Financial Performance

For CEO Bill Ready who assumed office a few months ago, the primary challenge is to attract more users to the platform and to navigate through the macroeconomic uncertainties, though the business has not been directly impacted by the headwinds so far. Since its turnaround more than two years ago, Pinterest has been consistently generating profit, on an adjusted basis. It had a relatively weak start to the fiscal year, with the bottom line slipping back into negative territory in the first quarter, defying expectations for earnings.

Read management/analysts’ comments on quarterly reports

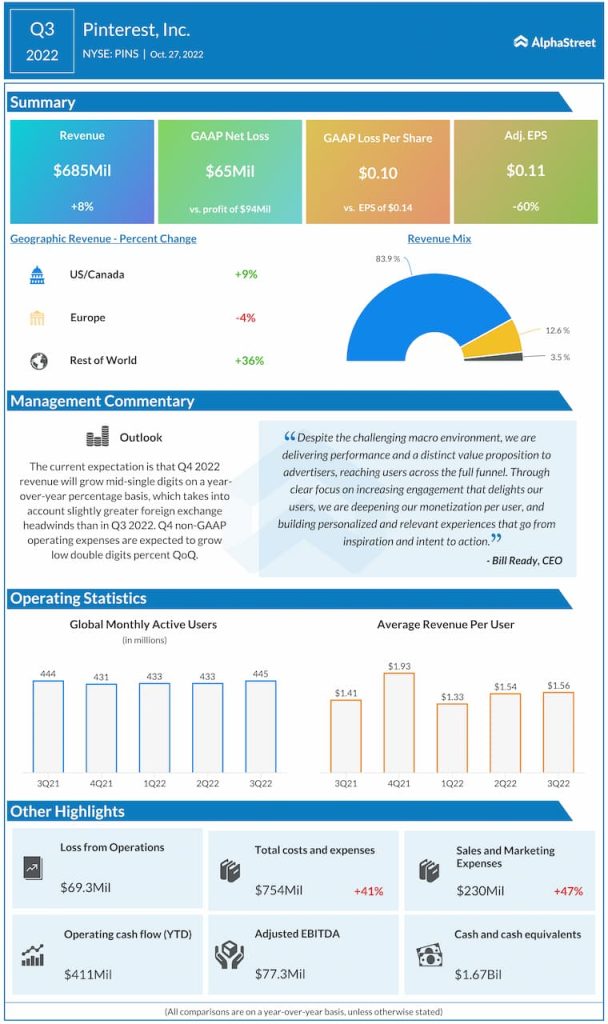

In the September quarter, revenues grew by 8% to $685 million, with most of it coming from the core US/Canada segment. Pinterest executives see a slight deceleration in top-line growth in the current quarter, citing a bigger foreign exchange impact compared to the previous quarters. Right now, their priority is to increase per-user revenue, which is on an uptrend currently, while attracting more advertisements and enhancing user engagement.

From Pinterest’s Q3 2022 earnings conference call:

“By making Pinterest more relevant to our users, we can increase and deepen their engagement with the platform. We’re doing this in multiple ways, including improving the personalization on our core services, leveraging our unique opportunities as the content platform, and broadening our appeal to emerging demographics. On personalization, we’re creating much more relevant experiences for users by combining the unique first-party signal on our platform with advancements in machine learning to recommend highly relevant content to users.”

Key Numbers

Third-quarter adjusted earnings, meanwhile dropped 60% from last year to $0.11 per share even as the number of global monthly active users edged up sequentially to about 445 million but remained broadly unchanged year-over-year. The top line and profit also came in above the estimates.

Meta Platforms Q3 profit drops and misses Street view; revenue down 4%

PINS closed the last trading session lower but maintained most of the gains it has made since last week’s quarterly report. In the past twelve months, the value has nearly halved, hurt by the tech selloff to some extent.