Till Wednesday, the company has been struggling to recover from the multi-year low on August 27 of $5.04. Rite Aid, which was hurt by the stiff competition, has been making additional investments in the marketing space for acquiring customers in the drugstore industry.

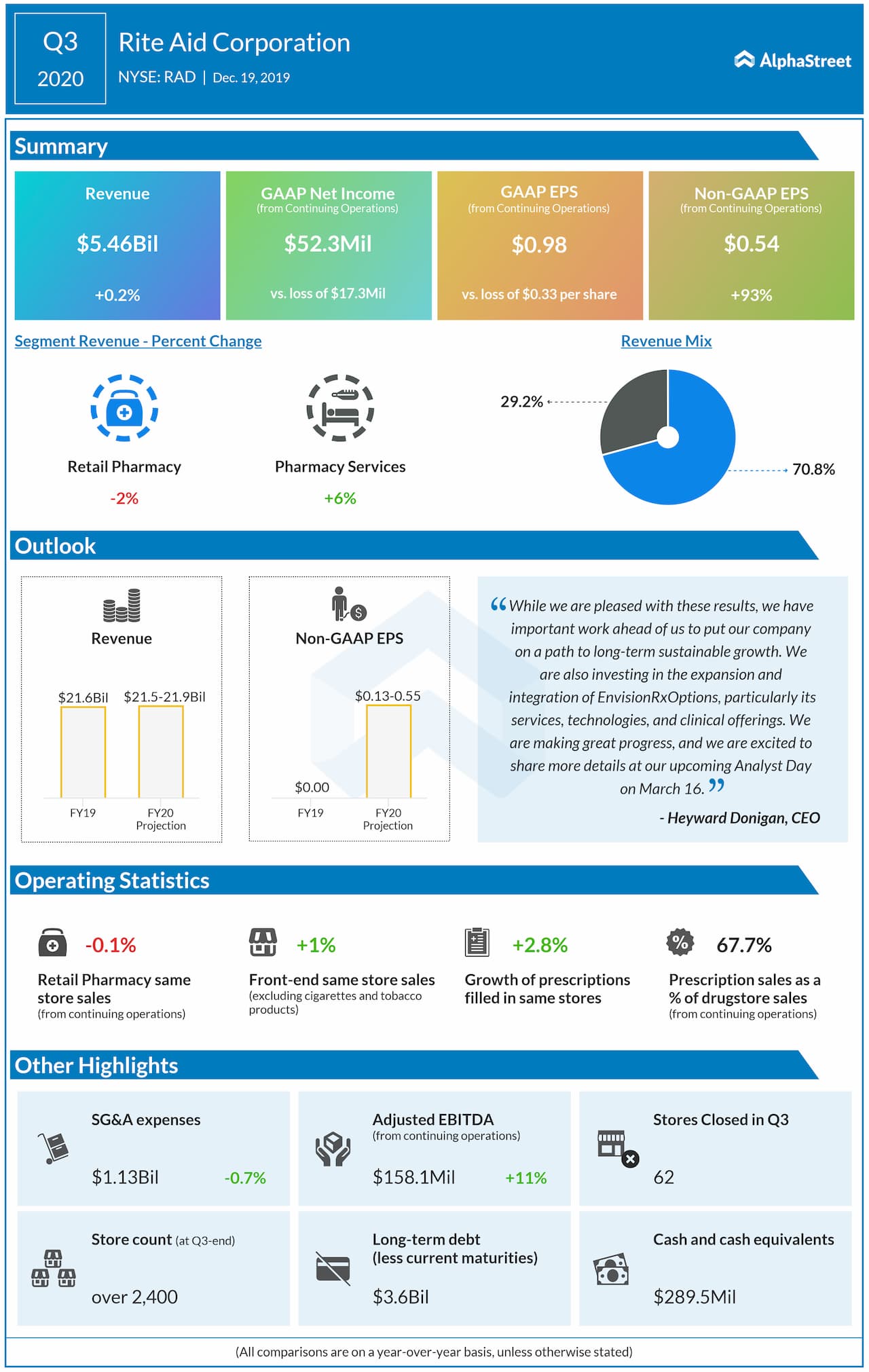

For the third quarter, the pharmacy retailer reported a profit compared to a loss last year, backed by lower costs and expenses as well as gain on debt retirements. The growth in the Medicare Part D membership drove the top line higher by 0.2%. This was hurt by a 1.7% decline in the Retail Pharmacy segment.

The company continues to invest in the expansion and integration of EnvisionRxOptions, particularly its services, technologies, and clinical offerings. The company is pursuing strategic partnerships with health plans and providers as it is on the front lines of healthcare delivery in America.

Rite Aid continues to have a focus on owned brand growth and will evolve its owned brand portfolio on the packaging with the goal of redefining its brands in fiscal 2021. Thrifty Ice Cream, which the company recently expanded to 900 additional stores, was a meaningful contributor to its Q3 growth.

Looking ahead into fiscal 2020, the company still expects net sales to be in the range of $21.5 billion to $21.9 billion and annual same-store sales growth in the range of 0-1%. The adjusted EPS guidance is narrowed to the range of $0.13-0.55 from the prior range of $0.00-0.56.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions