Trxade Health Inc. (NASDAQ: MEDS) is a health service IT company that is on a mission to enable independent pharmacies to operate efficiently by offering them a digitalized retail pharmacy experience. While creating strong value and ensuring transparency among channel partners, the drug delivery platform also helps contain healthcare costs.

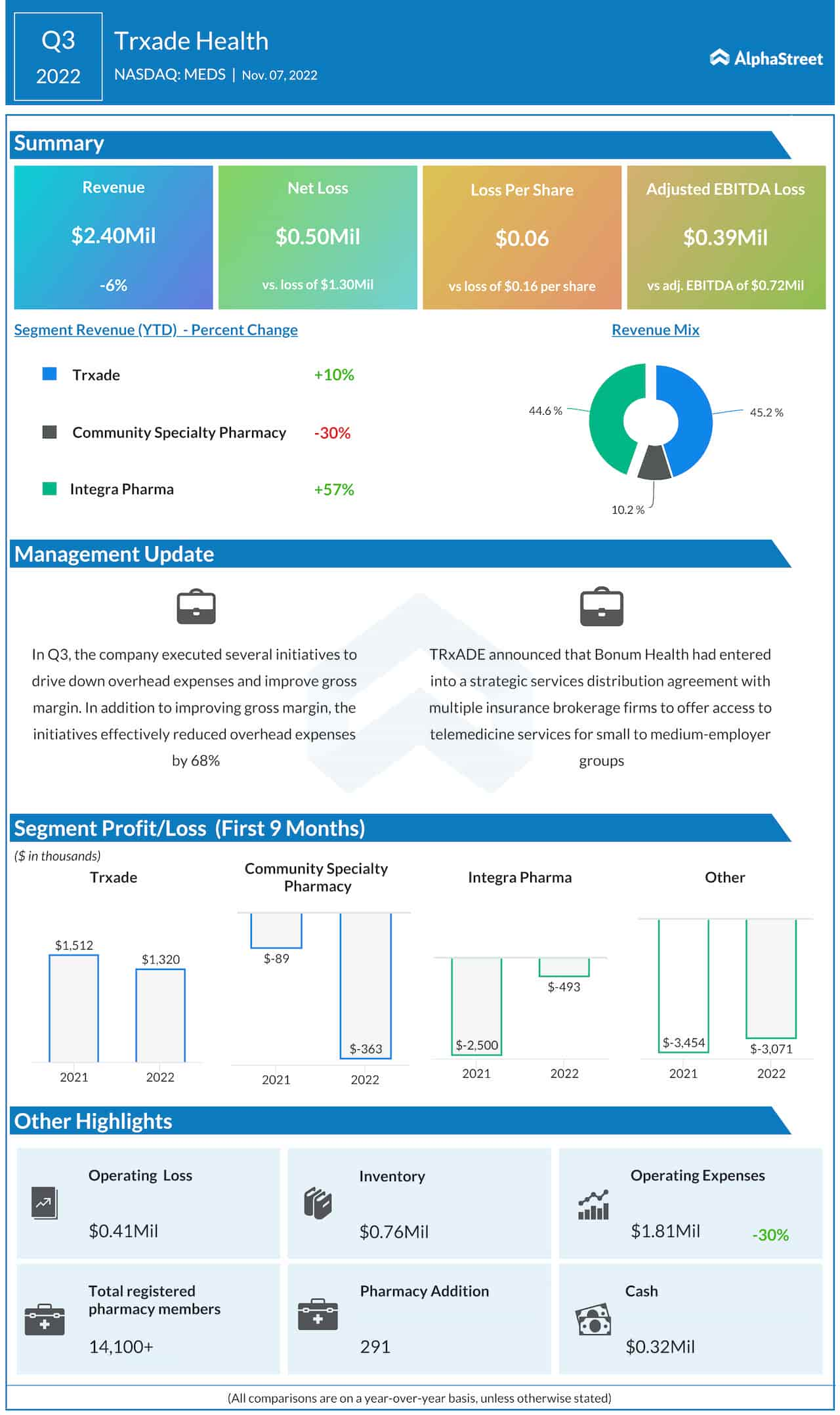

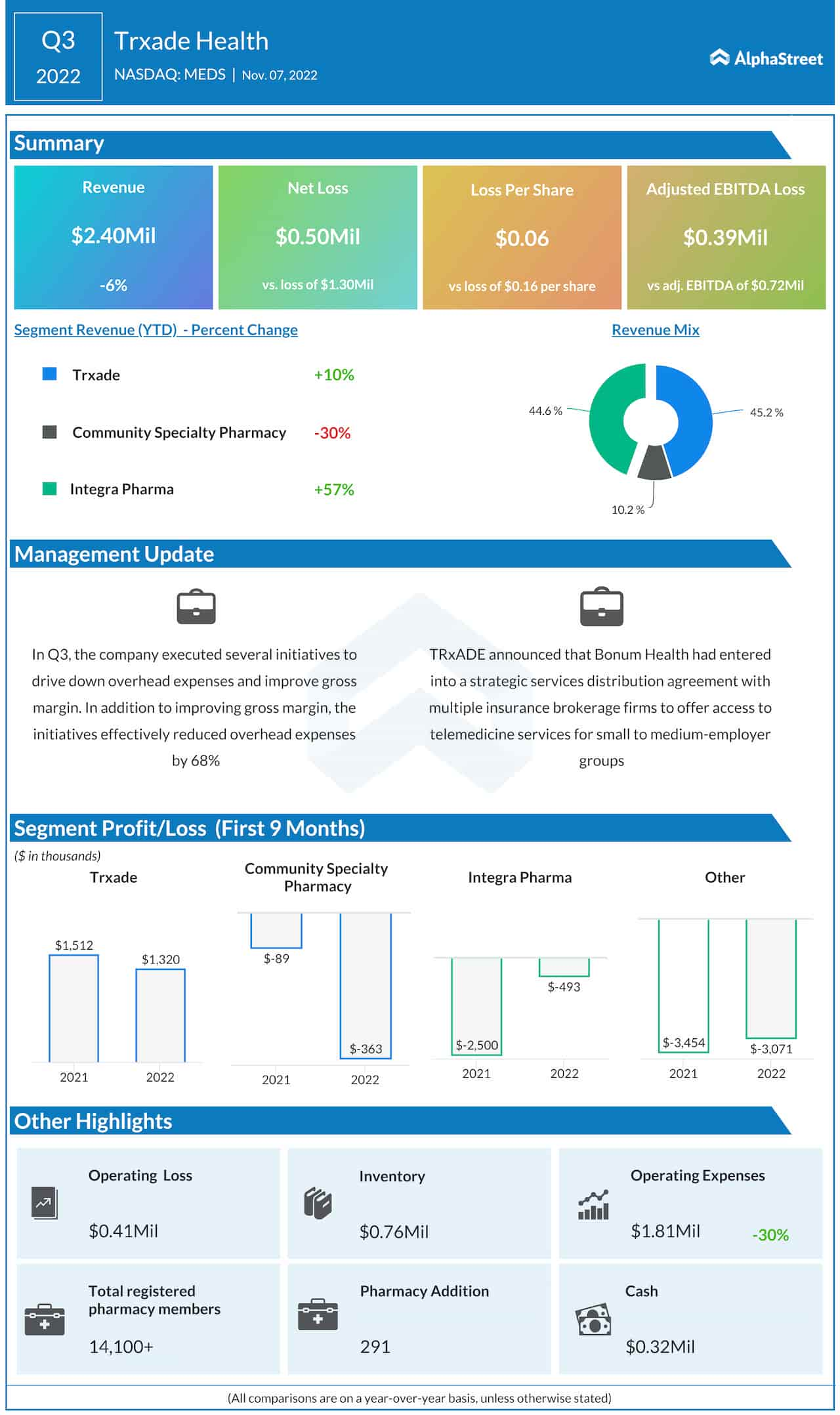

Over the years, the company has expanded its partner network consistently, thanks to the disruptive business model and technological innovation. In the three months ended September 30, Trxade’s net loss narrowed sharply from the prior-year period, mainly reflecting the management’s cost-reduction measures. While gross margin increased to an impressive 58%, revenues declined modestly.

TRxADE Health Q3 2022 Earnings Call Transcript

In an exclusive interview with AlphaStreet, Trxade’s chief executive officer Suren Ajjarapu spoke about the company’s third-quarter performance and provided updates on its operations and future plans.

Of late, the revenue share of Trxade Prime has been growing steadily. Do you see Prime outpacing the core Trxade segment in the near future?

Revenue generated by our TRxADE platform sales is steadily increasing and we expect that to continue. Revenue generated by TRxADE Prime decreased in the third quarter while we worked to implement software automation and restructure overhead costs to build a strong foundation for continued growth as we move forward. Yes, there is a possibility that Trxade Prime can outperform on revenues.

Do you expect recent improvements on the cost front to continue in future quarters; and what is your plan for reducing expenses without affecting business growth?

We continue to focus on expense reduction where it is appropriate. In the third quarter of 2022, we implemented additional software automation to reduce expenses without affecting future growth; we will continue to evaluate innovations as we move forward. Also, we mentioned two quarters in a row that we are looking for alternative ways and means to find partners for our B2C assets, which can further reduce expenses.

Can you talk a bit about Trxade’s strategy for effective pricing, in terms of growing margins without putting strain on customers?

We focus on developing strategic partnerships with vendors that share a similar mission and goal of providing value to our independent pharmacies with competitive pricing.

Fundamentals of Real Good Food Company’s operations are strong: Exec. chairman Bryan Freeman

How do you look at Trxade’s prospects in 2023, considering the lingering COVID uncertainties and unfavorable macro environment?

We still see some effects of COIVD; definitely, unfavorable macroeconomics play part in small businesses that are our true customers (independent pharmacies), it is Trxade goal to make them sustainable by using our Trxade marketplace and safeguard their diminishing margins, and also we continue to add new members and added new areas like clinics onto our marketplace, which actually improve our stability and growth prospects for 2023 and beyond.