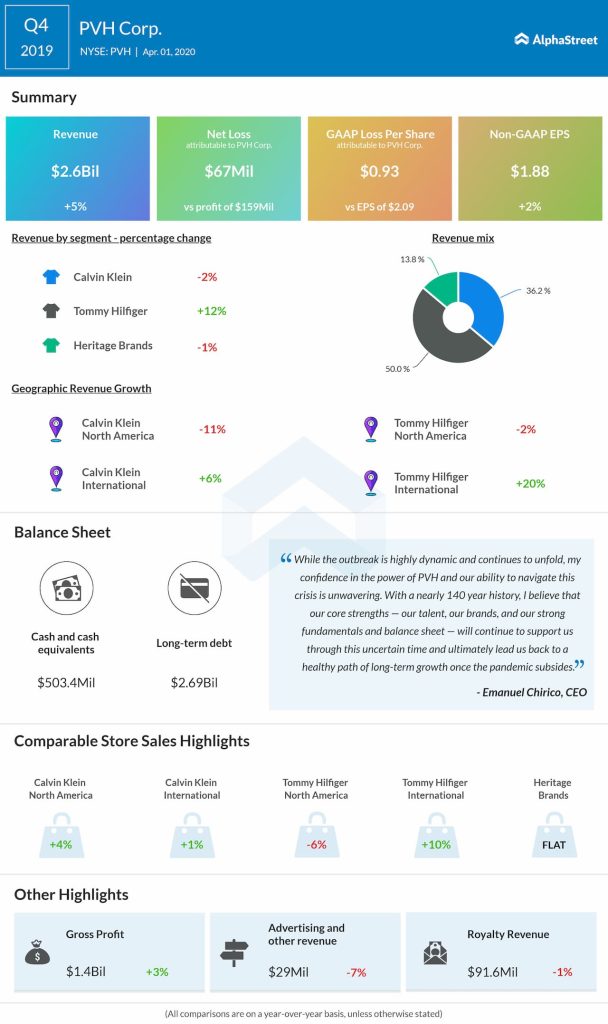

— Revenue in the Tommy Hilfiger business increased by 12% driven by the continued outperformance in Europe and the addition of revenue resulting from Australia and TH CSAP acquisitions.

— Revenue in the Calvin Klein business declined by 2% due to the decrease in the wholesale business resulting from the licensing of its directly operated women’s jeanswear wholesale business in the US and Canada to G-III Apparel Group.

— Revenue in the Heritage Brands business declined by 1% due to the weakness in the North American wholesale business.

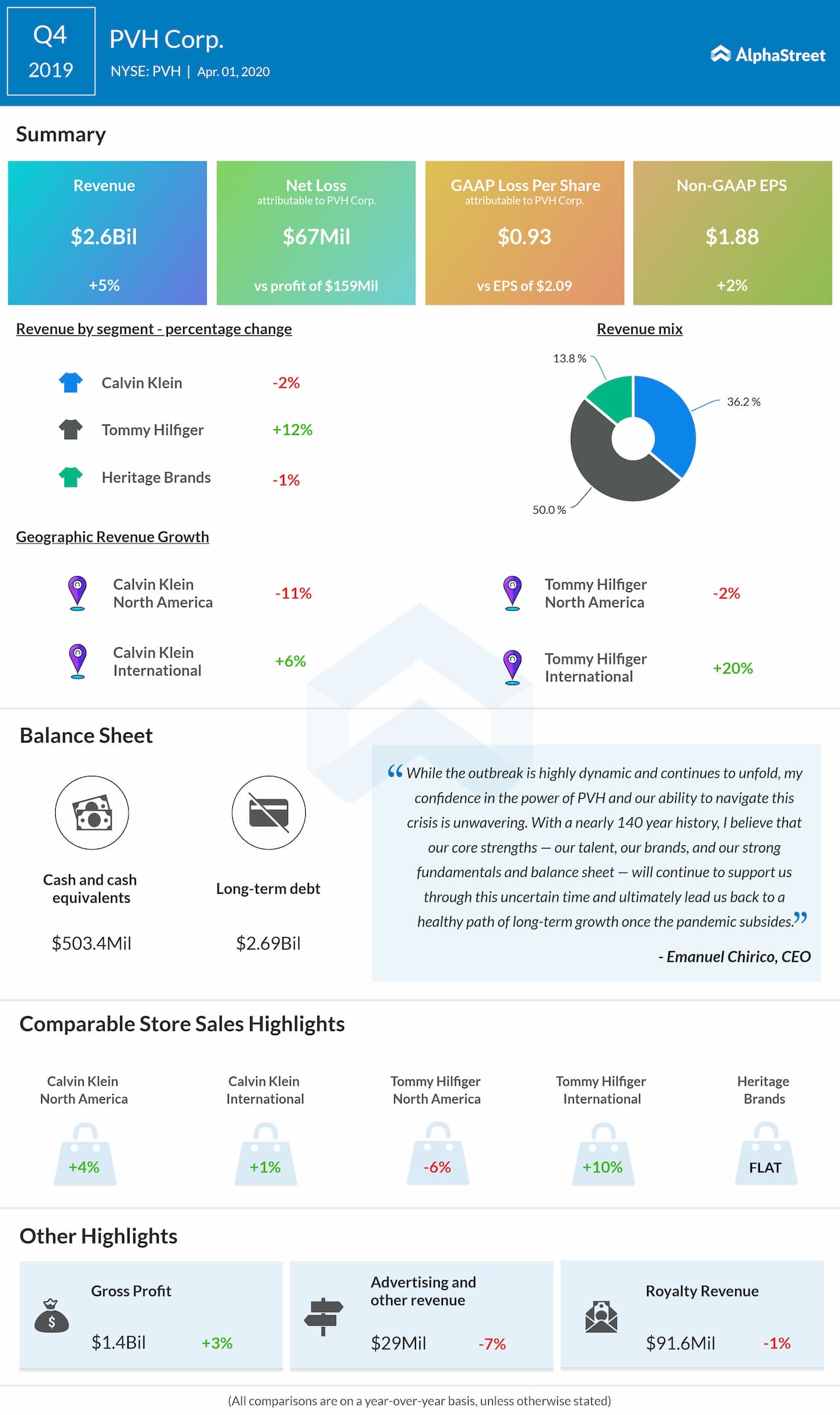

— The Covid-19 global pandemic is having a significant impact on the company’s business, results of operations, financial conditions, and cash flow in 2020.

— In the first quarter, the company’s retail stores in virtually all key markets experienced a sharply reduced traffic, consumer spending trends, and sales stoppages due to the virus-related concerns, reduced travel, temporary store closures, and government-imposed restrictions.

— Given the dynamic nature of the circumstances surrounding the pandemic, the company’s results could be impacted significantly in ways it is not able to predict. Therefore, PVH has not provided guidance for the first quarter and full-year 2020.