There could not have been a better period than the last decade for the concept of virtual money to bloom and flourish, both in terms of technology and market conditions. The increasing acceptance of cryptocurrencies as an investment option, despite the challenges related to their integration into the mainstream financial market, shows cryptos are here to stay.

Considering the rapid growth the sector is witnessing, it is natural that the market remains skeptical about the scalability of digital currencies. Unlike stocks and bonds, cryptos face stringent trust tests whenever people consider investing in them.

The recent spike in the price of Bitcoin (BTC), the pioneering cryptocurrency that continues to dominate the sector, to nearly $20,000 and the dramatic retreat to the $6,300-level within a few months is a testimony to the high volatility investors are currently dealing with.

The fact that Bitcoin managed to stabilize at the pre-boom levels in the long term and that scores of new crypto projects are currently in the pipeline – mostly employing the process called initial coin offering – indicate there is a consistent market. Adding to that case, the overall market capitalization of crypto assets surged nearly 16 times from last year to more than $200 billion in the first half of 2018. By now, the thousands of currency mining farms thriving across the worlds are a multi-billion dollar industry.

The emergence of digital currency from a wacky concept to a mode of financial transaction that is rapidly gaining popularity, even among corporates, justifies the growing concerns about their efficiency and security. The future of crypto trading depends a lot on the effective regulation of exchanges globally, because there would be few takers for any digital currency if it is susceptible to abrupt breakdowns.

RELATED: Mining chipmaker launches $1-billion IPO

It always makes sense to weigh these crucial factors while selecting a currency for investment and then the exchange, depending on the level of security and available trading-pairs. But, the risks do not end there in a market that witnessed a series of investment scams and thefts involving cybercriminals in recent months. Reputed crypto exchanges like California-based Coinbase have come up with a solution called custody service for preventing fraud, with security measures that supposedly match traditional stocks.

The prevalence of crypto manipulation is so widespread that several Wall Street veterans, including Bill Gates, have cast serious doubts over the credibility of the new-age currencies. Meanwhile, Google (GOOG) and Facebook (FB) recently imposed restrictions on crypto advertisements after several promotional items posted on their platforms were found to be misleading.

RELATED: Crypto ads face Google axe

The key to enhancing people’s confidence and sustaining the current growth of the crypto market is a centralized network capable of processing transactions without delay, even when the volumes are high. It would be a devastating experience for investors if they lose huge amounts just because a cryptocurrency ceased to exist for technical reasons. While the scenario is fast changing, with some governments and central banks weighing the prospects of considering digital currencies as legal tender, questions are also raised about the verifiability of crypto transactions.

Moreover, recent reports are saying that several hundreds of cryptos are currently on the brink of extinction, with values as low as one cent, do not bode well for the sector.

While doubting the viability of the likes of Bitcoin and the Blockchain technology that drives them, one should not miss the argument that digital currencies are the harbingers of a ‘green’ economy, simply because they are exchanged in an environment-friendly manner without using paper. That reminds us of the revolutionary transition of global stock markets from paper-based stock issues into electronic trading a couple of decades ago.

But, there are those who disagree, citing the energy gulping mining process, with some estimates showing that each Bitcoin transaction consumes as much as 200 kWh of energy. Meanwhile, the rise of energy-efficient currencies such as Burst and Evergreen, which consume minimal energy, might bring cheer to the green investors.

RELATED: A positive gesture from Nasdaq

There is enough reason to believe the crypto market might never grow big enough to pose a threat to conventional currencies. People are drawn to digital currencies primary because of the speculative element, unlike sovereign money that gains value purely based on its use for practical purposes.

While predictions of a mass shift to crypto in the near future are farfetched, it is up to the experts to decide whether the economy is ill-equipped for such a change, or, digital currencies are too unreliable to be taken seriously by governments.

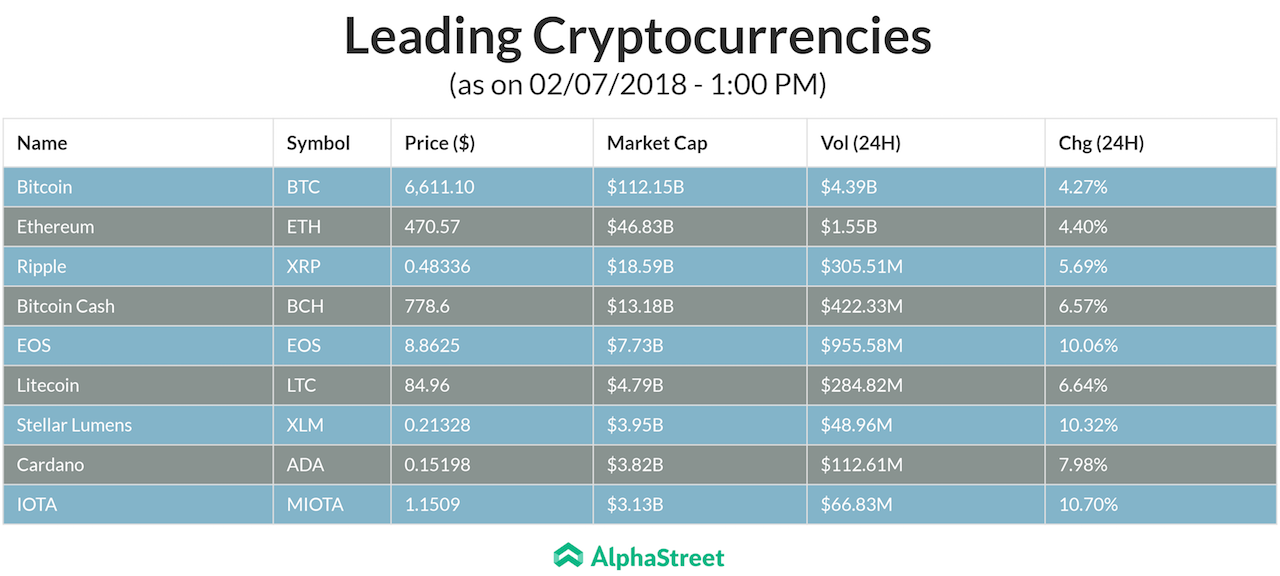

The week started on a positive note, with the major cryptos led by Bitcoin emerging from the downtrend that dragged the market to a one-year low last week. Among the top players, Ethereum (ETH), Ripple (XRP), EOS (EOS) and IOTA (MIOTA) maintained the upswing as the recent selling pressure eased. A resilient Bitcoin once again crossed the $6,500-mark as trading progressed, while IOTA recorded the biggest gain.