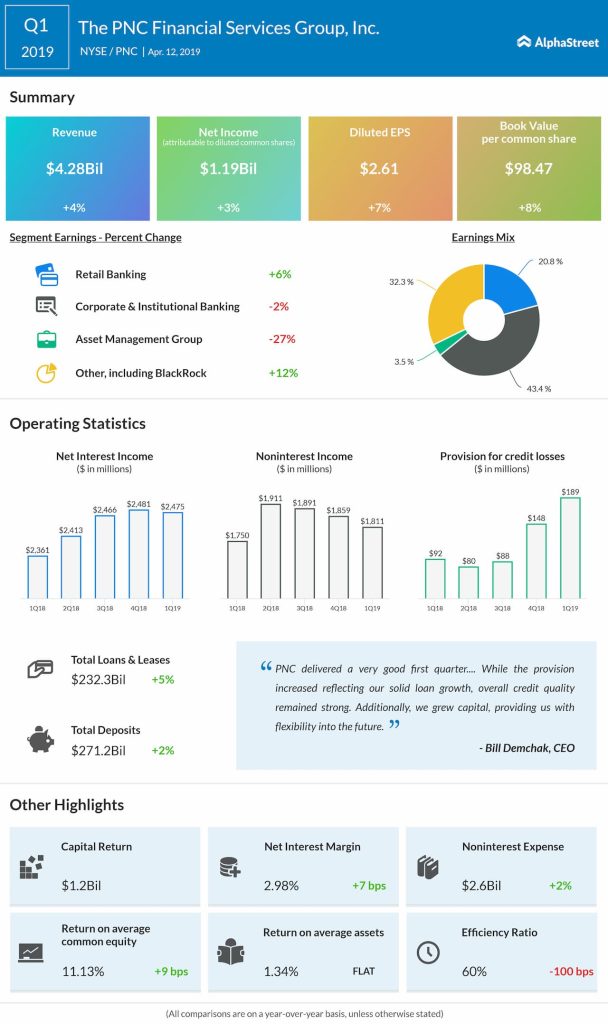

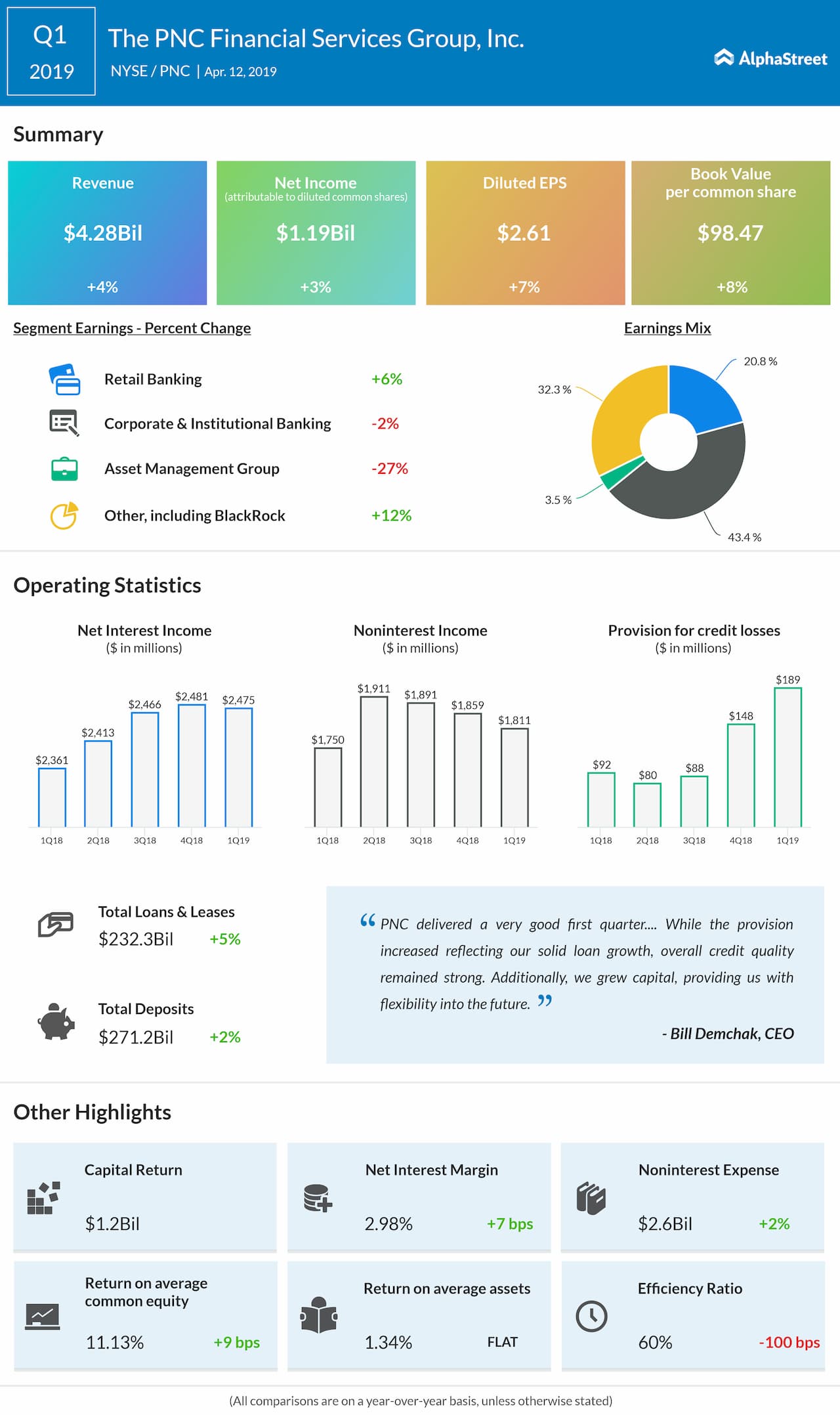

“PNC delivered a very good first quarter. Year over year, we grew net income, and compared with fourth quarter 2018, net interest income was stable despite two fewer days, our net interest margin expanded and we kept expenses flat. While the provision increased reflecting our solid loan growth, overall credit quality remained strong. Additionally, we grew capital, providing us with flexibility into the future,” said CEO Bill Demchak.

On April 4, 2019, the PNC Board declared a quarterly cash dividend of 95 cents per share effective with the May 5, 2019 dividend payment date. Two other banking giants JPMorgan (JPM) and Wells Fargo (WFC) have reported their quarterly results today. Citigroup (C) is expected to report its quarterly results on Monday.

The Pittsburgh-based banking firm’s stock had increased 10% since the beginning of the year and dropped 14% in the past 12 months. PNC shares closed Thursday’s trading up 1.12% at $128.72.