Ease of Access

For customers, being able to meet all their healthcare-related needs by visiting the neighborhood store makes the process highly convenient. The market for medical devices and other health-care products is growing fast. Now, the supermarkets are becoming a one-stop destination for the services and products. The community health centers will make available the services of all key professionals, including doctors and nurses.

Backed by its extensive store-network, Walmart (NYSE: WMT) is offering enhanced healthcare service at Sam’s Club, which has already launched the pilot for members. The retail giant might be looking to expand its network and size of business further amid the mounting competition.

New Biz Model

Best Buy (BBY) expects to use synergies from recent acquisitions in its new venture. Meanwhile, services under the pilot rolled out by Amazon Care (AMZN) will be initially available to employees and their relatives. In all cases, the companies aim to take advantage of their existing partnerships with healthcare providers – such as Humana (HUM) and Anthem (ANTM).

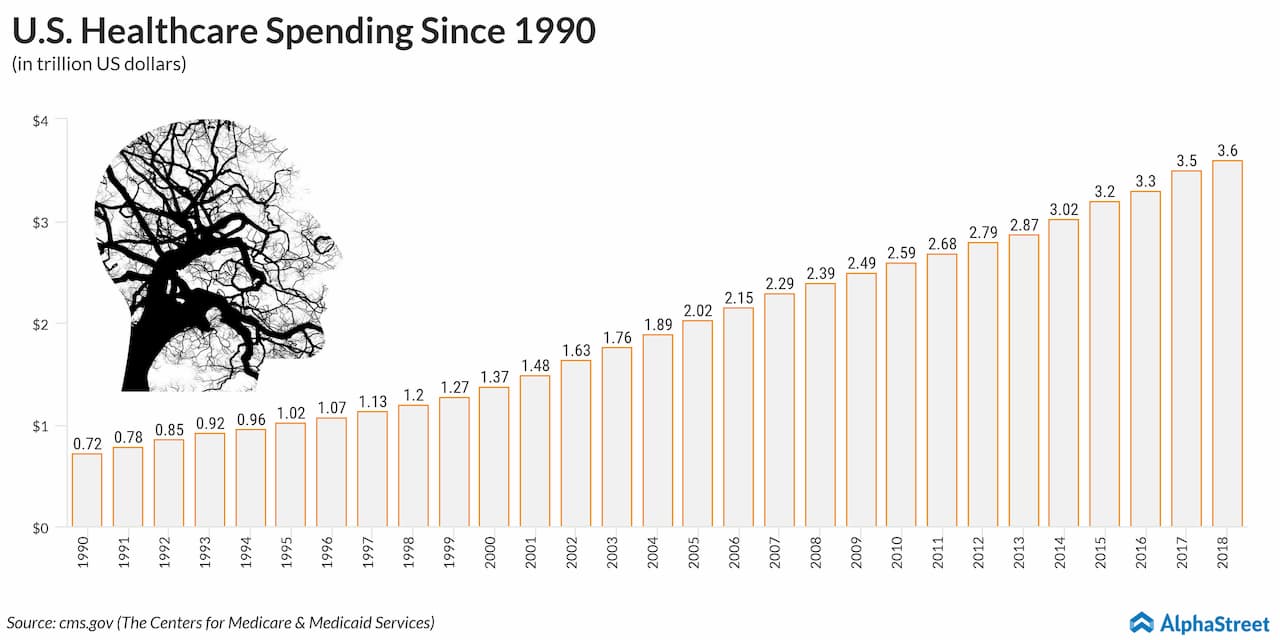

Currently, the American healthcare industry is estimated to be worth $3.5 trillion. By driving a part of the rapidly growing demand, traditional store operators and e-commerce firms get an opportunity to grow in scale, ultimately turning the sector into the biggest industry.

Crowded Market

While competing for market share among themselves, retailers will also have to face competition from full-fledged healthcare services providers like Walgreens Boots Alliance (WBA) and CVS Health Corp. (CVS). Of late, the retail pharmacy firms have been ramping up their store infrastructure and pursuing strategic deals – the acquisition of Aetna in the case of CVS.

Walmart’s stock reached a new high earlier this week, while Amazon is struggling to regain strength after slipping from the recent peak. Best Buy witnessed significant volatility since the beginning of the year but gained 24% during that period.