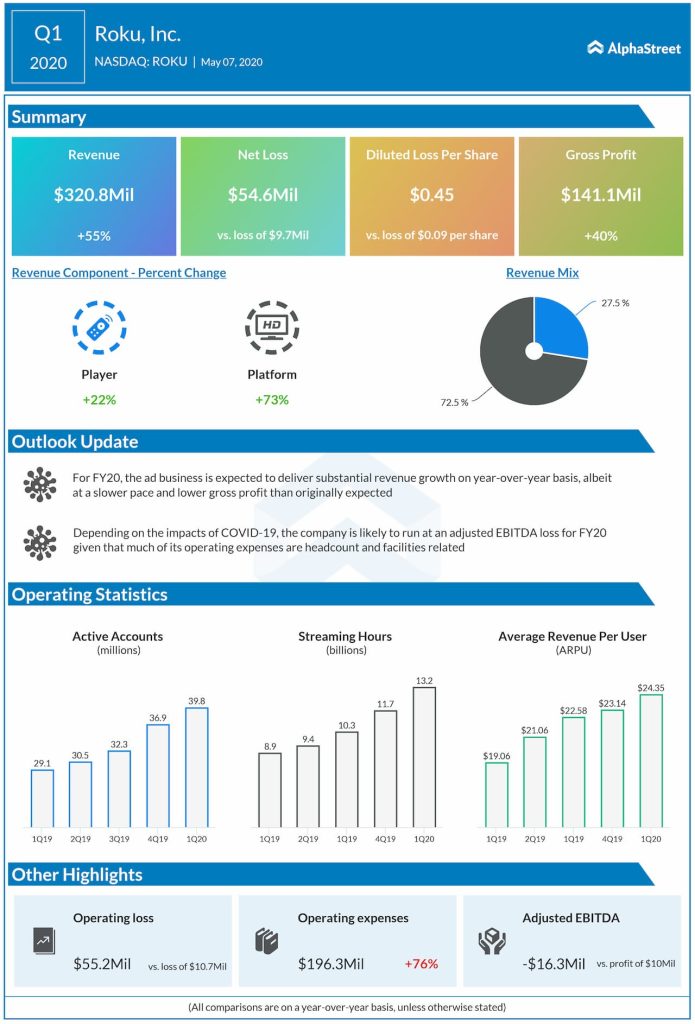

Despite the likelihood that total US advertising expenditures will decline in 2020, the company believes it is relatively well-positioned based on the effectiveness of its ad products and the trend towards streaming. The company expects its ad business to deliver substantial revenue growth on a year-over-year basis, albeit at a slower pace and lower gross profit that it has originally expected for the year.

The company has recently withdrawn its outlook for the full year. Depending on the impacts of COVID-19, the company is likely to run at an adjusted EBITDA loss for FY20 given that much of its operating expenses are headcount and facilities-related and therefore generally committed in the short-term.