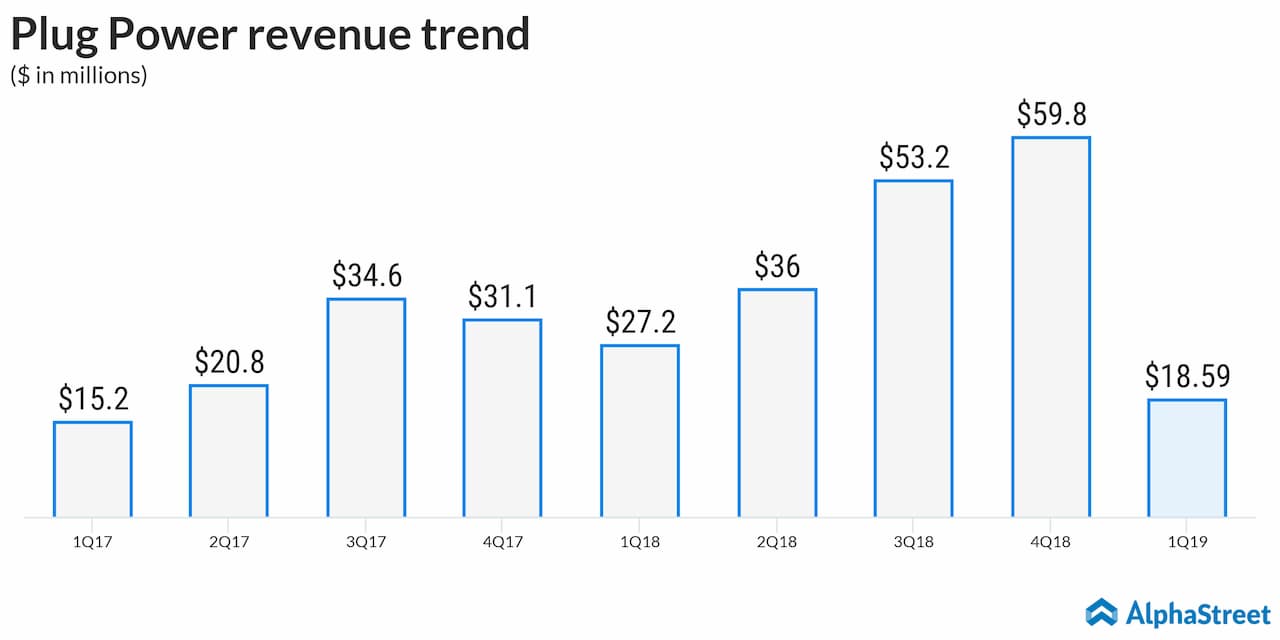

While this gives a somewhat positive picture of the stock, let’s not forget it’s not devoid of headwinds. In three of the last four quarters, the company failed to beat bottom-line estimates. During the first quarter, Plug Power posted wider losses on a 30% decline in revenues, even as the market was expecting narrower losses.

For the second quarter, analysts expect a 35% jump in revenues to $53.74 million, helped by its increased adoption in the electric vehicle industry.

READ: Earnings: Sogou stock falls on weak guidance

ADVERTISEMENT

Meanwhile, the Latham, New York-based firm is expected to report a net loss of 1 cent per share, compared to a loss of 12 cents per share it reported in the same quarter last year. The bottom-line for the quarter could be impacted by the constant increase in operating and infrastructure expenses as well as foreign currency weakness.

During the conference call, look out for any management commentary on the company’ strategy to peg its rising liabilities.

PLUG stock has gained 57% so far this year and 3.5% in the trailing 52 weeks. The stock has a 12-month average price target of $3.42, which is at a 66% upside from its Monday trading price.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.