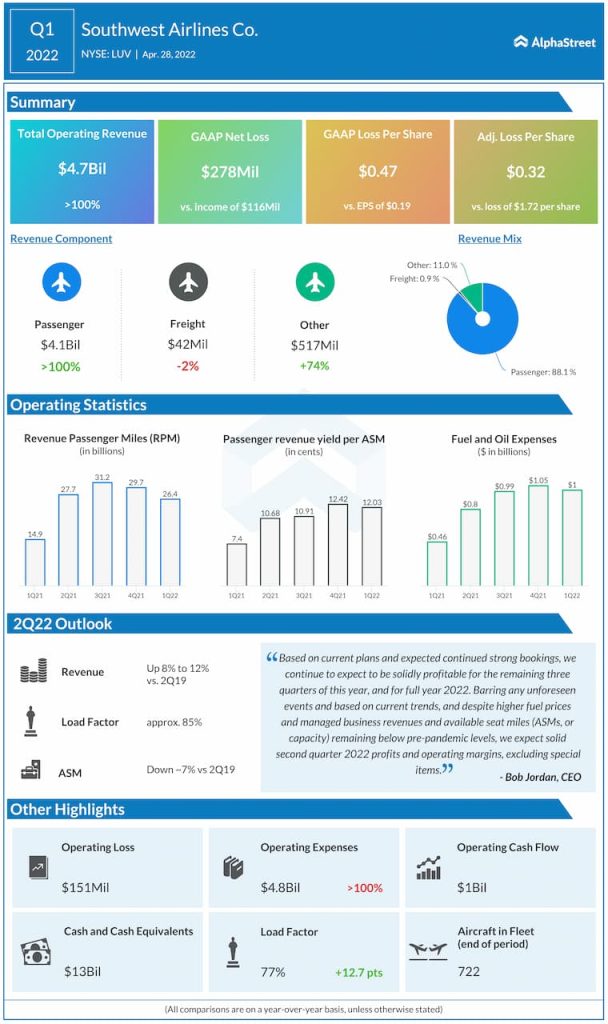

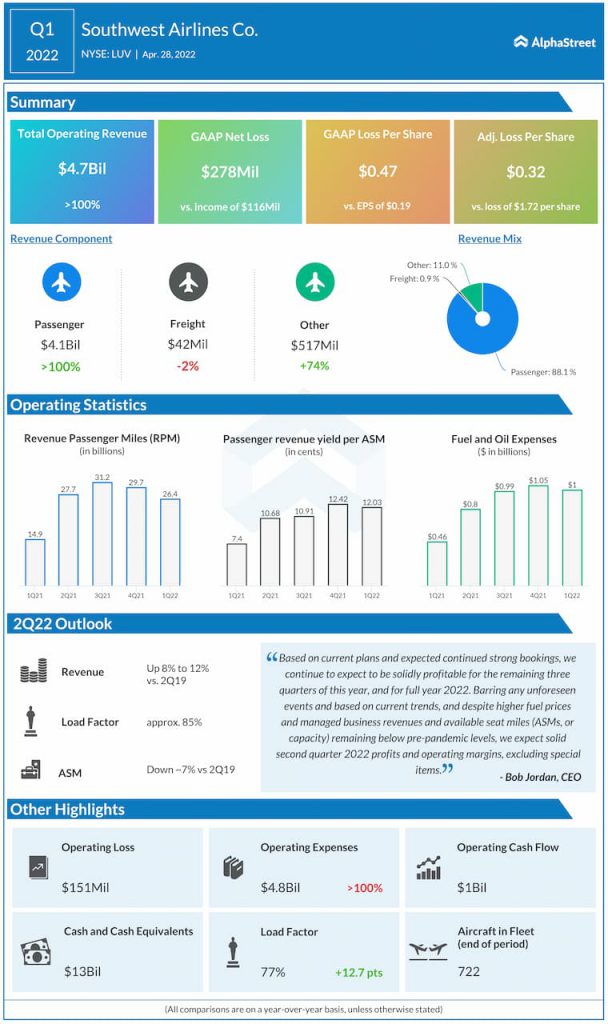

Revenue and profits

Managed business revenues continued to improve and were down around 31% and 23% in April and May 2022 respectively compared to 2019. Southwest currently expects managed business revenue for the second quarter of 2022 to be down 20-25% compared to the same period in 2019.

For the second quarter of 2022, Southwest expects operating revenue to increase 12-15% compared to 2019. The company continues to expect solid profits, excluding special items, in Q2 and for the remaining quarters of this year and also for the full year of 2022.

Capacity

In Q1 2022 available seat miles (ASM) or capacity was down 9.2% to 34.3 billion compared to Q1 2019. For the second quarter of 2022, Southwest expects capacity to be down around 7% compared to the same period in 2019. The company estimates capacity for the second half of 2022 to be roughly flat and for the full year of 2022 to decrease approx. 4% compared to their respective 2019 levels. Load factor is expected to be 85-87% for Q2.

Costs

In Q1 2022, operating expenses per available seat mile, excluding fuel and oil expense, profitsharing, and special items (CASM-X), increased 17.9% compared with Q1 2019. For Q2 2022, CASM-X is estimated to increase 14-18% compared to the same period in 2019. Economic fuel costs per gallon are expected to range between $3.30-3.40 in Q2.