Multi-talented giant Groupon saw its shares dip over 9% on February 14 after it posted final quarter results of 2017. With revenue sliding and profits missing street outlook, the higher EBITDA didn’t instill confidence in shareholders the way the coupon-giant wanted it.

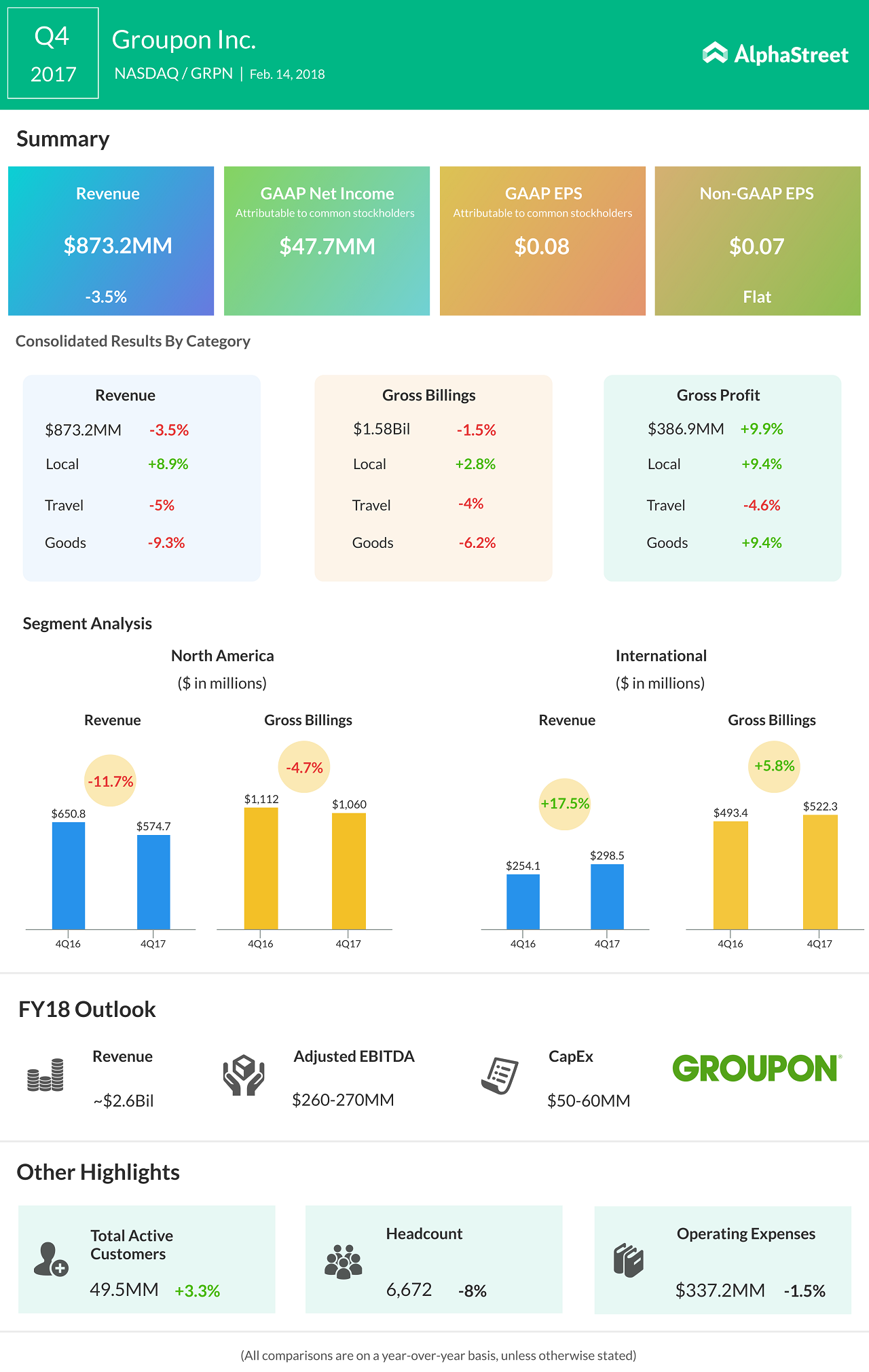

Direct revenue slipped 10% to about $527 million, with sales falling 6% to about 55 million global units in the three-month period. Gross profit shot 10% up to $387 million, but this clearly did not impress the market.

From discount coupons to a full-fledged e-commerce marketplace, Groupon has come a long way. But in an environment dominated by the likes of Amazon, Alibaba, and even eBay, the company looks like it needs a wake-up call — something disruptive and innovative.

Amazon has Amazon Pay and Alexa, and Alibaba has similar products, if not a solid customer base back home. CEO Rich Williams might want to stop and think about this in the long run. What its competitors do, is stay in the public eye, and in this age of social media, it is a possible strategy to explore.

Meanwhile, we have composed a quick snapshot of the earnings in Q4 2017…