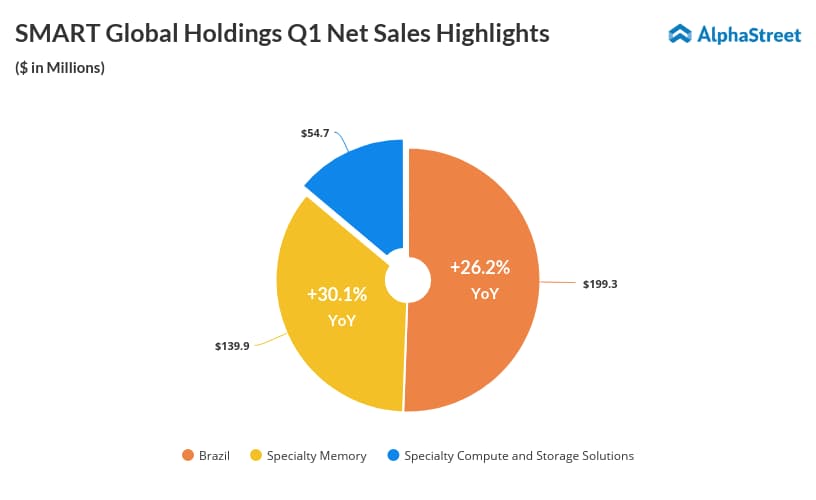

Net sales surged by 48% to $393.9 million, benefited by the strength in the Specialty Memory business. The results were also driven by solid sequential growth from its new Specialty Compute & Storage Solutions business.

Brazil continued to be the major contributor to the company’s strong performance and added many new memory products for PC, server and smartphone applications as well as a new polymer cell-based battery product for smartphones. The company’s business in Brazil also met expectations.

Looking ahead into the second quarter of fiscal 2019, the company expects net sales in the range of $310 million to $325 million and non-GAAP earnings of $0.73 to $0.77 per share. GAAP EPS is predicted to be in the range of $0.53 to $0.57 and gross margin is projected to be 18% to 20%.

Smart Global remained optimistic about its overall business in the long term. The company expects higher seasonality during the second quarter in its Brazil business. However, other lines of business are predicted to perform at or above its prior forecast in the second quarter.

Shares of Smart Global ended Tuesday’s regular session up 0.76% at $31.91 on the Nasdaq. The stock has fallen over 12% in the past year, while it has risen over 3% in the past three months.