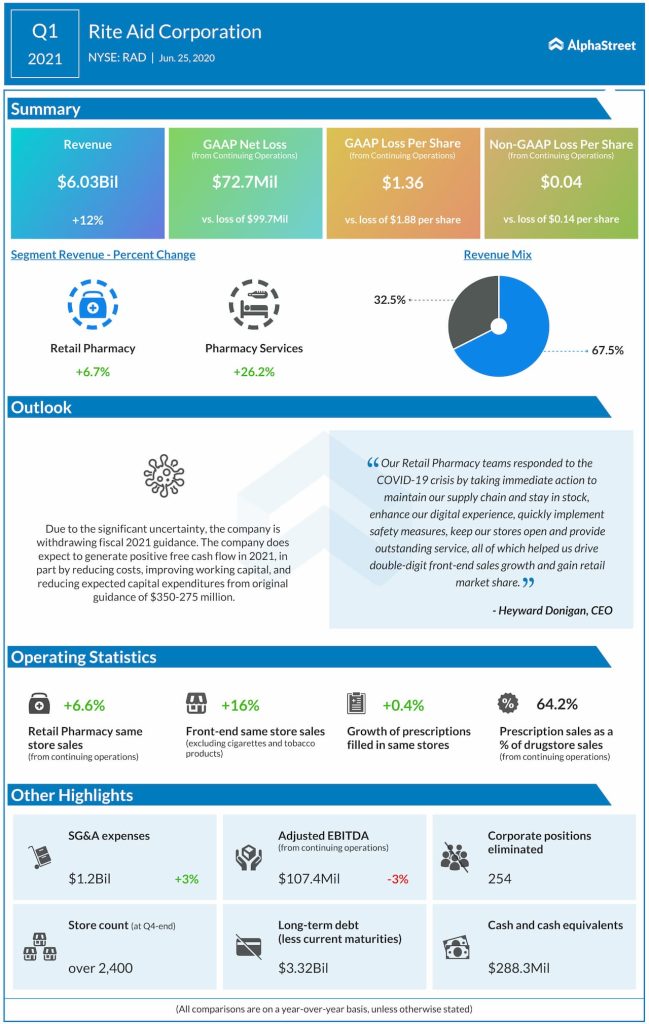

The company was able to maintain its supply chain and stay in stock backed by the immediate action taken by the Retail Pharmacy teams. Rite Aid achieved double-digit front-end sales growth and gain retail market share driven by the actions taken in response to the COVID-19 crisis.

However, Rite Aid experienced a decline in acute prescriptions and increased costs incurred to assure the safety of its associates and customers. The company expects to generate positive free cash flow in fiscal 2021, in part by reducing costs, improving working capital, and reducing expected capital expenditures from original guidance of $350-275 million.

Take a look at our Health Care articles here