As mentioned on its quarterly conference call, these platforms

continued to grow during the quarter, with Discover, the curated content

platform, growing both in reach and time spent. The company has broadened its

product and content offerings through partnerships and is making efforts to

provide culturally-relevant experiences to its international users through its

Discover channels.

The number of people watching over 15 minutes of premium Discover content daily grew by around 50% year-over-year, turning Discover into a prime spot for mobile content consumption. Snap is also investing significantly in Originals and other premium content offerings.

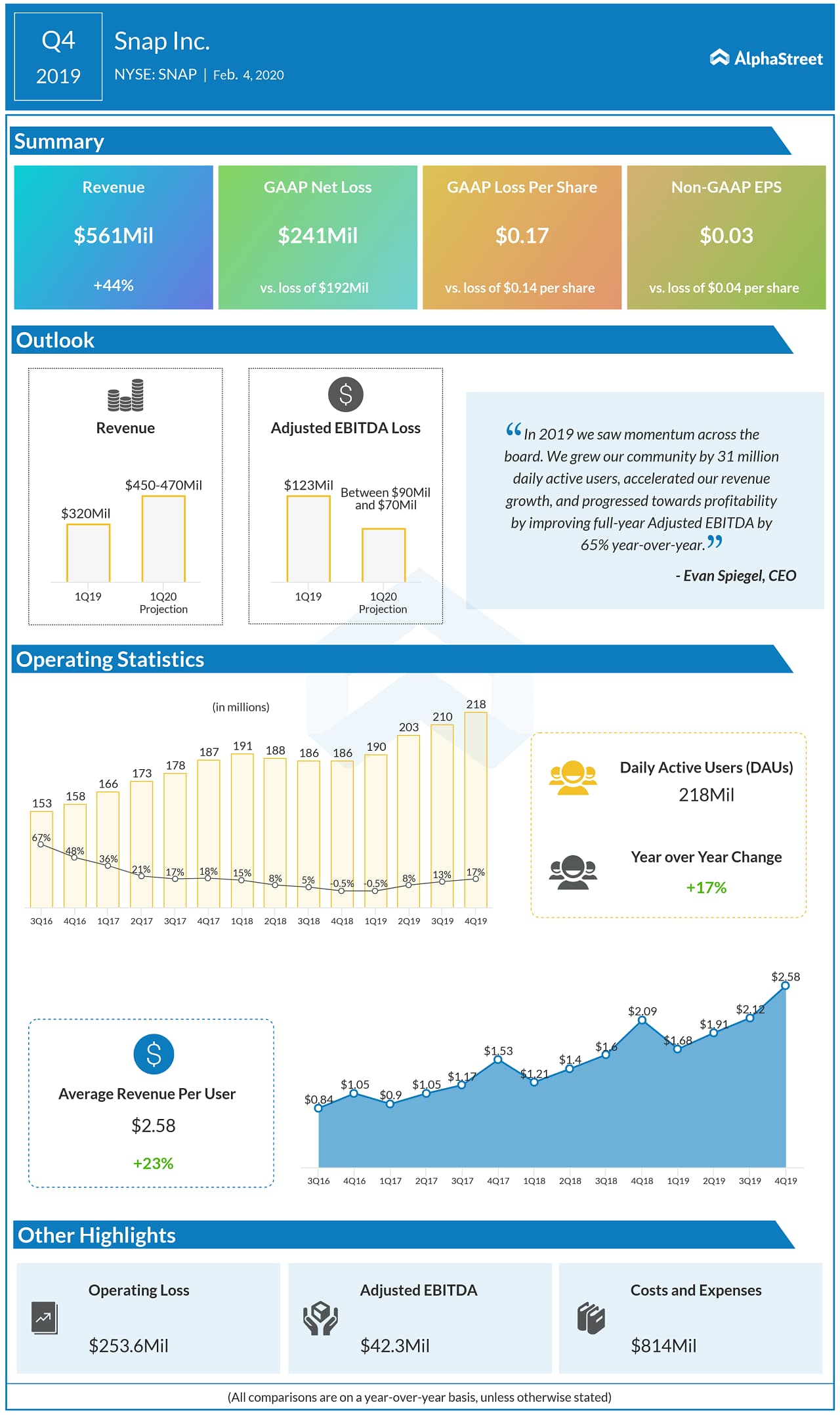

Also read: Snap Q4 2019 Earnings Report

ADVERTISEMENT

The Lens Studio platform is helping drive engagement on Snapchat

by increasing the number of AR experiences available. During the quarter, the

number of users who came to Lens Explorer for augmented reality experiences

climbed by five times compared to the same period last year.

Snap sees meaningful potential ahead and believes its platform is

still extremely under-monetized. The company is working to scale its revenue in

order to be able to self-fund its investments in future.

Snap’s shares were up 4.8% in afternoon hours on Thursday. The stock has gained over 19% in the past three months.