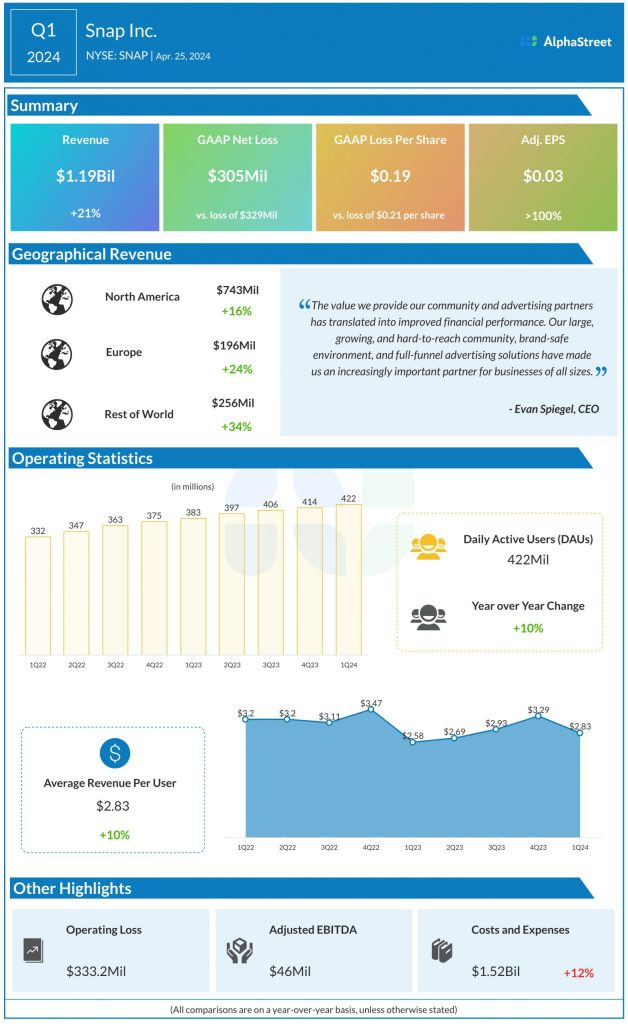

Better-than-expected quarterly results

The company recorded double-digit revenue growth across all its geographic regions during the first quarter. Revenue in North America increased 16% YoY to $743 million while in Europe, it rose 24% to $196 million. Revenue from Rest of World climbed 34% to $256 million. The regional performance benefited from a pickup in DR-related advertising revenue growth during the quarter.

User growth and engagement

In Q1, Snap’s daily active users (DAUs) grew 10% YoY to 422 million. DAUs in North America remained flat while DAUs in Europe grew 4%. Rest of World DAUs rose 19%. The company also saw a 10% growth in global average revenue per user (ARPU) in Q1. It recorded double-digit increases in ARPU across all its geographies.

Snap witnessed a rise in engagement levels during the first quarter, driven mainly by Spotlight and Creator Stories. Total time spent watching Spotlight content increased over 125% YoY in Q1.

Strength in advertising

Snap’s advertising revenue grew 16% YoY to $1.11 billion in Q1. Direct-response advertising revenue increased 17%, helped by a pickup in demand and an improved operating environment. The number of small and medium-sized advertisers on Snapchat increased 85% YoY in Q1. Brand-oriented advertising revenue rose 12% YoY, helped by strong demand for Takeover products.

Outlook

For the second quarter of 2024, Snap expects revenues to range between $1.22-1.25 billion, indicating a year-over-year growth of 15-18%. DAUs are estimated to be approx. 431 million in Q2.