Net revenues soared by 188% year-over-year to RMB1.39 billion ($201.9 million). The increases in the company’s user base, time spent, and the ability to monetize user traffic drove advertising and marketing revenues higher by 209.2%. However, the decrease from agent and platform service hurt other revenues by 34%.

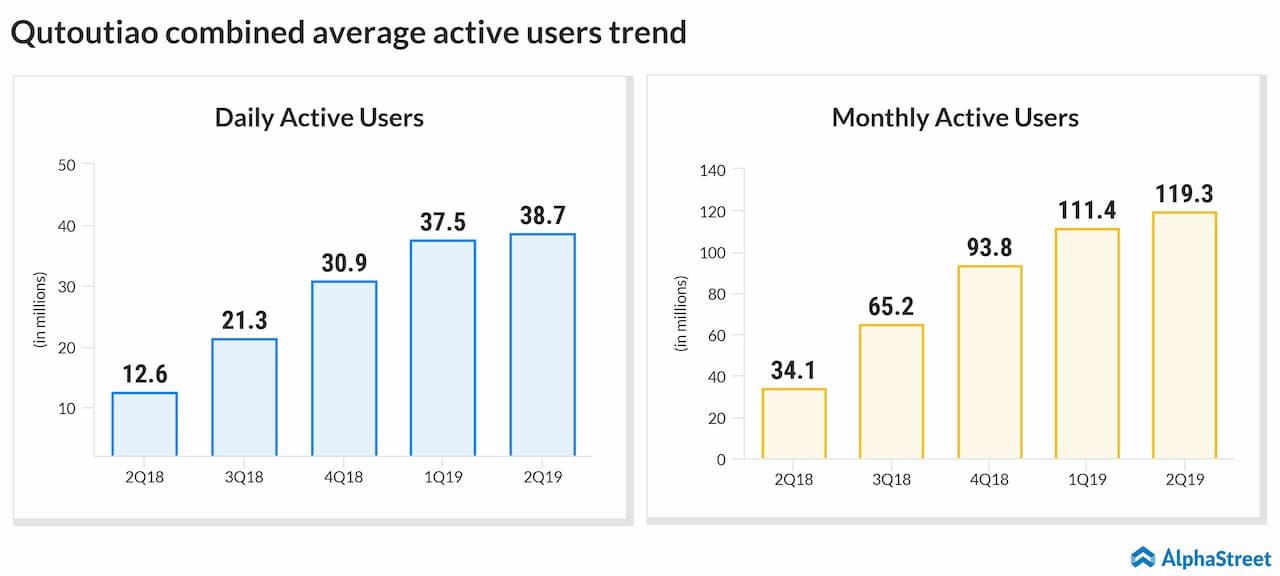

Combined average monthly active users jumped 250% year-over-year to 119.3 million and combined average daily active users surged 207% to 38.7 million in the recently ended quarter. Average daily time spent per DAU reached 60 minutes, representing a year-over-year increase of 27.5%.

For the third quarter of 2019, the company currently expects net revenues to be at a similar level as it has achieved in the second quarter of 2019. This reflects the company’s preliminary estimates of market and operating conditions and customer demand.

The growth of Qutoutiao’s user base and the level of user engagement are critical to its success. The business will continue to be significantly affected by its success in growing the number of active users and increasing their overall level of engagement on its platform. The company’s user growth rate is expected to slow over time as the size of its user base increases.

As of June 30, 2019, the company had cash, cash equivalents and short-term investments of RMB2.29 billion ($333.2 million), compared to RMB1.64 billion as of March 31, 2019. The company had a convertible loan of RMB1.17 billion and non-current lease liabilities of RMB26.59 million as of June 30, 2019.