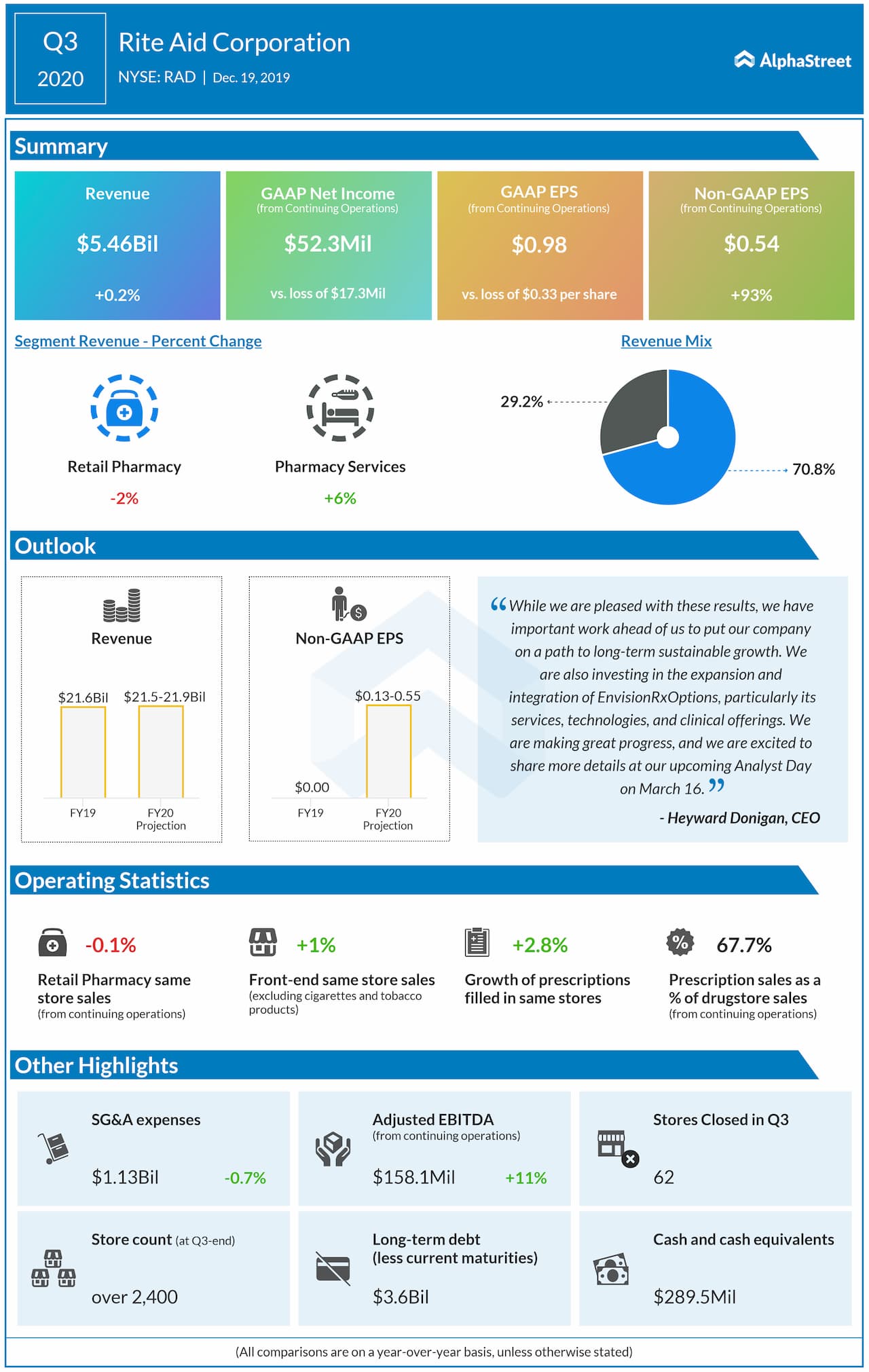

Pharmacy retailer Rite Aid Corporation (NYSE: RAD) swung to a profit in the third quarter of fiscal 2020 from a loss last year, helped by a gain on debt retirements and an increase in adjusted EBITDA. The results exceeded analysts’ expectations.

Net income was $51.5 million or $0.96 per share compared to a loss of $4.5 million or $0.09 per share in the previous year quarter. Adjusted earnings soared by 93% to $0.54 per share. This is much better than the analysts’ expectations of $0.09 per share.

Revenue rose by 0.2% to $5.46 billion. This is compared to the consensus estimates of $5.42 billion. Revenue from the Retail Pharmacy segment declined by 1.7% due to a reduction in store count, while that from the Pharmacy Services segment rose by 6% helped by an increase in Medicare Part D membership.

Looking ahead into fiscal 2020, the company still expects net sales to be in the range of $21.5 billion to $21.9 billion and annual same-store sales growth in the range of 0-1%. The adjusted EPS guidance is narrowed to the range of $0.13-0.55 from the prior range of $0.00-0.56.

The company’s outlook assumes continued prescription count growth, improvements in generic drug costs and strong SG&A expense control, offset by a decline in prescription reimbursement rates. Adjusted EBITDA is now expected to be $515-545 million. Capital expenditures are anticipated to be about $230 million for the full year.

For the third quarter, same-store sales from the Retail Pharmacy declined by 0.1%, which consists of a 0.1% rise in pharmacy sales and a 0.5% decrease in front-end sales. Front-end same-store sales, excluding cigarettes and tobacco products, rose by 1%. Pharmacy sales were negatively impacted by about 331 basis points as a result of new generic introductions.

The number of prescriptions filled in same stores, adjusted to 30-day equivalents, increased 2.8% over the prior-year period resulting primarily from its continued emphasis on driving clinical services, including immunizations. Prescription sales from continuing operations accounted for 67.7% of total drugstore sales.

The company continues to face weakness in the Retail Pharmacy segment because of a decline in foot traffic count at its stores. The significant opportunity for the company, digital business, is likely to be the major contributor to the growth in the long term.