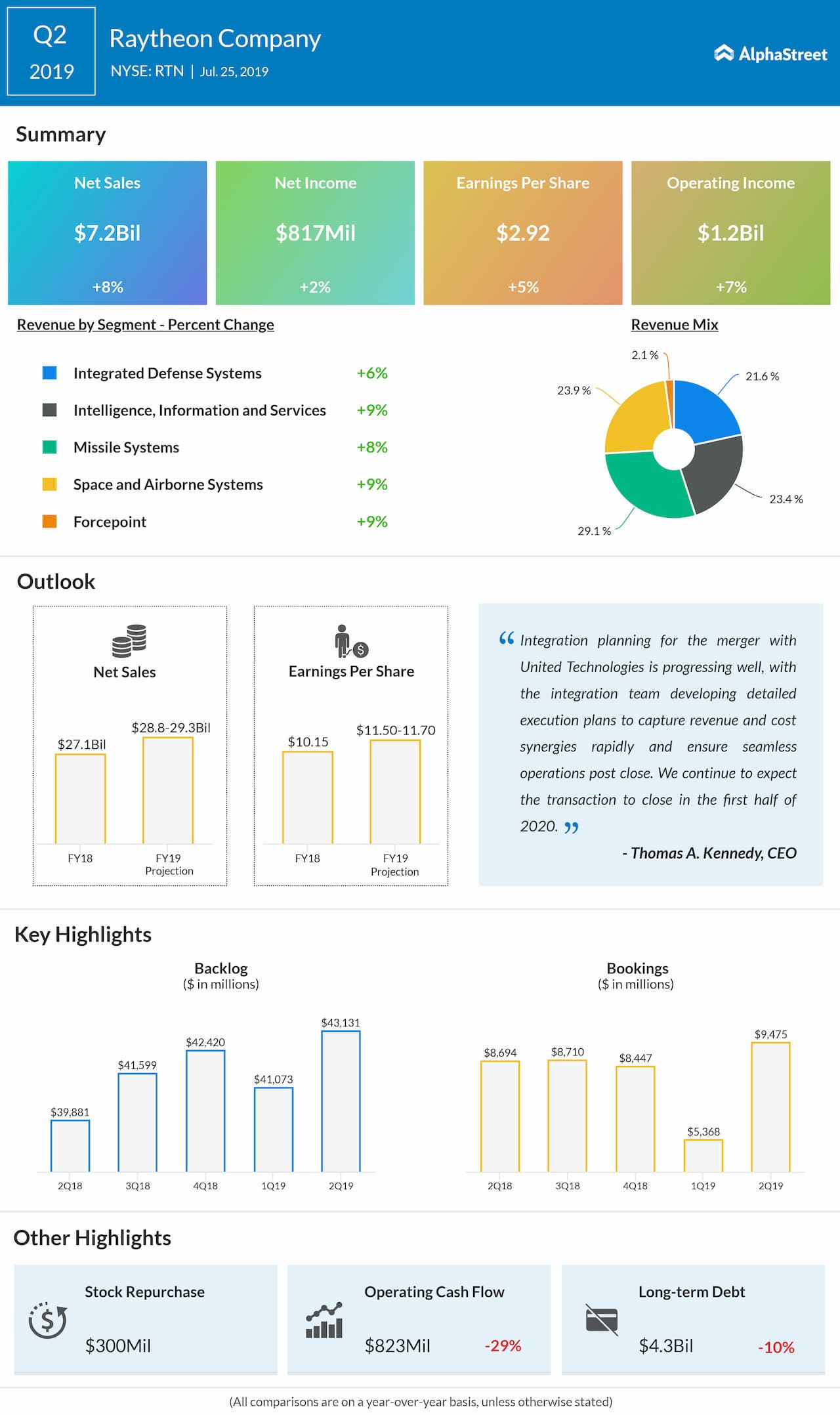

Net sales grew by 8.1% to $7.16 billion. The results were driven by higher sales on various international Patriot programs, an increase in sales on classified programs in both cyber and space, in Missile Systems, and in Space and Airborne Systems. Bookings jumped by 9% to $9.48 billion.

Looking ahead into the full year 2019, the company lifted its net sales outlook to the range of $28.8 billion to $29.3 billion from the previous range of $28.6 billion to $29.1 billion. EPS from continuing operations guidance is raised to the range of $11.50 to $11.70 per share from the prior range of $11.40 to $11.60 per share.

The company said the integration planning for the merger with United Technologies (NYSE: UTX) is progressing well. Raytheon continues to expect the transaction to close in the first half of 2020.

For the second quarter, sales from Integrated Defense Systems increased by 8% on higher net sales on various international Patriot programs. Sales from Intelligence, Information and Services rose by 5% on higher sales on classified programs in both cyber and space.

Also read: United Technologies Q2 earnings results

Missile Systems sales grew by 8% driven by higher sales on classified programs, the High-speed Anti-radiation Missile (HARM) program, and the Phalanx program. Sales from Space and Airborne Systems increased by 13% backed by higher sales on classified programs, the Next Generation Overhead Persistent Infrared (Next Gen OPIR) program, and an international tactical radar systems program.

Backlog at the end of the second quarter 2019 was a record $43.13 billion, an increase of 8% compared to the end of the second quarter 2018.

Shares of Raytheon ended Wednesday’s regular session up 1.58% at $184.19 on the NYSE. The stock has fallen over 6% in the past year while it has risen over 20% in the year so far.