With the Form-10 registration, you’ve moved closer to becoming a fully reporting company. By when is the NASDAQ uplisting expected?

The filing of the Form 10 registration statement, and the recent filing of our first quarterly report on Form 10-Q, was a crucial milestone in our multi-pronged effort to provide increased transparency and accountability to our shareholders. Our transition to a fully reporting company with the SEC brings a new level of credibility to SIRC, with the goal of attracting more sophisticated and institutional investors.

Trxade explores alternative ways to find partners for B2C assets: CEO Suren Ajjarapu

We will have a stepping stone to the OTCQB or the OTCQX as we solidify the management team, improve the composition of our Board of Directors, grow revenues, and analyze market conditions. Once the new team has completed its evaluation of the business, its financial reporting, and cleared comments on Form-10 received from the SEC, we will begin planning for a Nasdaq listing, which we believe should happen in 2023. A Nasdaq listing would bring additional liquidity and broaden our shareholder base through an enhanced profile within the investment community.

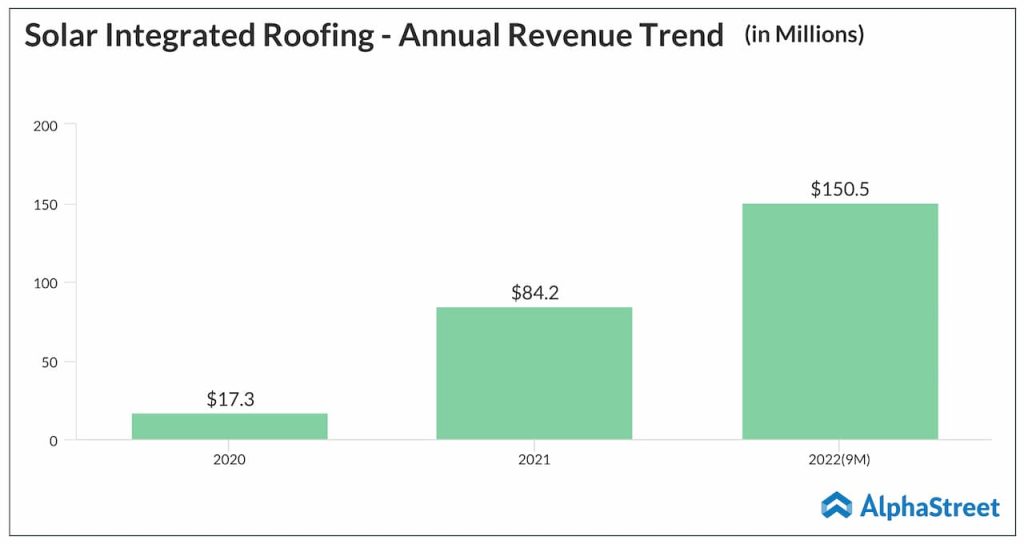

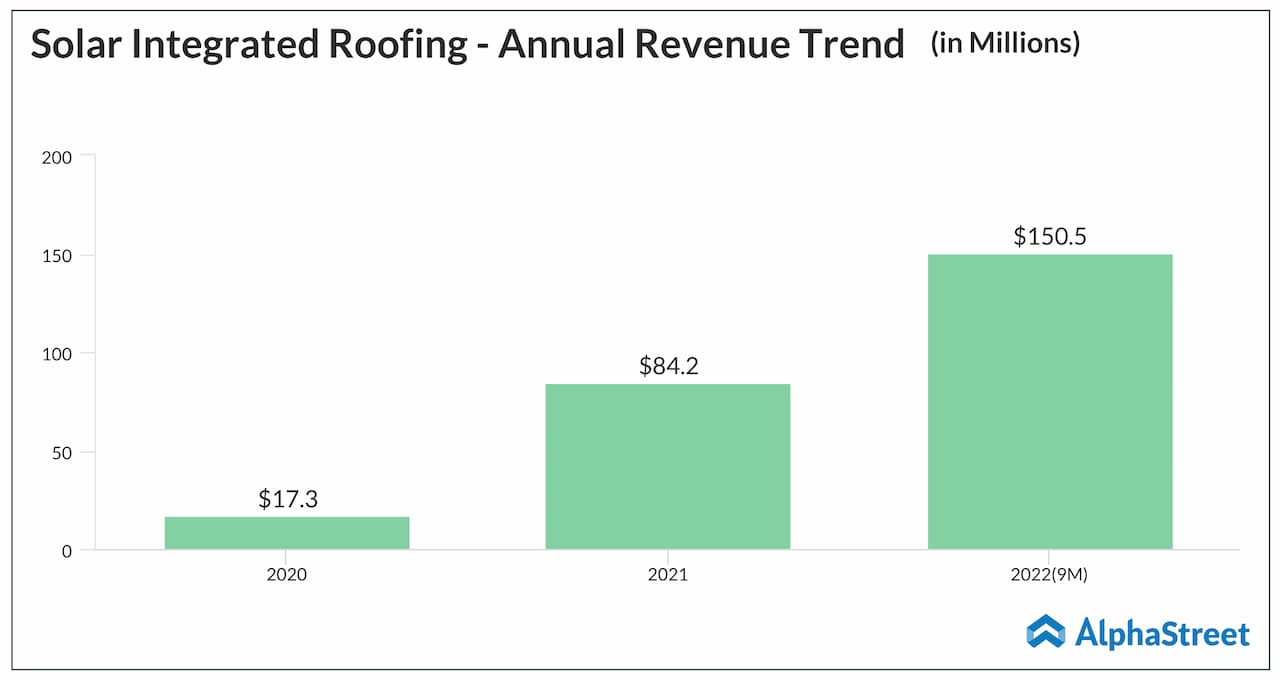

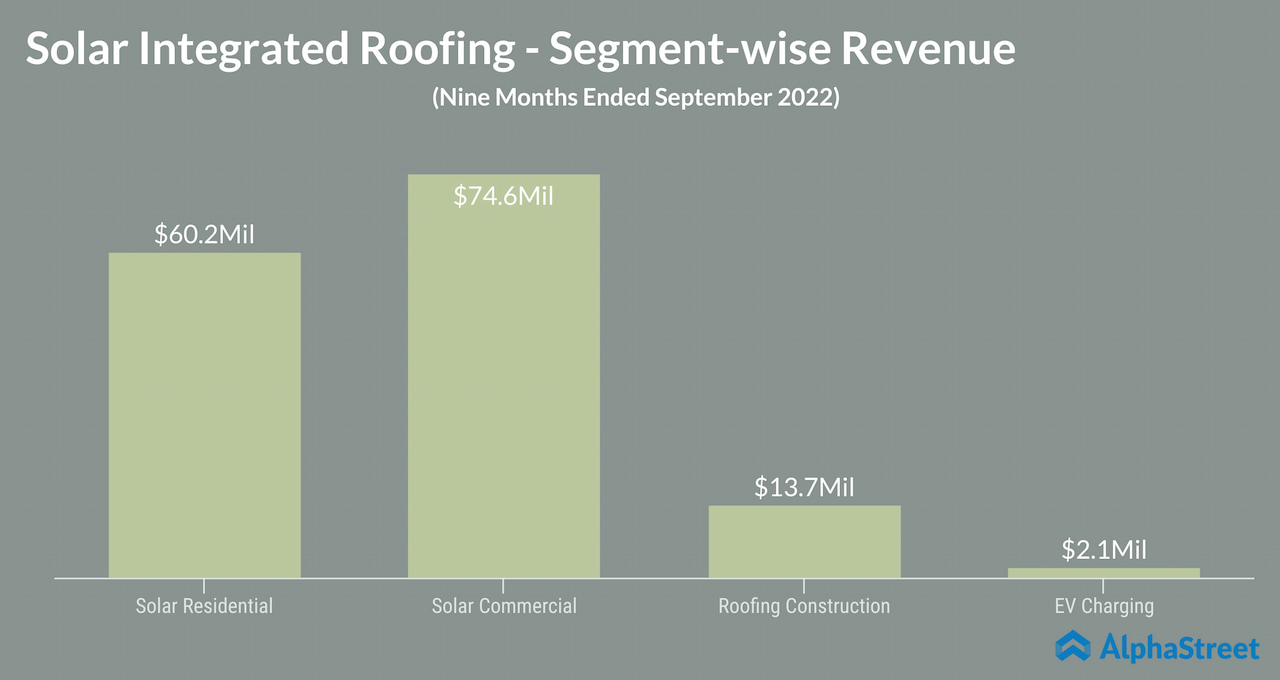

Do you expect the accelerated revenue growth this year to translate into consistent profitability in the coming quarters?

As a new executive team a few short weeks into our appointments, it is too early for us to begin forecasting what will happen in 2023. That being said, we can report that market conditions driving our residential, small commercial, and EV businesses continue to remain strong. We have an excellent team that is laying the foundation for consistent profitability for years to come.

How do you look at the macro headwinds and inflation pressure, which could be a near-term impediment to growing the business?

In fact, we are seeing the opposite, with rising energy prices and government incentives driving consumers everywhere to consider going solar. As energy prices rise, more consumers are being empowered to take control of their electric bills and protect against power outages with clean energy. Combined with the proliferation of net metering – paired with a variety of federal, state, and utility-level incentives for clean energy – there is significant encouragement for consumers to transition to solar, battery backup, and EV charging. We believe we have demonstrated success to date, and in our opinion, we are only scratching the surface of SIRC’s potential.

What is your strategy for the EV charging business, considering the rapidly growing EV market and government grants?

Electric vehicle charging is a large, growing market with few national players on the installation side of the business. One of our subsidiaries was one of only 16 companies nationally awarded with a 5-year Blanket Purchase Agreement from the General Services Administration (GSA) as part of the $5B in federal funds allocated to EV charging installations in the Biden Infrastructure Bill. These stations are set to supercharge the increasingly widespread adoption of electric vehicles by consumers and fleets by providing charging stations across the interstate system and addressing current gaps of service. We believe our potential share of the $5B in federal EV charging funds alone could generate hundreds of millions in revenue for us over the course of the program.

Plastiq plans major investments in business after listing on NYSE: CEO Eliot Buchanan

What is your long-term goal for growing the product portfolio and expanding into new markets?

Long-term, we are committed to becoming a vertically integrated, single-source solutions provider of solar power, roofing, and EV charging systems. This will allow us to capture value across all aspects of our business and also aggressively expand into large-scale commercial projects, microgrids, and project financing. We are assembling the team needed to take the SIRC family of companies to the next level, forming a truly national organization with the ability to scale. I look forward to seeing what 2023 holds for our growing company.