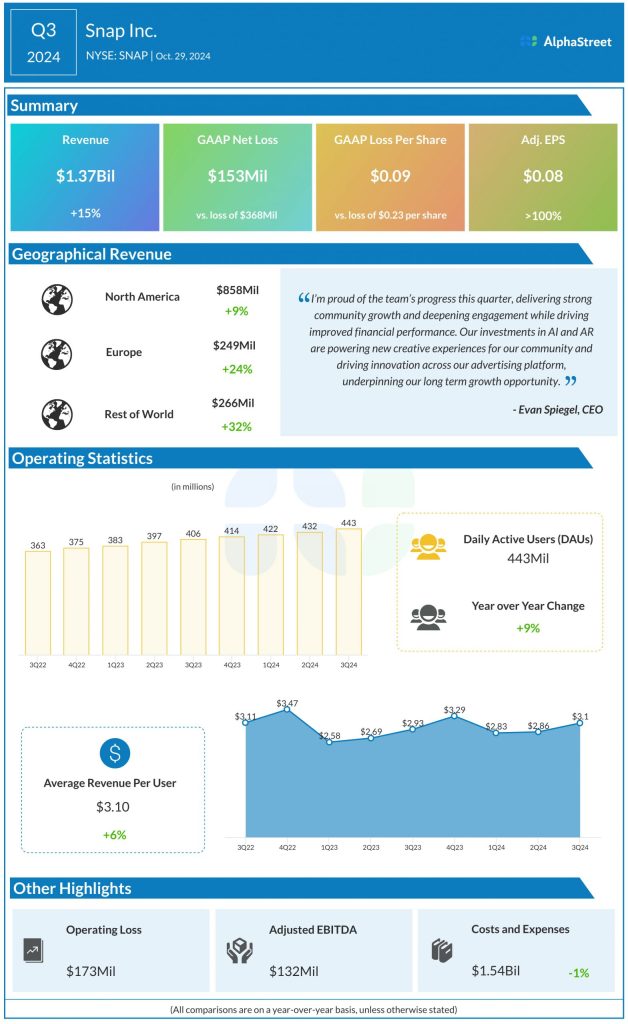

Revenue and earnings growth

The company saw revenue growth across all its regions during the quarter, with double-digit growth in Europe and Rest of World driven by progress on the DR ad platform.

User growth and engagement

The Snapchat-owner has been seeing steady growth in users and engagement. In Q3, daily active users (DAUs) increased 9% YoY to 443 million. Total time spent watching content increased 25% YoY. As mentioned in the Q3 report, over a billion Snaps were shared publicly on Snapchat every month in Q3 and there are around 10 million Snapchatters using Simple Snapchat across dozens of countries. Spotlight reached more than 500 million monthly active users on average in Q3, up 21% YoY. The number of people sharing Spotlight content with friends rose more than 60% YoY in the quarter.

Advertising

Snap is seeing strength in its advertising business. In Q3, advertising revenue increased 10% YoY to $1.25 billion, driven mainly by growth in DR advertising revenue. DR advertising revenue increased 16%, helped by strong demand for 7-0 Pixel Purchase optimization and a growing contribution from App Purchase optimization.

AI and AR

Snap’s investments in artificial intelligence (AI) and augmented reality (AR) are gaining traction. The company introduced AI in Snapchat Memories, enabling users to share AI-generated collages and video mashups. In Q3, the number of Snaps sent to its AI-powered chatbot, My AI, in the US more than tripled quarter-over-quarter.

Augmented reality continues to drive engagement. More than 375,000 AR creators, developers and teams have built over 4 million Lenses worldwide. The addition of generative AI capabilities in Lens Studio is expected to help improve the AR experience. Snap also introduced the fifth generation of Spectacles in Q3, which is expected to help create immersive AR experiences.

Outlook

Snap forecasts DAUs to reach approx. 451 million in the fourth quarter of 2024. This would imply an increase of around 9% YoY and around 2% sequentially. Revenues are projected to range between $1.51-1.56 billion in Q4, implying a YoY growth of 11-15%.