Roku Inc. (NASDAQ: ROKU) beat revenue estimates and reported a narrower-than-expected loss for the fourth quarter of 2019, sending the stock climbing over 6% in aftermarket hours on Thursday.

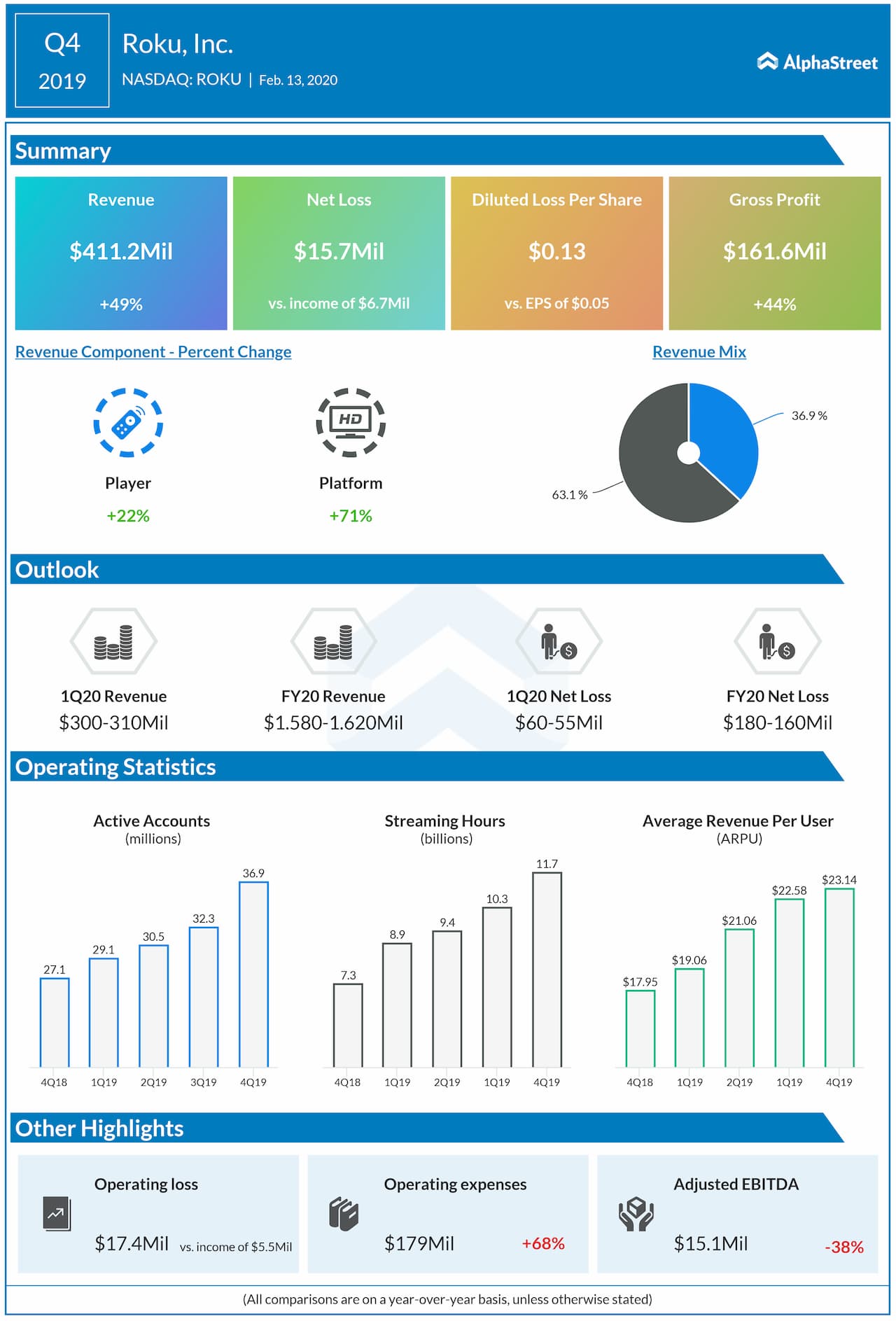

Total revenues jumped 49% to $411.2 million, smashing forecasts of $392 million.

Net loss

attributable to common stockholders was $15.7 million, or $0.13 per share,

compared to a net income of $6.7 million, or $0.05 per share, last year. Analysts

had projected a loss of $0.14 per share.

Active accounts grew 36% during the quarter. Player units increased 33% due to strong holiday sales and retail execution. The company also saw an increase in platform monetization with a 29% growth in ARPU, helped by growth in video advertising impressions across the platform.

Also see: PepsiCo Q4 2019 Earnings Report

ADVERTISEMENT

For the first

quarter of 2020, Roku expects total revenue of $300-310 million and net loss of

$55-60 million. For the full year of 2020, the company expects total revenue of

$1.58 billion to $1.62 billion and net loss of $160-180 million.

The company continues to face immense competition in the TV streaming space from the giants Netflix (NASDAQ: NFLX) and Amazon (NASDAQ: AMZN). Also, the penetration of new and growing companies in the market could turn fatal for Roku during this year. Meanwhile, market experts fear that a change in users’ habits could decelerate the subscribers’ growth rate in the future.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.