Off-price retail apparel operator Ross Stores (ROST) reported a 30% jump in earnings for the first quarter helped by higher sales and an increase in comparable store sales despite unfavorable weather. Despite earnings and sales exceeding the analysts’ forecasts, the company’s stock dropped 4% in after-market trading as second quarter outlook was below Street’s view and the lifted full-year earnings outlook was below market analysts’ view.

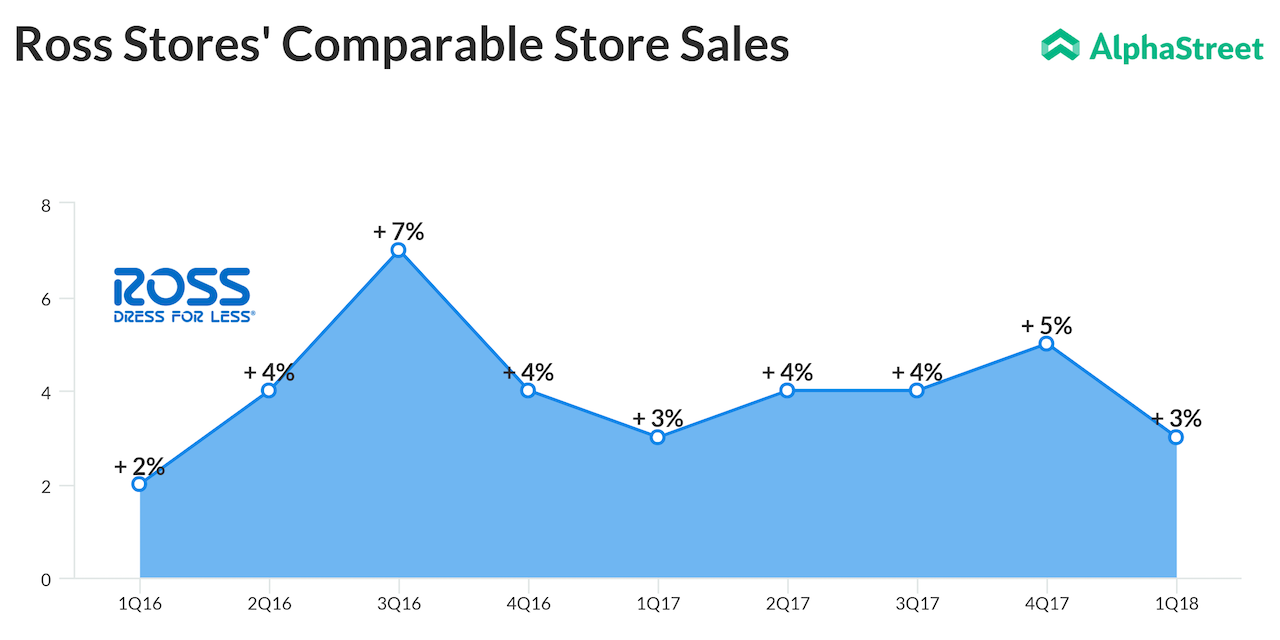

With sales increasing by 9% to $3.6 billion, earnings climbed 30% to $418 million or $1.11 per share. The recently ended quarter EPS included a $0.17 per share benefit from recently enacted tax legislation and a $0.02 per share benefit from the favorable timing of packaway-related expenses that Ross expects to reverse in subsequent quarters. Comparable store sales rose 3%.

Operating margin was 15.1% for the first quarter, down slightly from last year, as higher freight costs and wage-related investments offset an improvement in merchandise gross margin and favorable timing of packaway-related expenses.

Looking ahead into the second quarter, the company expects same-store sales growth of 1-2% and EPS of $0.95-$0.99. The EPS estimate includes the benefit from lower taxes, partially offset by the shift in packaway expenses.

For fiscal 2018, Ross Stores raised its EPS guidance to a range of $3.92-$4.05 from the previously forecasted range of $3.86-$4.03. The revised EPS outlook includes the benefit from lower taxes.

During the first quarter, the Dublin, California-based company bought back 3.3 million shares of common stock for an aggregate of $255 million. As planned, Ross Stores remains on track to repurchase a total of $1.075 billion in common stock during fiscal 2018.

Shares of Ross Stores ended Thursday’s regular trading session up 0.42% at $82.96 on the Nasdaq. The stock had been trading between $52.85 and $85.66 for the past 52 weeks.