Mixed results

Strong travel demand

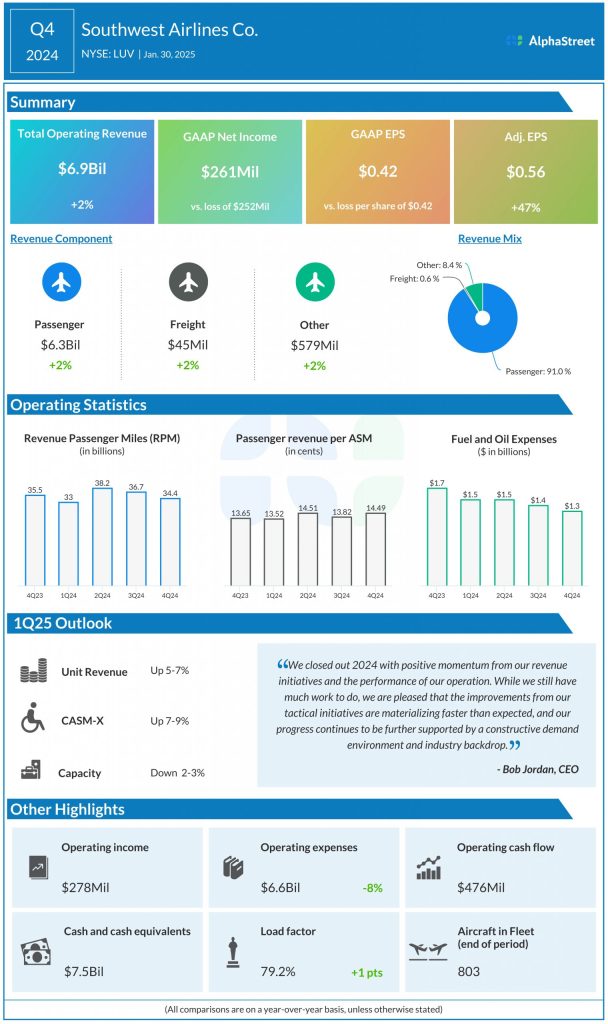

LUV’s top line benefited from strong demand for travel. Revenue per available seat mile (RASM), or unit revenues, increased 6.2% in the fourth quarter. The airline saw better-than-expected bookings during the holiday season. The company’s revenue management techniques and its network optimization efforts also helped boost its performance in Q4.

Southwest expects to see continued demand for travel in the first quarter of 2025. Unit revenues are projected to increase 5-7% year-over-year, driven by capacity rationalization and the execution of tactical initiatives.

In Q4, capacity was down 4.4%. Load factor was 79.2%. The company expects capacity to decrease 2-3% in the first quarter of 2025 and to increase 1-2% in the second quarter of 2025.

Inflationary pressures

Cost per available seat mile, excluding fuel and oil expense, special items, and profitsharing expense, or CASM-X, increased 11.1% YoY in Q4 2024, driven mainly by higher labor cost pressure and lower capacity levels. Economic fuel costs were $2.42 per gallon.

Southwest expects CASM-X for the first quarter of 2025 to increase 7-9% YoY, mainly due to inflationary pressures and capacity moderation efforts. Unit cost trends are expected to improve through the year, helped by an easing in labor comparisons, a gradual improvement in capacity, and cost plan benefits. Economic fuel costs per gallon are expected to range between $2.50-2.60 in Q1 2025.