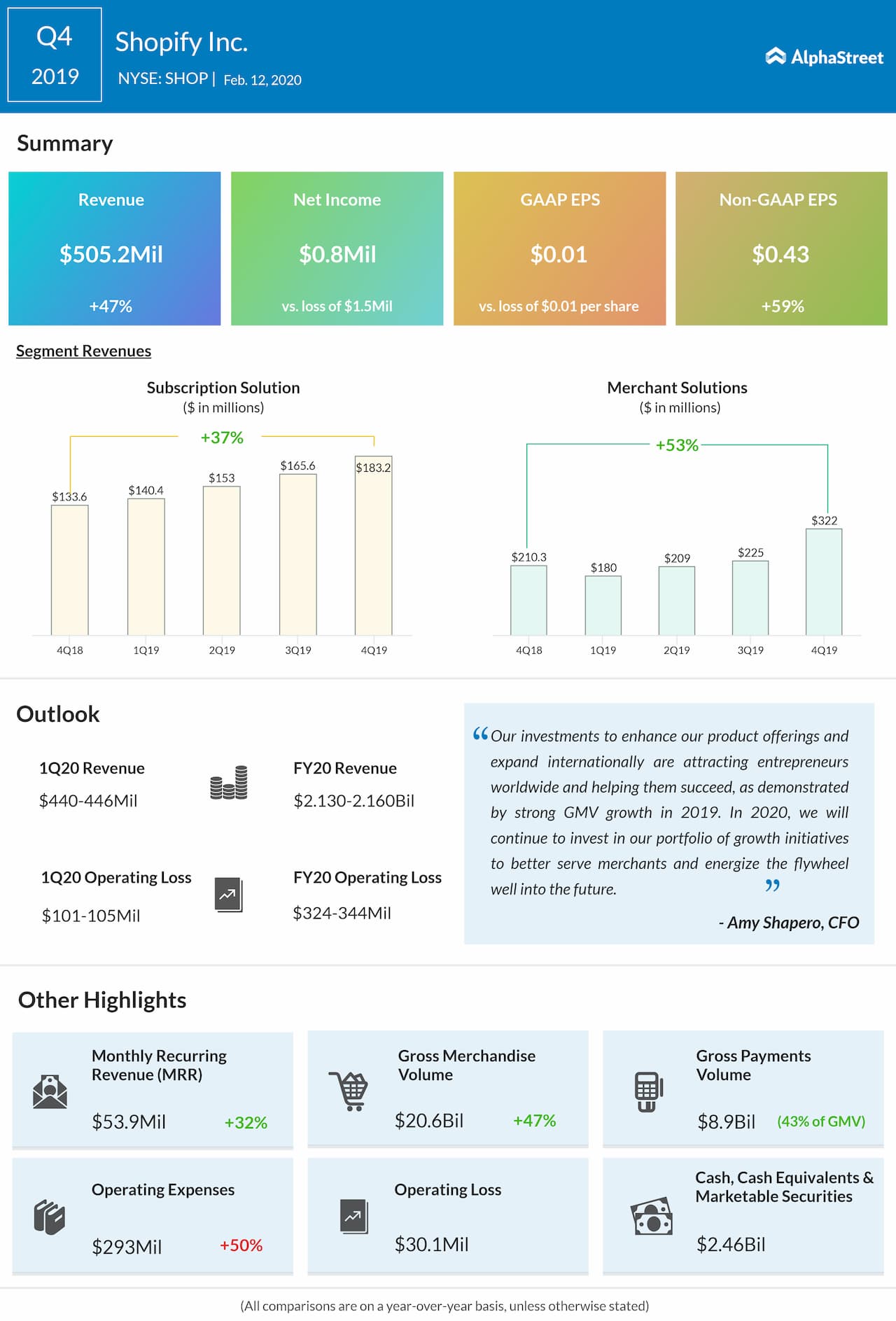

Net income was $0.8 million,

or $0.01 per share, compared to a net loss of $1.5 million, or $0.01 per share,

in the prior-year quarter. Adjusted net income was $50 million, or $0.43

per share.

Shopify posted double-digit revenue increases in its Subscription Solutions and Merchant Solutions divisions. The company’s investments in its product improvement initiatives and expansion efforts helped bring more merchants onto the platform leading to a growth in monthly recurring revenue.

Also read: Shopify Q4 2019 Earnings Preview

The company has been making

progress on the integration of 6 River Systems with its Shopify Fulfilment

Network during the quarter. In addition, the adoption of Shopify Shipping has

increased with 45% of merchants in the US and Canada using the service in the

fourth quarter. This number was less than 40% in the same period last year.

Shopify launched 13 new

language capabilities on its platform including Danish, Finnish, Hindi and Thai

and rolled out Shopify Payments in four more countries, expanding its footprint

to 15 countries.

For the first quarter of 2020, Shopify expects revenues of $440 million to $446 million. For the full year of 2020, Shopify expects revenues of $2.13 billion to $2.16 billion.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.