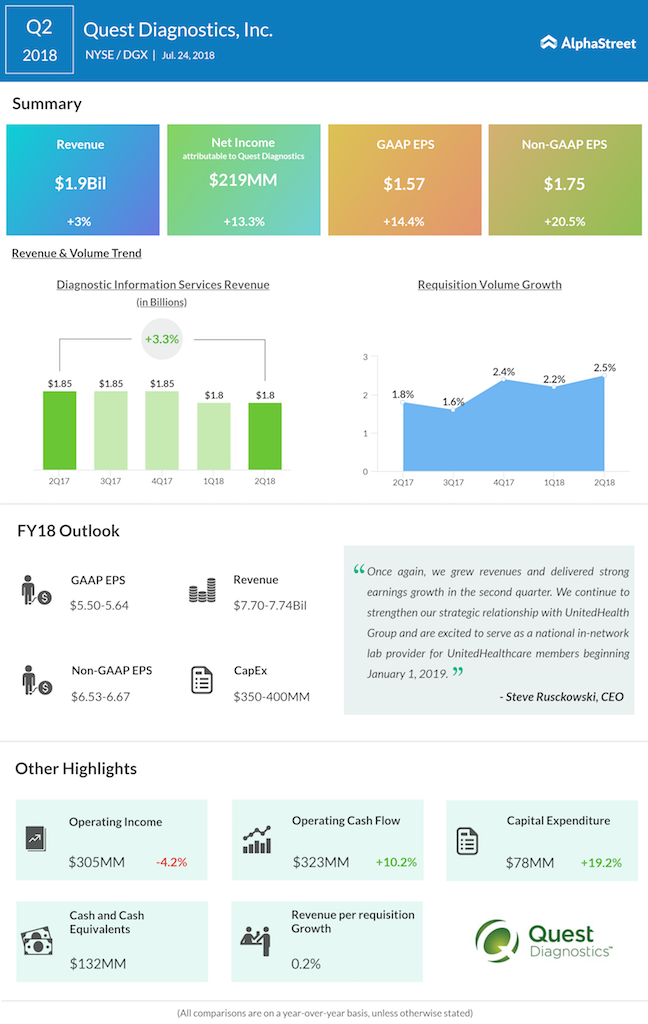

Quest Diagnostics Incorporated (DGX) posted a 3% improvement in net revenues of $1.92 billion for the second quarter of 2018 compared to the same period last year. Diagnostic Information Services revenues grew 3.3% in the quarter. Reported net income grew 13.3% to $219 million while diluted EPS rose 14.4% to $1.57 compared to the prior-year period.

Adjusted net income increased 17.3% to $225 million while adjusted diluted EPS saw an improvement of 20.5% to $1.75.

The company’s revenue numbers missed market expectations, but adjusted EPS came in line with analyst estimates. Requisition volume increased 2.5% while revenue per requisition rose 0.2%.

Steve Rusckowski, Chairman, President and CEO, said, “We continue to strengthen our strategic relationship with UnitedHealth Group and are excited to serve as a national in-network lab provider for UnitedHealthcare members beginning January 1, 2019.”

Quest narrowed its full-year 2018 outlook based on its first-half performance. The company now expects revenues to come in between $7.70 billion to $7.74 billion, reflecting revenue growth of 4% to 4.5%. Reported diluted EPS is expected to be between $5.50 and $5.64, while adjusted diluted EPS is expected to be $6.53-6.67 for the full year.