It needs to be noted that the company has a history of beating estimates consistently, which complements its efforts to achieve breakeven this year – by focusing more on third-party advertising and content partnerships.

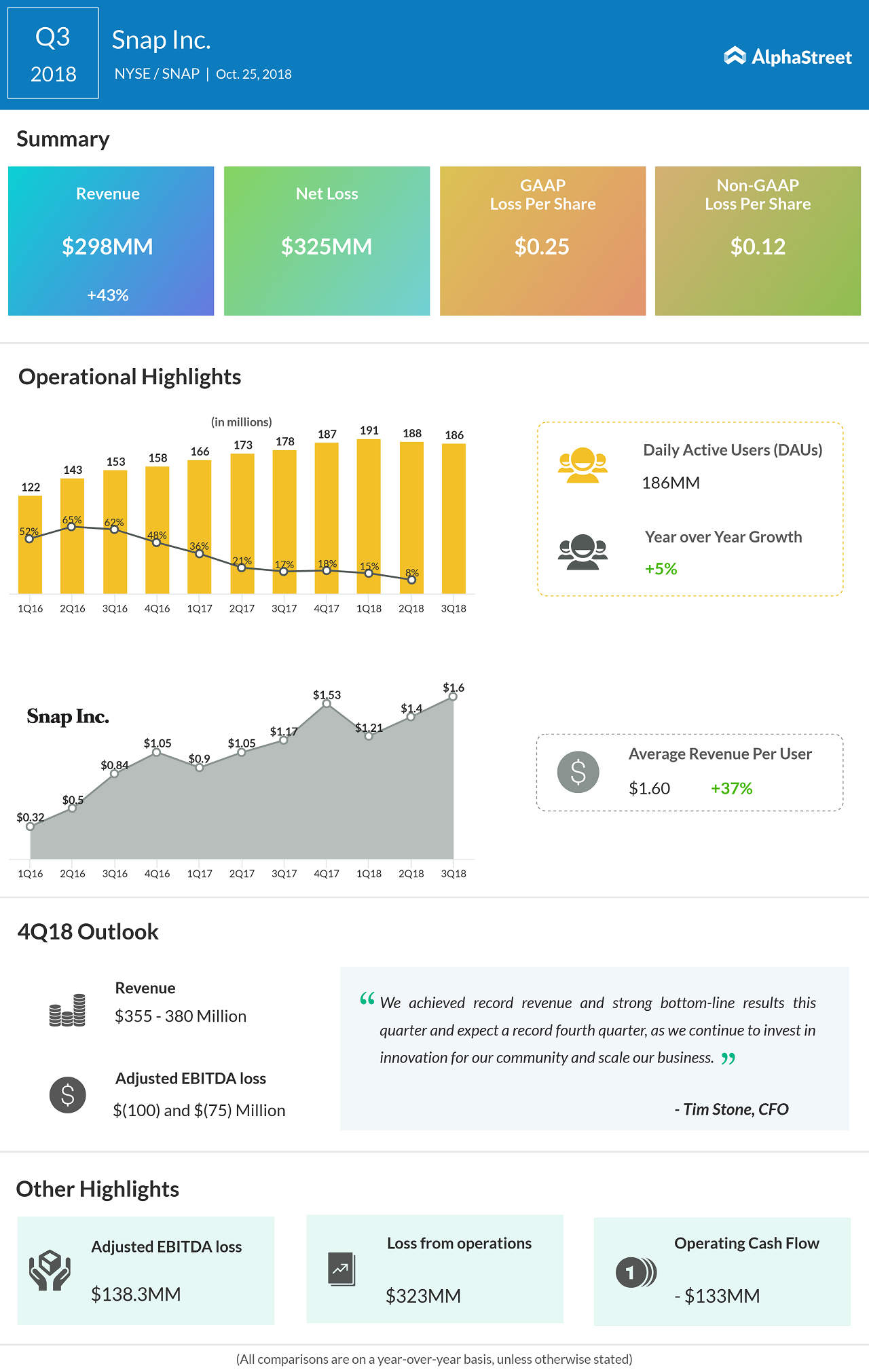

When Snap reported its September-quarter results, the improvement in the bottom-line and revenue figures was nearly eclipsed by a drop in the number of users, continuing the trend seen in the preceding quarters. And, the stock suffered badly. While net loss narrowed by two cents to $0.12 per share and beat estimates, aided by a 43% revenue growth, the number of daily active users declined sequentially.

For the company, the progressive contraction of the user base is a cause for concern, especially in the wake of increasing competition from the likes of Instagram. Currently, the improvement in average revenue per user – thanks to the revised prices – is the key to sustaining the positive momentum.

Customers seem to be ditching the app primarily due to the new design which according to experts is not appealing to the target users, especially when compared to the feature-rich Instagram and WhatsApp. In short, Snap’s ability to keep users engaged is inferior to that of its peers due to the limitations of the app.

Customers seem to be ditching the app primarily due to the new design which according to experts is not appealing to the target users, especially when compared to the feature-rich Instagram and WhatsApp. In short, Snap’s ability to keep users engaged is inferior to that of its peers due to the limitations of the app.

Also see: Snap Q3 2018 Earnings Conference Call Transcript

Stone’s exit followed a series of executive departures, including chief strategy officer Imran Khan, communications VP Mary Ritti, HR head Jason Halpert and Content VP Nick Bell. The talent exodus is another dampener as far as recovery is concerned.

Snap shares progressively declined since the beginning of last year, losing as much as 63%. Having regained momentum in the recent weeks, they traded sharply higher during Friday’s regular session. However, the stock is still far below its post-IPO peak.