Snap Inc.’s (NYSE: SNAP) shares soared 30% on Wednesday after the company beat projections on revenue and earnings for the third quarter of 2020 a day ago. The stock has jumped 128% since the beginning of this year and gained 60% over the past three months.

The company’s investments in new features have paid off with a strong increase in the number of users and it has also witnessed momentum on the advertising front. Augmented reality is another area of focus which is bringing forth a whole new experience in ecommerce for customers who want to check out the suitability of their purchases.

Quarterly numbers

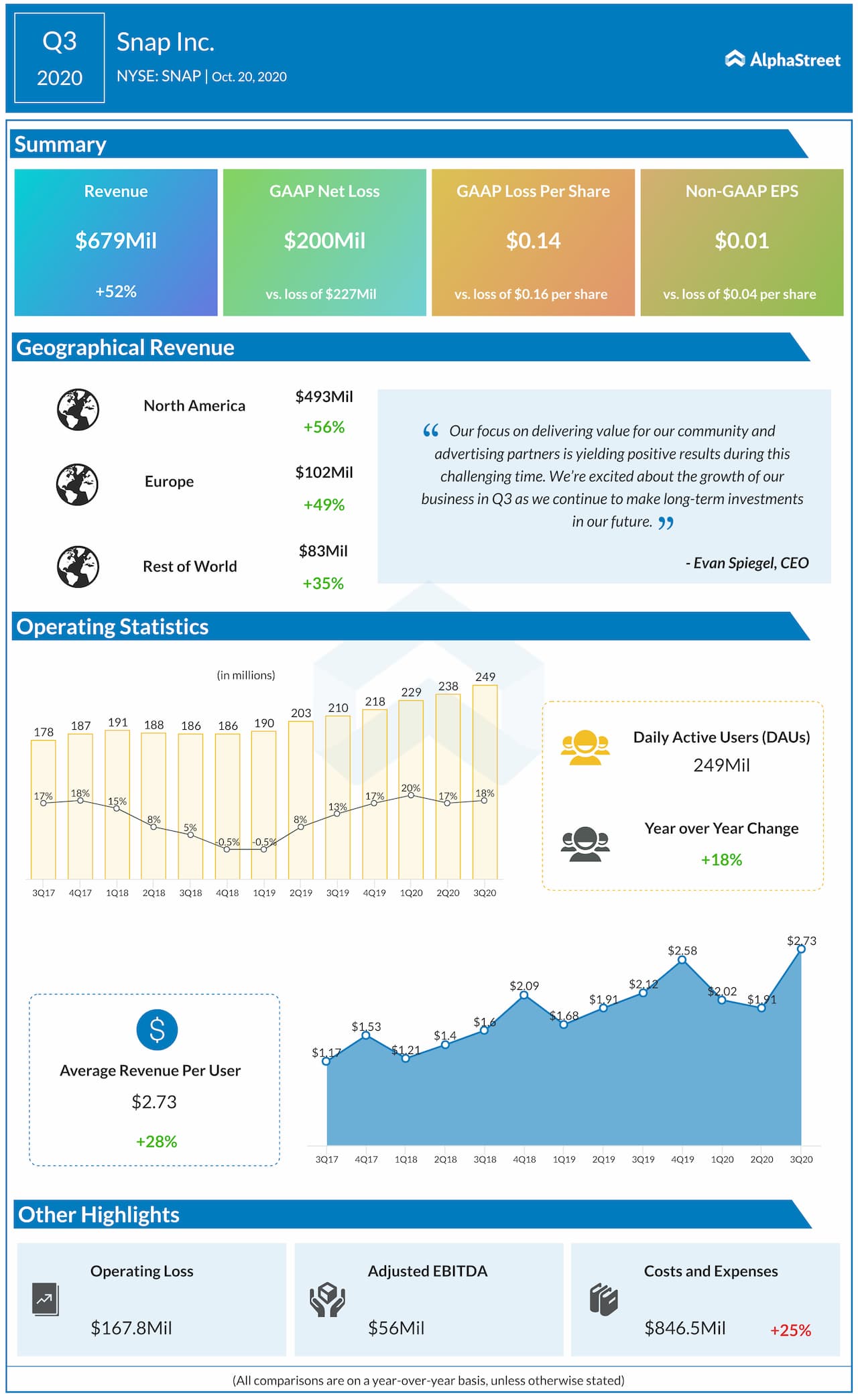

Total revenue increased 52% year-over-year to $679 million while adjusted earnings amounted to $0.01 per share surpassing expectations. The company saw double-digit growth across all its geographies. Daily active users (DAUs) increased 18% while average revenue per user rose 28% year-over-year.

User growth

One of the highlights of the quarter was the growth in Snap’s user base. The number of daily active users increased by 39 million to reach a total of 249 million. In North America, DAU rose 7% to 90 million and in Europe, it jumped 10% to reach 72 million. DAU for Rest of World grew 43% to 87 million.

Snap’s engagement levels benefited from the easing of the COVID-19 pandemic-related restrictions in many places. The investments made in local content and language support helped drive growth in the Rest of World region. The company’s messaging app Snapchat reaches over 90% of the Gen Z population and 75% of the Gen Z and Millennial population in countries like the US, the UK and France.

Advertising

Snap’s investments in its ad platform and products reaped benefits during the quarter. During the pandemic period, companies began to evaluate their advertising spend and as businesses adapted to the environment, advertising began to see a recovery in the third quarter with some advertisers even increasing their ad spend.

The fact that Snap reaches a vast majority of the Gen Z and Millennial population makes it attractive to brands that are trying to widen their customer base. The company saw growth in advertisers as well as revenues during the quarter. Snap’s ad products are gaining strong adoption with revenues from its Commercial ad product doubling year-over-year.

Augmented Reality

Augmented reality is another key investment area for Snap. Augmented reality is seeing rapid adoption and the company believes it is well-positioned to take advantage of the opportunities in this space. Investments in Lens Studio are a key growth driver for the augmented reality platform.

Snap sees an exciting opportunity in ecommerce with growth in mobile content consumption and video advertising and it is increasing its efforts in this area. For ecommerce, the company is using augmented reality to provide customers with new experiences like trying on products virtually, browsing catalogs and even showrooming. Through AR, customers can visualize the item they want to buy in real life and make better decisions. Snap is encouraged by the early adoption from brands for its AR products.

Outlook

Although the operating environment has improved over the past few months, Snap still believes its business could be impacted by volatility in the market. The company is also not sure how the advertising demand will play out during the holiday season for the fourth quarter. If conditions remain favorable, Snap expects revenues to grow 47-50% year-over-year in the fourth quarter. The company also anticipates DAUs to grow 18% year-over-year to approx. 257 million in Q4.

Click here to read the full transcript of Snap Q3 2020 earnings call