Shares of Take-Two Interactive Software Inc. (NASDAQ: TTWO) were up over 1% on Monday. The stock has dropped 13% year-to-date and 16% over the past 12 months. Despite the drop, there is a bullish sentiment around the stock on the back of the investments it is making and the anticipated growth in the industry. Here are three factors that bode well for the company:

Strong portfolio

The company has a strong portfolio of games that remain popular with its users. Titles like Grand Theft Auto, Red Dead Redemption, and NBA 2K continue to drive engagement and attract new users. Grand Theft Auto V continues to generate strong sales and since its launch, has remained within the top five best-selling titles across major markets. During its third quarter 2022 earnings announcement, Take-Two said Grand Theft Auto V had sold-in more than 160 million units worldwide.

NBA 2K22 exceeded the company’s expectations with over 8 million units sold in worldwide. In Q3, the average number of users playing the game every day was up 10% compared to NBA 2K21 in the same period last year. NBA 2K22 saw an 8% increase in total in-game purchasers and a 30% increase in new-to-franchise spenders. Red Dead Redemption 2 also performed well selling nearly 43 million units worldwide in Q3.

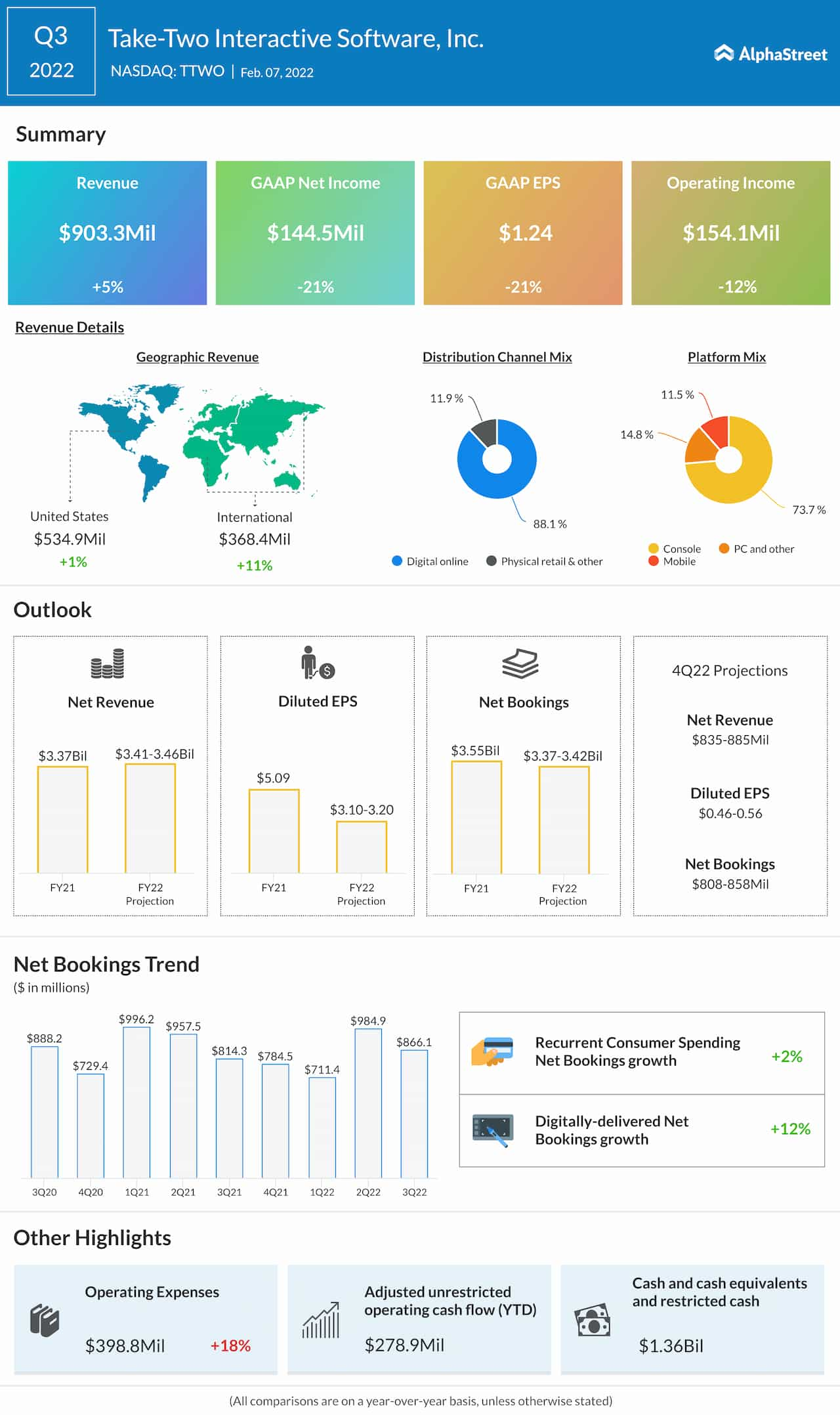

Strength in these titles helped drive a 5% growth in revenue and a 6% increase in net bookings during Q3. Although the strong momentum seen during the pandemic is starting to wane as people return to their pre-pandemic activities, there is still opportunity for growth with the release of new offerings such as OlliOlli World and Tiny Tina’s Wonderlands.

Zynga acquisition

Take-Two’s acquisition of Zynga, which is expected to close in the first quarter of FY2023, is another growth driver for the company. This transaction will help Take-Two diversify its business and expand its position in the interactive entertainment industry. By bringing in titles such as FarmVille, Toon Blast, Toy Blast and Golf Rival from Zynga, Take-Two can establish a strong position in the rapidly growing mobile gaming space.

Take-Two has identified $100 million of annual cost synergies that it expects to achieve within the first two years after the closing of the deal and over $500 million of annual revenue opportunities that can be delivered over time.

Growth in the industry

Based on data from IDG Consulting, the global video game market stood at $233 billion in 2021. This number is estimated to grow to $253 billion in 2022 and to $286 billion in 2025. This would reflect a compound annual growth rate of 5%.

Click here to read the transcript of Take-Two Interactive’s Q3 2022 earnings conference call