KB Home’s CEO Jeffrey Mezger said, “We expect to stay highly selective with respect to additional land investments until markets settle and there’s clarity in pricing to gain confidence in achieving our required returns. We continue to develop land that we already own, investing $317 million in development and related fees. As part of a regular review of our land portfolio, we have been active in renegotiating land contracts to reduce purchase prices and extend closing timelines.”

What to Expect

Second-quarter financial results are slated for release on June 21 at 4:10 pm ET. It is estimated that the slowdown experienced in the early months of the fiscal year extended into the May quarter. Analysts expect earnings to drop to $1.32 per share from $2.32 per share in the year-ago quarter. The revenue forecast is $1.39 billion, down 19.4% year-over-year.

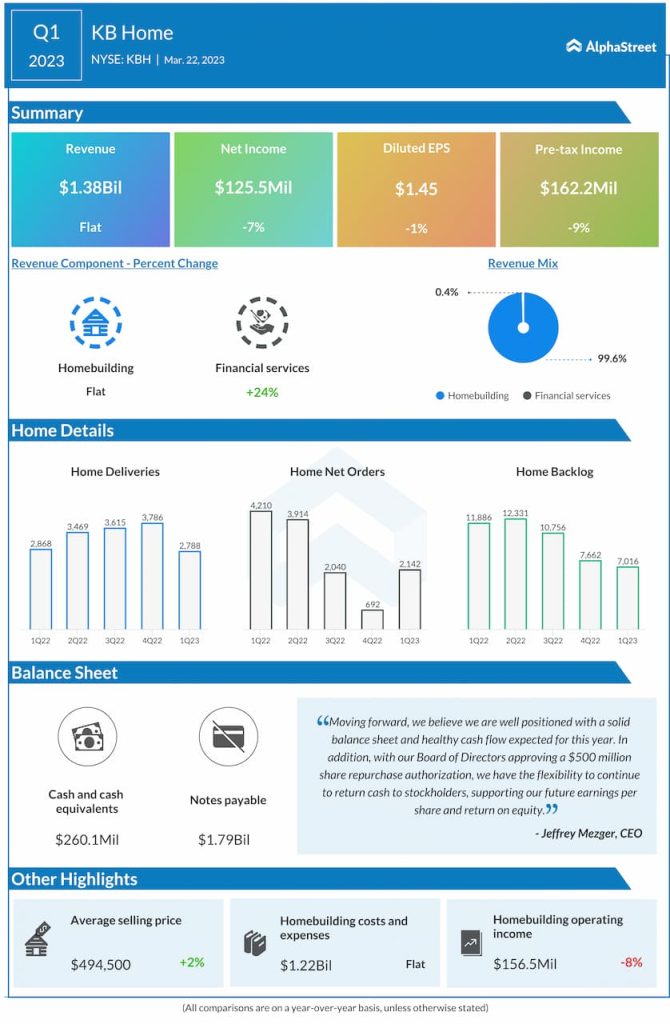

Mixed Q1

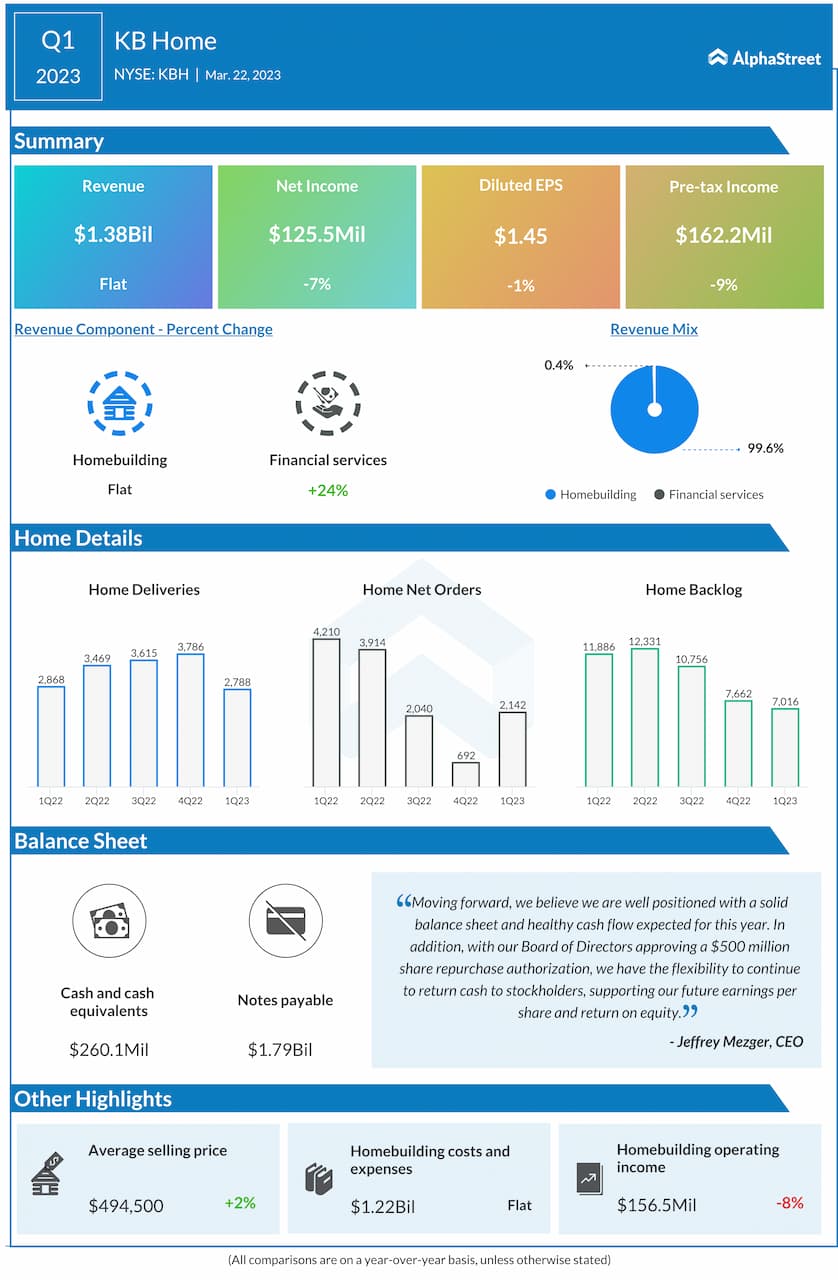

In the first quarter of 2023, KB Home’s earnings and revenues exceeded Wall Street’s projections, after missing on both metrics in the preceding quarter. Meanwhile, earnings decreased slightly from last year to $1.45 per share while revenues remained unchanged at $1.38 billion. That was partially offset by a decline in costs and an increase in average selling price. Deliveries and new orders decreased during the three-month period.

While recession fears continue to weigh on business sentiment in the real estate market, KB Home executives are optimistic about the company’s performance for the rest of 2023. Orden volumes were strong in the early weeks of the second quarter and sales continued to improve. Also, the pricing environment remains favorable and the gross margin is expected to hold above 20% of sales.

Road Ahead

One reason behind the bullish outlook is the company’s continued geographical expansion beyond its core market but interestingly, it comes at a time when the housing market is going through a weak phase. The company managed to maintain healthy inventory levels due to the built-to-order model that allows it to effectively prioritize deliveries among customers looking for personalization and those who choose quick-moving homes. Meanwhile, it is likely that construction and delivery would continue to be impacted by the lingering supply chain issues.

Shares of KB Home opened Thursday’s session slightly above $50 and traded higher in the early hours. In the past twelve months, their value nearly doubled.